Weekly Market Recap: The Fed Pivoted. Now What?

Stocks likely to be on a "choppy Road To Nowhere" until election

Now that Jerome Powell has gone "full pivot", will stocks shoot higher?

Not necessarily, says portfolio manager Michael Lebowitz, who steps in this week while Lance Roberts moves into his new house.

Michael thinks stocks will be on a "choppy road to nowhere" between now and the election.

We discuss why, as well as his rosy outlook for long-duration bonds on this week's Market Recap.

To hear it all, click here or on the video below:

NOTE: tickets are now on sale for our Oct 19th, 2024 Fall online conference. Buy your ticket now at our lowest Early Bird discount price:

RECENT VIDEOS

Stephanie Pomboy & Grant Williams: Investors Need To Realize Change Is Upon Us

"Way Too Much Is Priced Into This Market" | Mike 'Mish' Shedlock

Credit, Not Stocks, May Be The Better Investment From Here | Steven Bavaria

TM NOW ON PODCAST PLAYERS

Just a reminder that if you prefer to listen to my interviews on your podcast player, Thoughtful Money is now available on the major podcast platforms:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this new Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters now receive my “Adam’s Notes” summaries to the interviews on this channel, plus periodic advance-viewing and/or exclusive content not made available to the public, and now our new MacroPass service.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now:

But whether you do or not, get ready for another week of more great content ahead. We have interviews with Wolf Richter, Lacy Hunt, Thomas Hoenig and Craig Wichner.

Stay tuned!

cheers,

A

My sincere thanks to Lance Roberts and his team at Real Investment Advice for kindly making their weekly Bull/Bear market report available to the Thoughtful Money audience below:

Signals Suggest Bulls Trump Bears…For Now.

By Lance Roberts | August 24, 2024

Inside This Week’s Bull Bear Report

Bullish Signals Versus Bearish Headlines

How We Are Trading It

Research Report – Red Flags In The Retail Sales Report

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

Markets Ignore Revisions

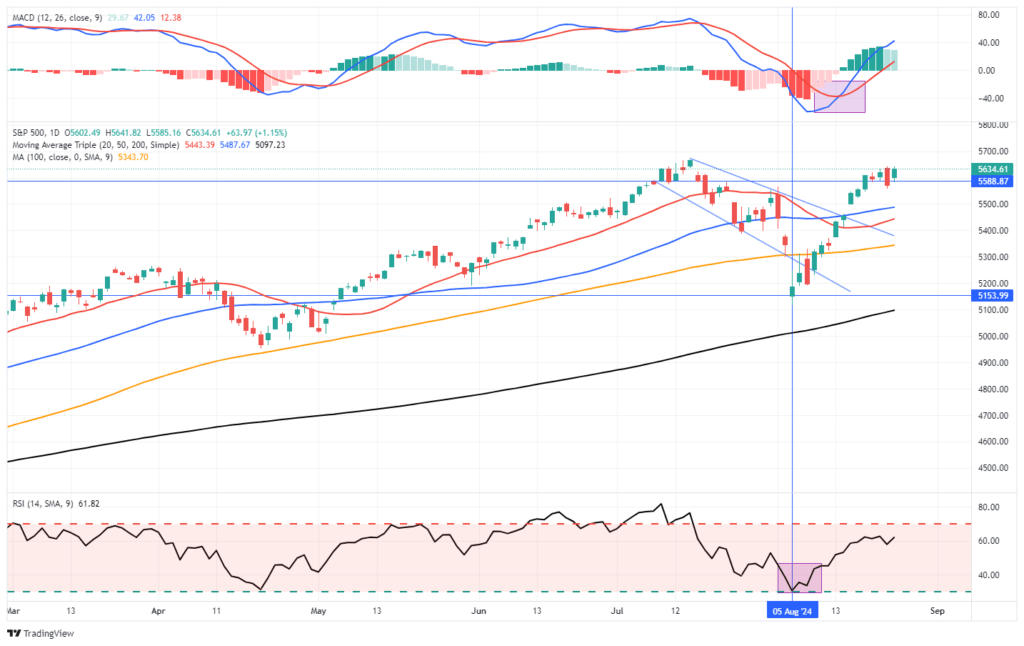

As noted last week, the rapid rally from the lows of three weeks ago had some good and bad elements. The positive is that the rally reversed the MACD “sell signal,” suggesting the bullish bias has returned. Furthermore, the rally cleared all-important resistance levels with ease. The market quickly crossed the 100, 50, and 20 DMAs, leaving only recent all-time highs as significant next resistance. The only negative to the advance is the nearly complete reversal of the previous oversold conditions. Such isn’t a critical issue, but it suggests we will likely see a minor pullback to retest support at the 50-DMA. Such will provide a better entry point to add exposure as needed.

That analysis mostly remains the same this week.

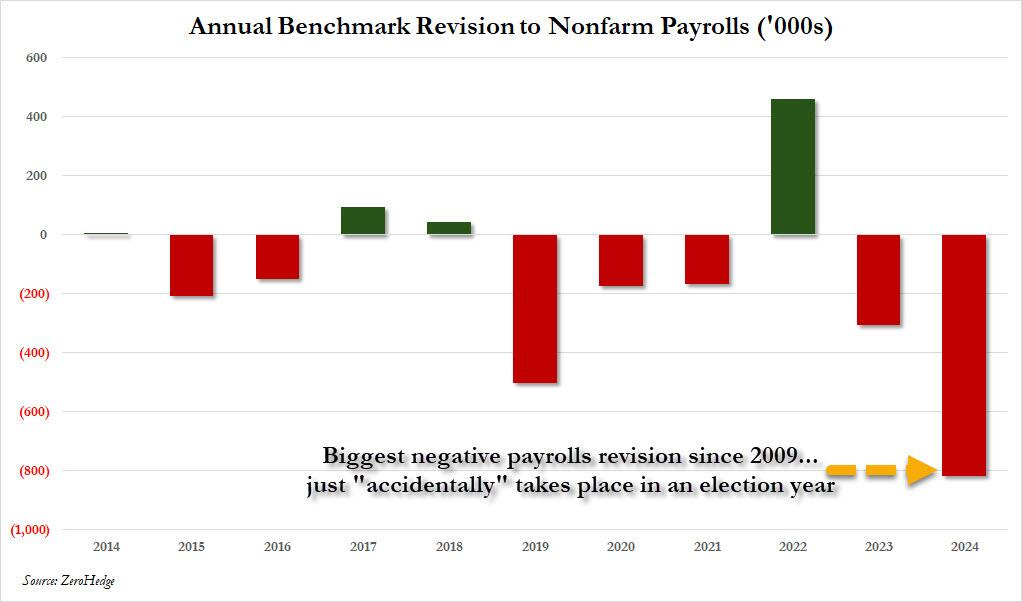

There were two important events this week. The first was the Bureau of Labor Statistics report showing a massive negative revision of 818,000 jobs over the last year. As noted by Zerohedge:

