Brent Johnson: An Important Update On The Dollar Milkshake Theory

The demise of the dollar will take longer & more surprising turns than many expect

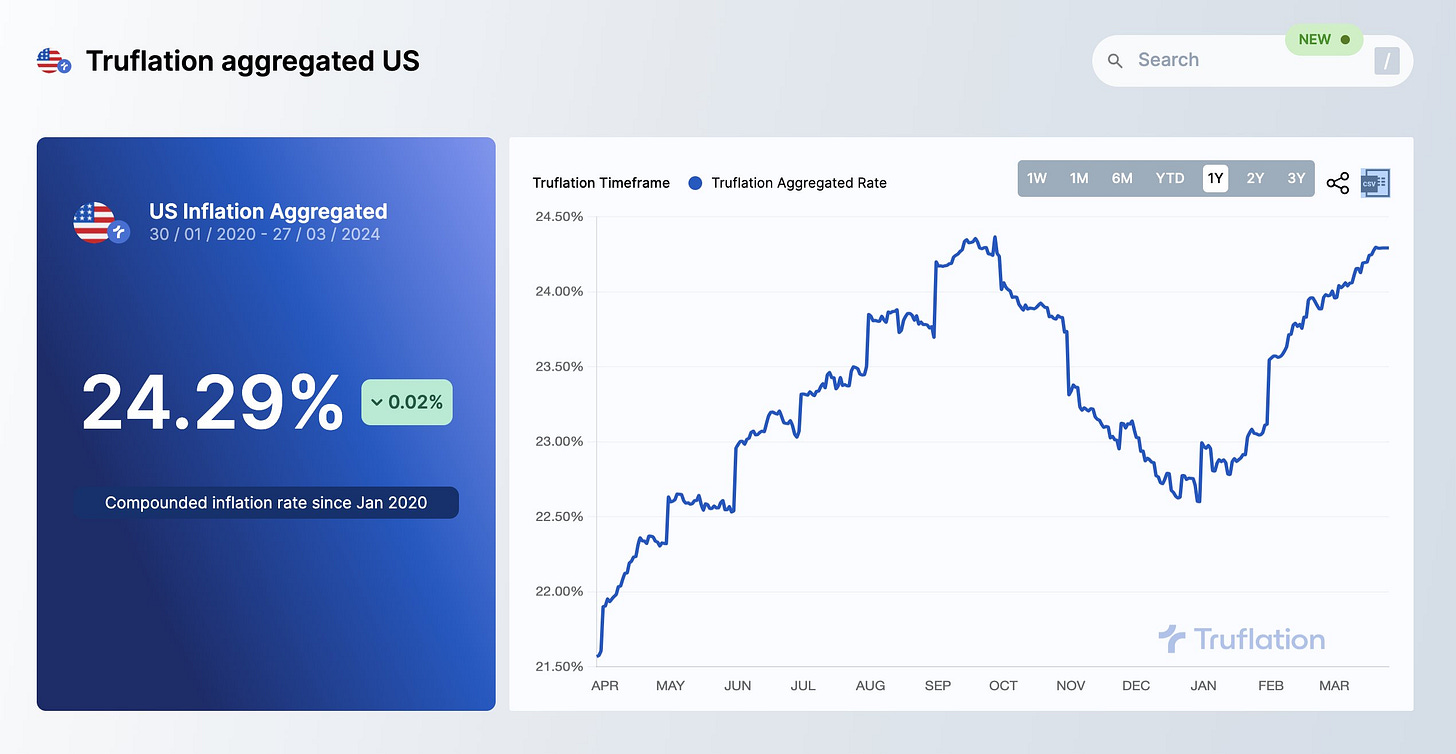

According to Truflation, the US dollar has lost nearly 25% of its purchasing power since January of 2020:

Many everyday Americans struggling to pay their monthly bills may argue that's an understatement.

What the US dollar does, vs real things as well as vs other national currencies, has very real implications -- economically, financially & geopolitically -- for everyone watching this video, regardless of where you live.

For a better sense of what it's likely to do from here, we're fortunate to speak today with Brent Johnson, CEO & Portfolio Manager at