“As the chart below shows, the 2024 revision was the biggest in the past decade and the second biggest on record, with just the 824K downward revision in 2009 just (barely) greater.“

Such a headline is undoubtedly concerning and supports the view that the actual economy is substantially weaker than the headlines suggest. Of course, we, and the markets, were already well aware of this, which is why the markets largely ignored the report when it came out. However, such is always the case with data revisions, given that the markets are forward-looking. Such reminds me of a classic moment in the illegal road race classic “The Gumball Rally,” where Franco, the race car driver portrayed by Raul Julia, told his boss and co-driver:

“And now, my friend, the first rule of Italian driving (pauses to rip the rearview mirror off the windshield and throw it behind him), what is behind me is not important.”

Speaking of looking forward, that’s what the market did on Friday as Jerome Powell made it clear at the Jackson Wyoming Economic Summit that rate cuts are coming.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks. We will do everything we can to support a strong labor market as we make further progress toward price stability.”

With markets closing in on all-time highs, several bullish signals have been triggered, likely limiting more bearish concerns in the near term.

Bearish Headlines Are Easy To Find

If you want clicks and views, the best way is to promote fear. You don’t have to look too hard to find videos discussing why the economy and markets are about to crash. Here is an example:

Warren Buffett’s recent stake reduction in Apple (AAPL) is a good example. Immediately, headlines suggested that Mr. Buffett was preparing for a market crash. No other than Mr. Buffett knows his reasoning, but Apple was a huge stake in his portfolio. Even after the reduction, Apple is still Berkshire’s largest holding. From a purely risk management analysis, the sale of Apple to rebalance portfolio weightings was a prudent call.

Notably, bearish headlines and commentary are certainly concerning. For example, seasoned investor David Roche warned of an impending bear market in 2025, citing reasons such as a sluggish U.S. economy, an artificial intelligence bubble, and insufficient rate cuts. Brian Moynihan, CEO of Bank of America, voiced concerns over the Fed’s rate policy and its impact on consumer confidence. Wall Street veteran Ed Yardeni warned that A.I. shows signs of an inflating bubble, and top economists and money managers have been weighing in on the possibility of a recession.

The issue with extremely bearish headlines is the worst possible outcomes rarely occur. As I discussed in “Rules To Navigate A Volatile Market:”

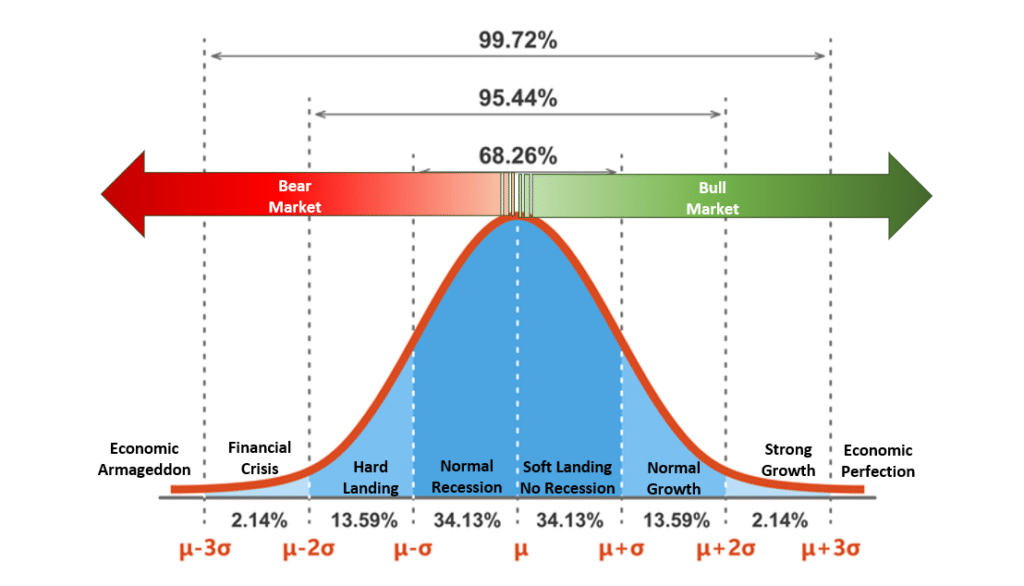

“It is easy for us to imagine the worst possible outcomes. However, as investors, we must focus on the ‘probabilities’ and ‘possibilities’ of macro outcomes.

On The Real Investment Show, I spent a good bit of time discussing the normal distribution of events in the economy. The chart below is a normally distributed “bell curve” of potential events and outcomes. In simple terms, 68.26% of the time, normal outcomes occur. Economically speaking, such would be a normal recession or the avoidance of a recession. 95.44% of the time, we are most likely dealing with a range of outcomes between a fairly deep recession and normal economic growth rates. However, there is a 2.14% chance that we could see another economic crisis like the 2008 Financial Crisis.

But what about ‘economic armageddon?‘ Such an event where nothing matters but ‘gold, beanie weenies, and bunker.’ is just a 0.14% possibility.”

Does this mean the markets will never correct? No. But it does suggest that our emotions often lead us to make the worst investment decisions over time.

Bullish Signals Rising

Understandably, reading bearish commentary triggers our psychological response of “loss aversion.” However, understanding our psychology can help us control the thoughts and actions that lead to poor decision-making.

While significant macro events have and can happen, they often take far longer to materialize than many expect. Therefore, an excellent way to control our psychology is to focus on time frames we can control. In other words, as we have often stated, “invest for the market you have rather than the one you want.”

Currently, there is little reason to be concerned, as bullish signals trump bearish headlines. For example, as noted Thursday morning:

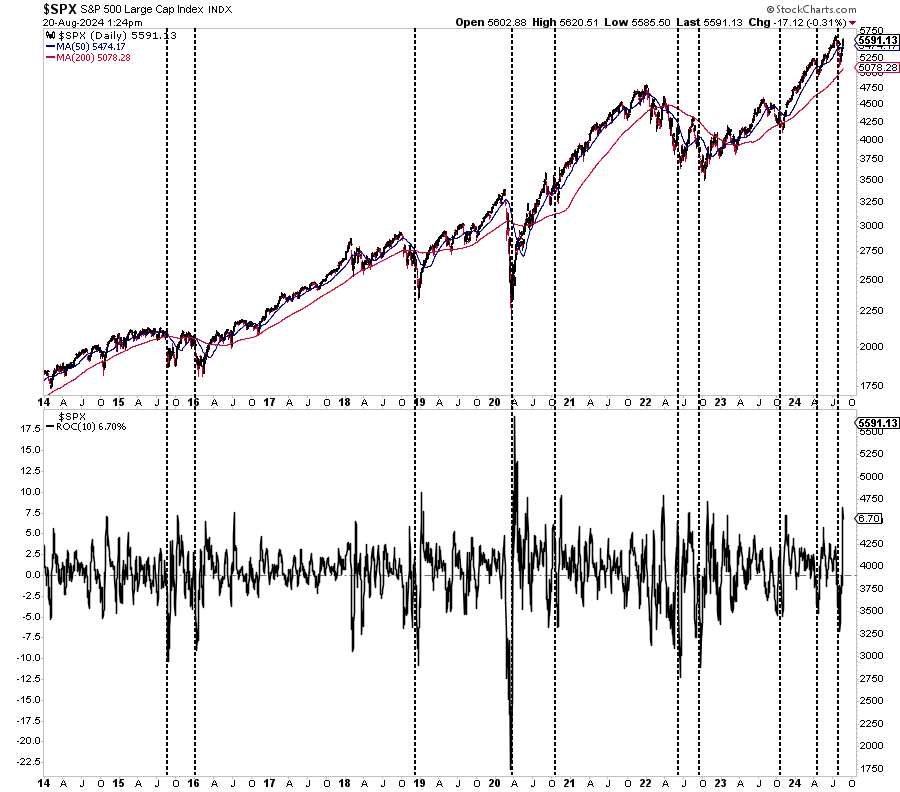

“As shown below, rapid V-shaped recoveries tend to be bullish indications of both the end of the corrective period and the resumption of the bullish trend. Since 2014, periods that saw a sharp price decline, as measured by the 10-day rate of change, followed by a sharp advance, were bullish indications. However, as seen in 2015 and 2022, such a reversal does not preclude a secondary correction from occurring.”

Notably, Sentiment Trader recently did a similar study on V-shaped bottoms and concluded:

“Stocks are already overbought on some measures, and sentiment is quickly recovering from the brief freak-out a couple of weeks ago. The run has been astounding, but past performance after impressive v-shaped bottoms suggests that there should be more gains in store over the next couple of months.

The biggest caveat is that it has been exceptionally unusual to see this type of move during uptrends, and the only other times it happened, gains were capped in the weeks and months ahead. An objective look at what is inherently emotional trading behavior suggests that we should be modestly confident that this rapid shift in momentum should carry stocks even higher. However, since it’s occurring so near record highs, we shouldn’t be overly confident that we can rely on the types of gains after more protracted declines.”

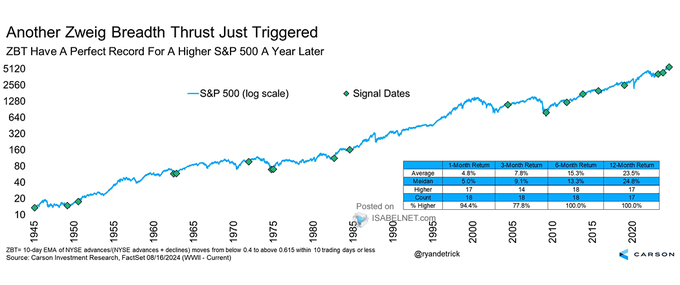

Furthermore, this week, the market triggered a Zweig Breadth Thrust. Investing legend Marty Zweig developed this indicator to identify turning points in the market. The indicator is the 10-day EMA of NYSE Advances divided by NYSE Advances plus NYSE Declines. As Carson shows in the following chart, those breadth thrusts denote a continuation of the bull market rather than an end.

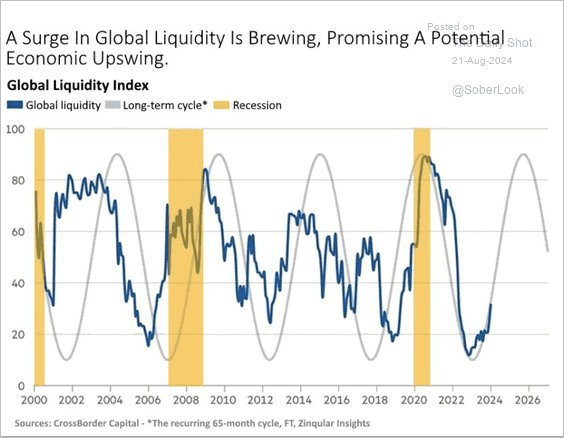

Importantly, liquidity drives markets. Global liquidity is rising, and the Federal Reserve and other central banks are beginning to ease monetary policy. This will support both the economy and the financial markets as earnings stabilize.

Notably, while these bullish signals are important and suggest that the bull market remains intact in the near term, they still do not displace the need for risk management.

Yes, Risk Management Still Matters

Over the next few weeks to two months, the various signals of improving breadth and liquidity support higher prices. However, this does not mean investors should ignore the potential risks. An unexpected and exogenous event, as we saw with the “Yen Carry Trade” three weeks ago, is a good example. The things that tend to disrupt the markets are not what we know about; they are the things we don’t that send sellers rushing for the exit.

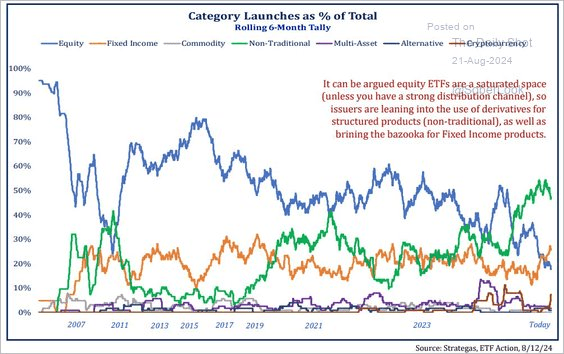

Therefore, investors should remain mindful of the risks they are taking to generate portfolio returns. A good example is that Wall Street currently produces numerous ETFs to satisfy investor appetite. After all, Wall Street’s job is not to ensure you are making money but to create and sell products to you for their profit. A good example is that over the last year, 50% of all new ETFs issued were derivative-based. These are ETFs that use options to create higher returns.

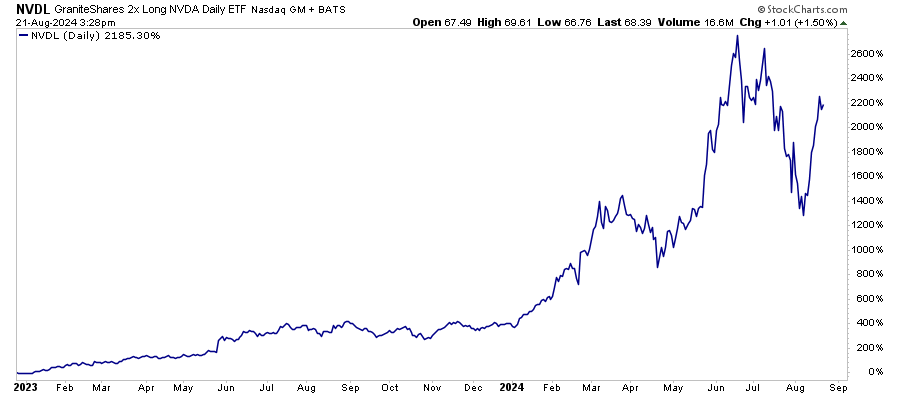

A good example is the numerous single-stock ETFs that now provide 2x leverage. That leverage is exciting on the way up, as you are doubling your rate of return, but it will also crush you on the way down. For example, the 2x Nvidia ETF rose ~2600% since inception. However, if you bought it in June or July, you lost ~50% of your money in less than one month. Few investors can survive that type of volatility.

As my mom used to say: “It’s all fun and games until someone gets their eye poked out.”

The Rules

Therefore, ensure you follow your risk management process if the unexpected occurs.

Raise portfolio cash levels to lower volatility and align with your risk tolerance.

Reduce equity risk, particularly in areas highly dependent on economic growth.

Add or increase the duration of bond allocations, which tend to offset risk during risk-off events.

Reduce exposure to commodities and inflation trades as economic growth slows.

If an unexpected event occurs, the preparation allows you to survive the impact. Protecting capital will mean less time spent getting back to breakeven. After the event, and when market signals dictate, it is relatively easy to reallocate funds to equity risk as needed.

Even with bullish signals intact currently, it is certainly understandable that you may still feel uneasy heading into the election. There is nothing wrong with that. Investing during periods of uncertainty can be difficult. However, you can take steps to ensure that increased volatility is survivable.

Have excess emergency savings, so you are not “forced” to sell during a decline to meet obligations.

Extend your time horizon to 5-7 years, as buying distressed stocks can get more distressed.

Don’t obsessively check your portfolio.

Consider tax-loss harvesting (selling stocks at a loss) to offset those losses against future gains.

Stick to your investing discipline regardless of what happens.

If I am correct, and the bull market continues, you will continue participating even though you may underperform the benchmark index. However, our job is not to beat some random benchmark index that has nothing to do with our personal financial goals or time frames.

If I am wrong and the market declines, the preparation will reduce downside volatility and allow you to make more rational decisions about what to do next.

That is the process we are currently using for our clients.

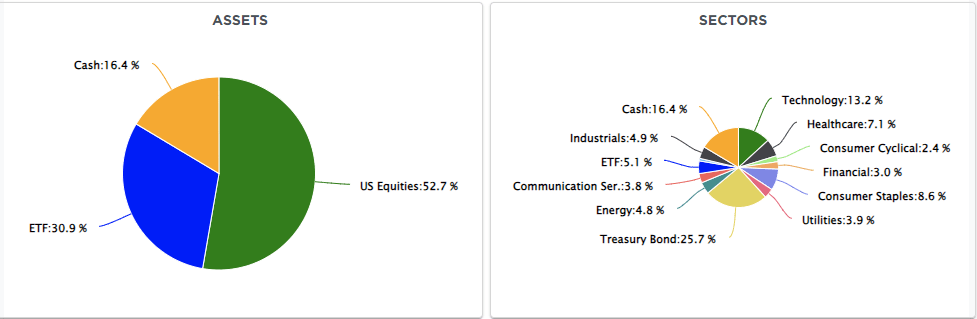

How We Are Trading It

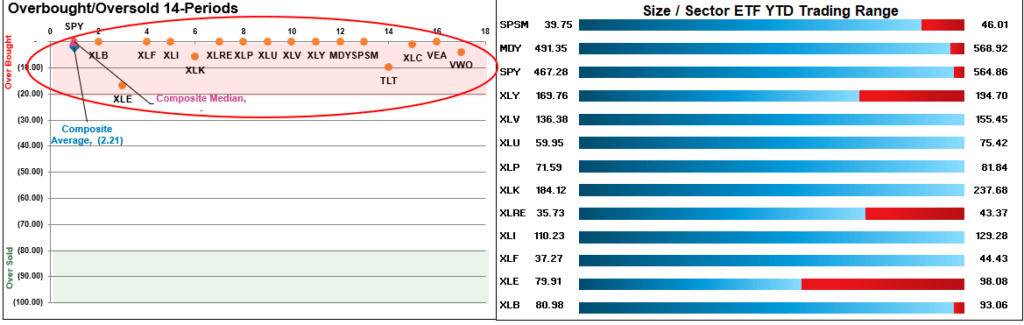

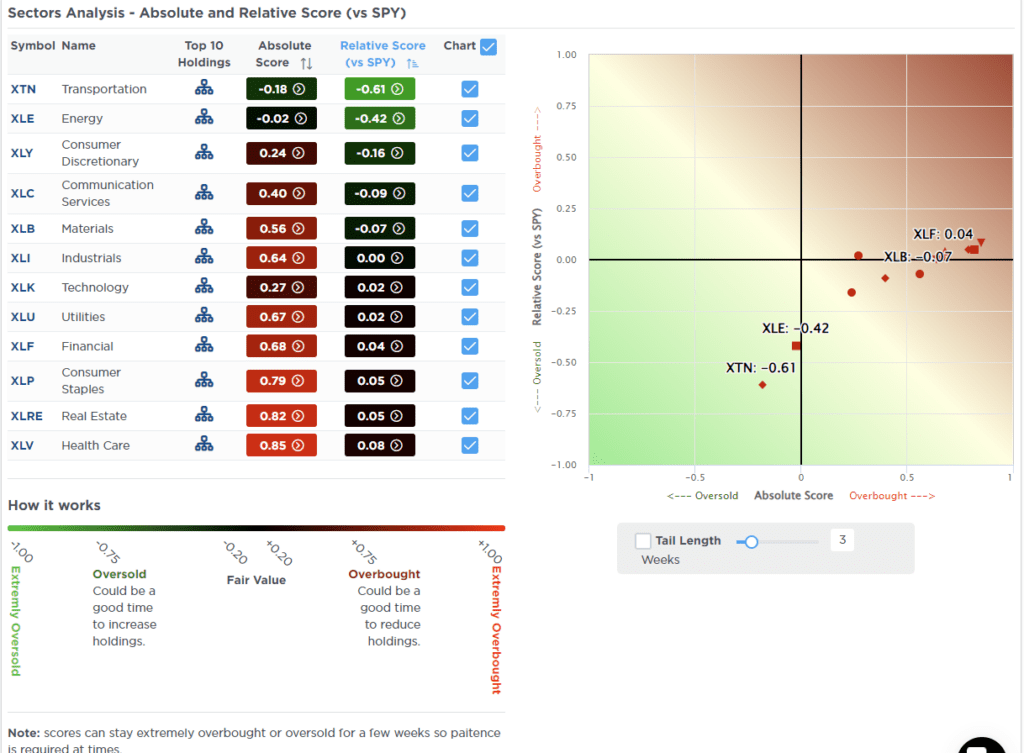

As noted, current bullish signals are keeping our portfolio allocated toward equities. However, as shown in the Market Sector Relative Performance analysis below, everything is back to short-term overbought. Historically, the markets have trouble rising from such levels without a short-term pullback.

We remain concerned about the potential for upcoming election volatility and remain underweight equities and overweight cash for now. With the market overbought following the recent rally, we are watching for a correction back to support that does not reverse those bullish signals. If such occurs, we will increase exposure accordingly.

We remain focused on the upcoming election, which may introduce some volatility in October. We are also willing to sacrifice some short-term performance for safety. Once we pass the election, if the bullish market signals remain, we should see a rally at the end of the year.

However, 2025 may be an entirely different story. We will discuss that when we get there.

For now, continue to keep moves small. As the market confirms its next direction, we will adjust accordingly.

Have a great week.

Research Report

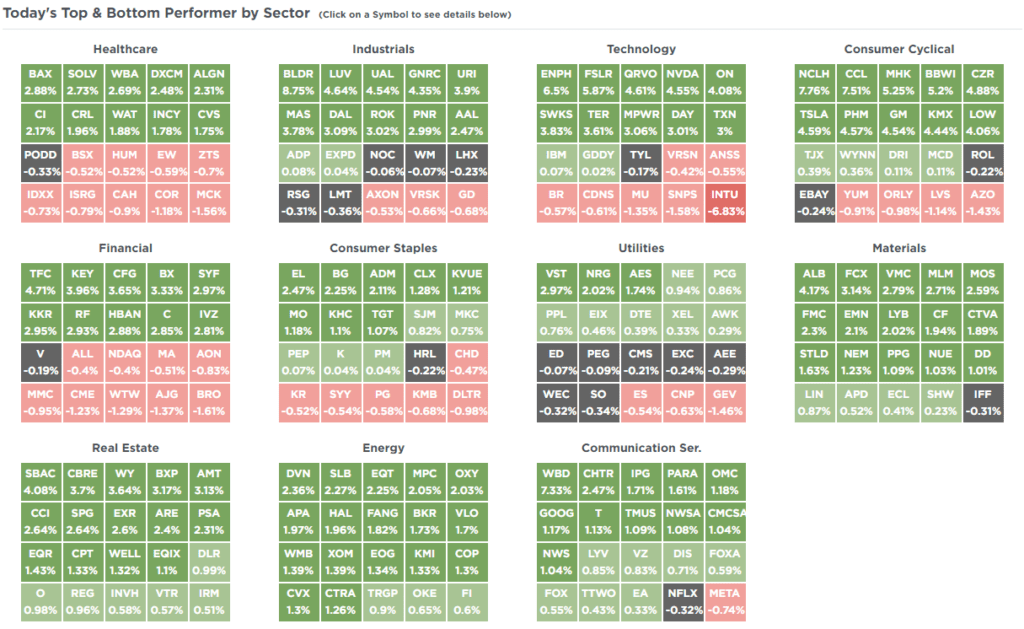

SimpleVisor Top & Bottom Performers By Sector

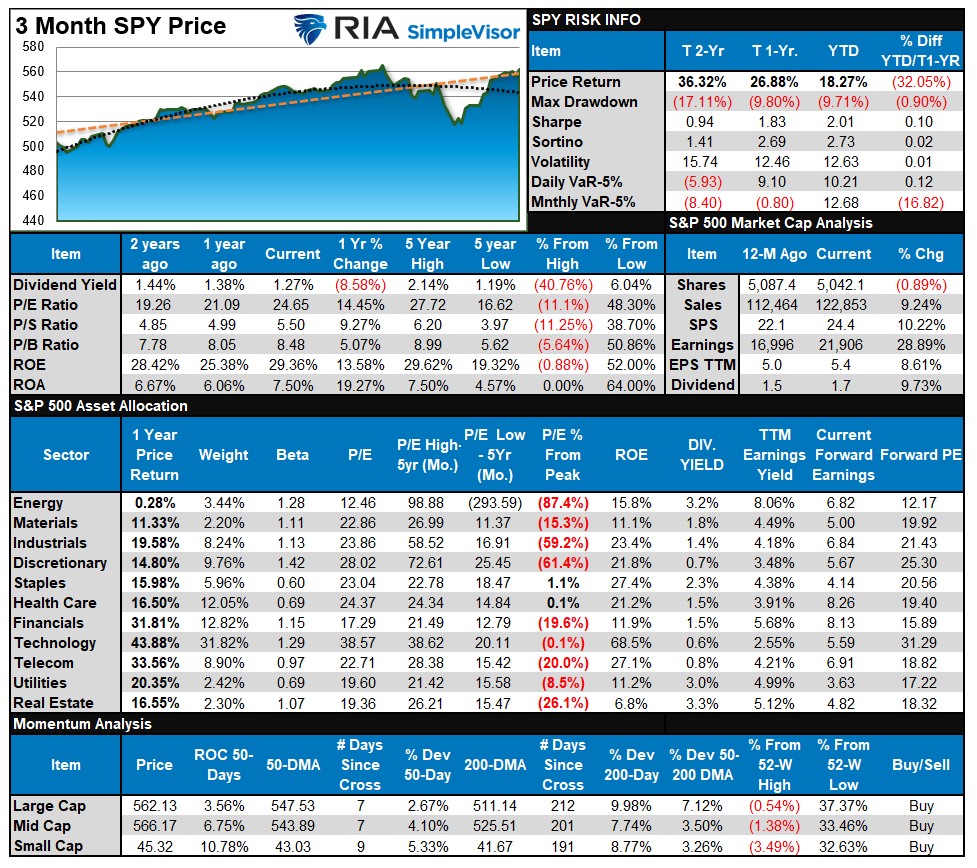

S&P 500 Weekly Tear Sheet

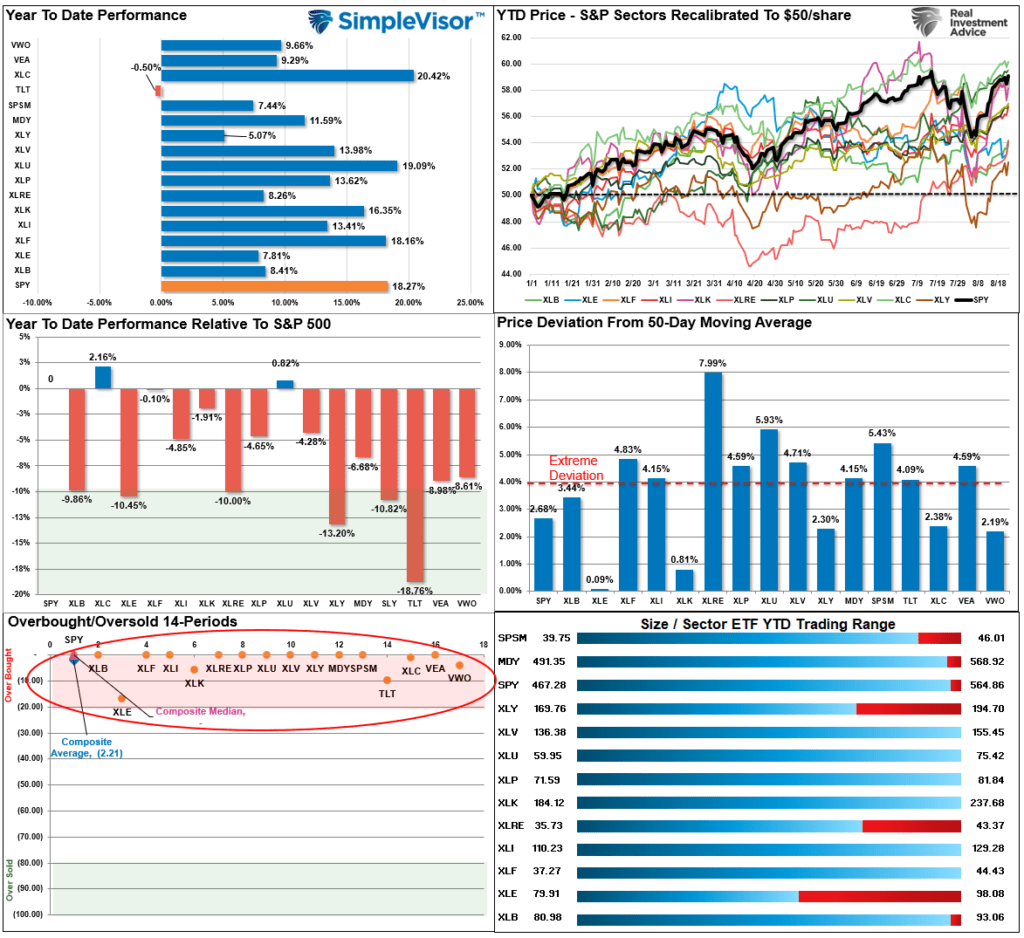

Relative Performance Analysis

As noted last week,

“The snap-back rally over the last two weeks was inspiring as the 5-10% summer correction occurred without significant damage. With that correction behind us, the subsequent market event risk will be the November election.”

As noted, with every market and sector at more extreme levels of overbought conditions, look for minor corrections to support before adding exposure to portfolios. I would be unsurprised to see some selling hit the markets next week.

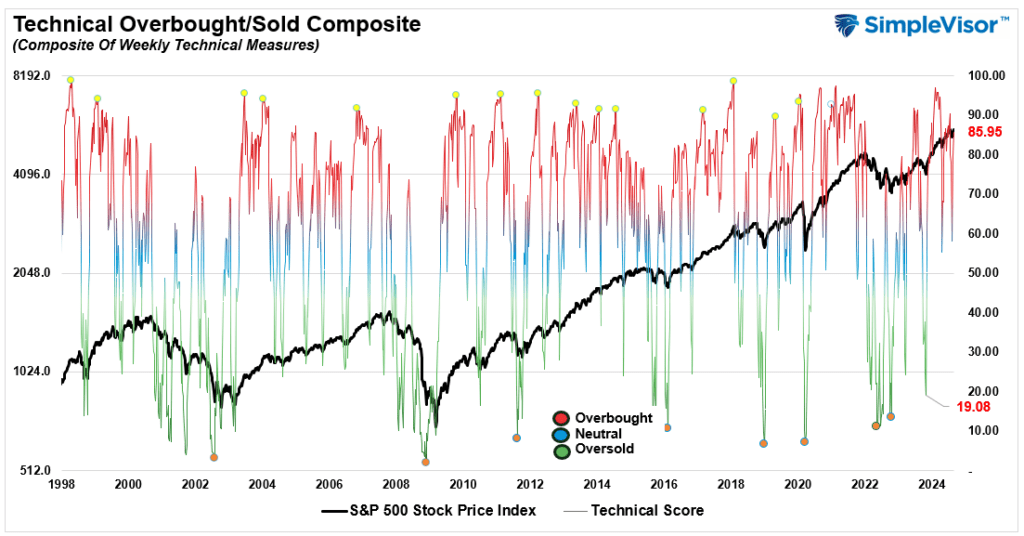

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 85.95 out of a possible 100.

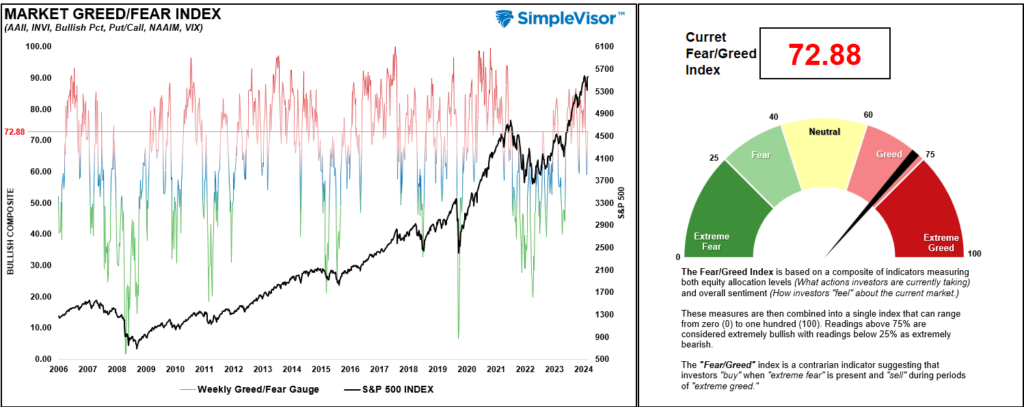

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 72.88 out of a possible 100.

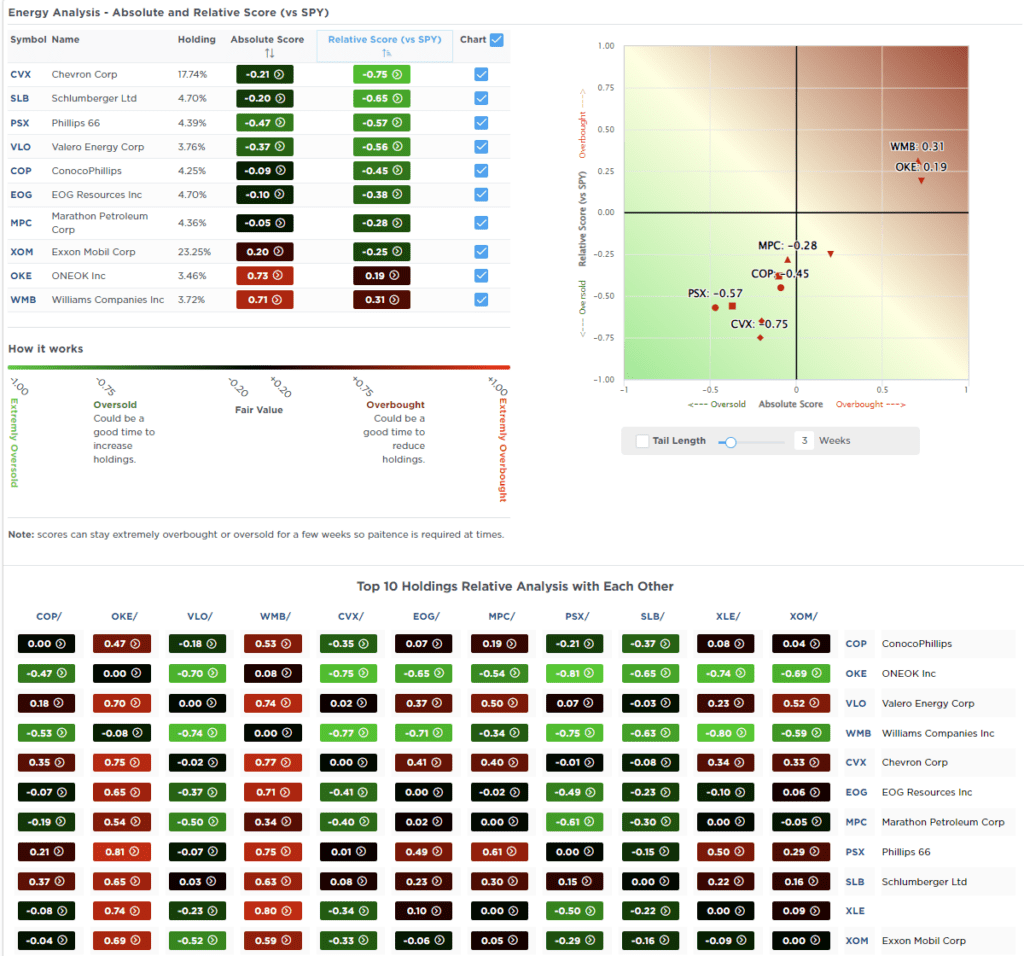

Relative Sector Analysis

Most Oversold Sector Analysis

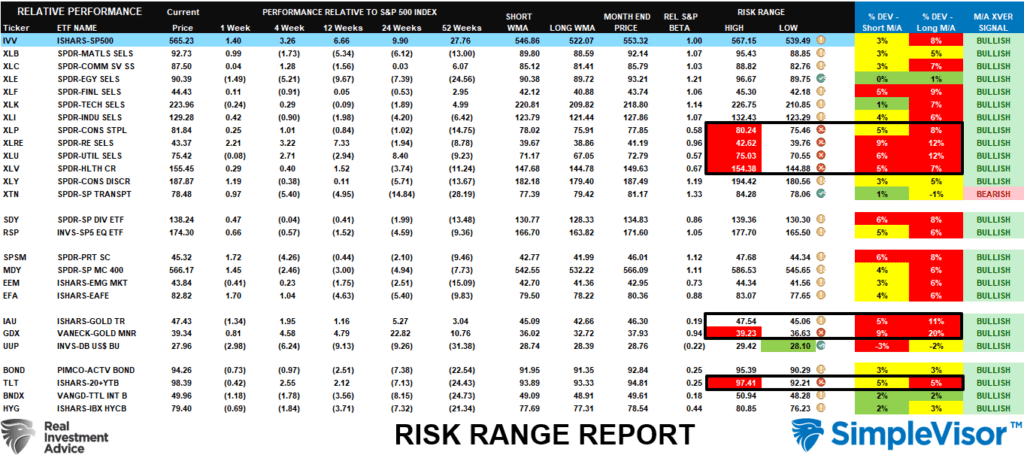

Sector Model Analysis & Risk Ranges

How To Read This Table

The table compares the relative performance of each sector and market to the S&P 500 index.

“MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

The table shows the price deviation above and below the weekly moving averages.

As stated last week:

As noted last week, technology led the charge in the market recovery, but so did many of the more defensive sectors of the market, from Staples to Real Estate and Bonds. Those defensive sectors are highly extended and have deviated from long-term means, suggesting a rotation back toward growth is likely. Gold Miners are currently 20% above their long-term mean, which is unsustainable. Take profits and rebalance weightings, as this sector can experience sharp declines. Bonds and interest rate-sensitive sectors like Utilities are also very overbought.

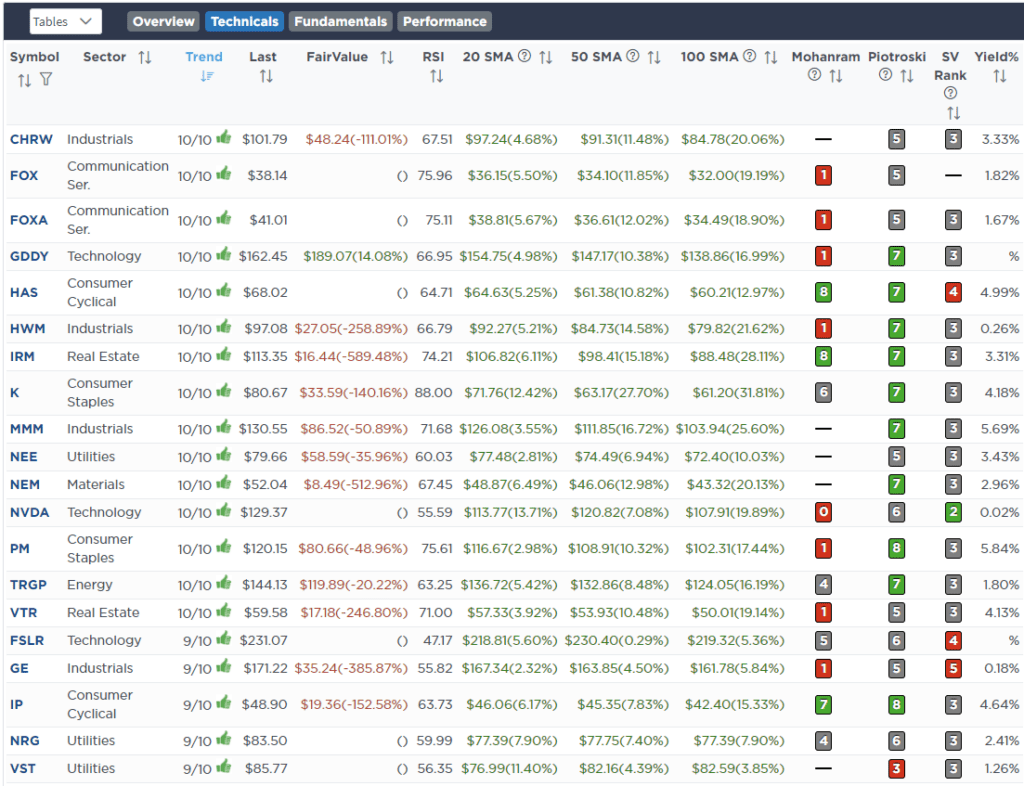

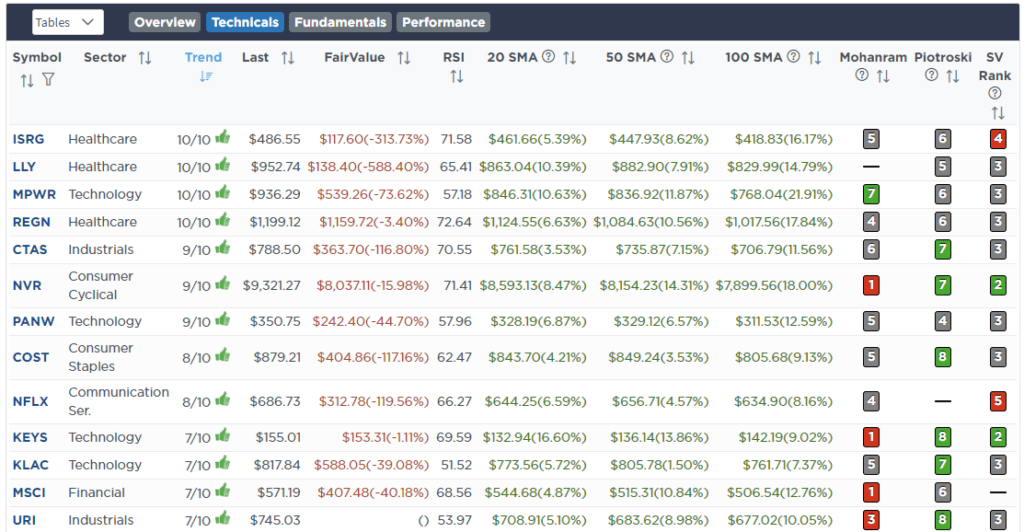

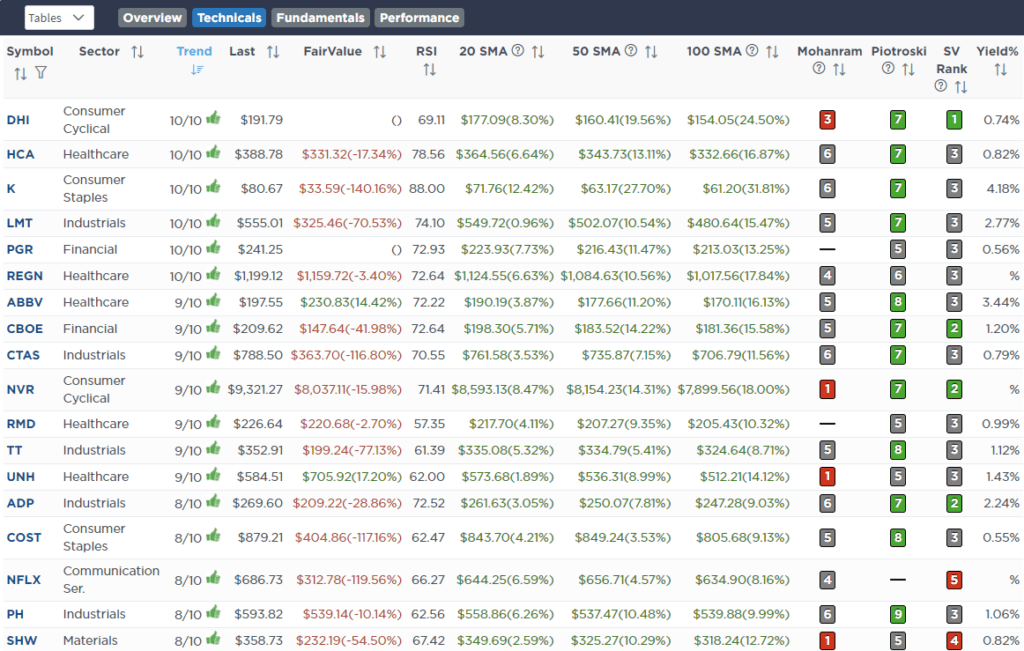

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

Relative Strength Stocks

Momentum Stocks

Fundamental & Technical Strength W/ Dividends

(Click Images To Enlarge)

RSI Screen

Momentum Screen

Fundamental & Technical Screen

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

No Trades This Week

Lance Roberts, C.I.O.

Have a great week!

Thoughtful Money LLC is a Registered Investment Advisor Promoter/Solicitor.

We produce & distribute educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Thoughtful Money. MacroPass and the Thoughtful Money logo are trademarks of Thoughtful Money LLC.

Copyright © 2024 Thoughtful Money LLC. All rights reserved.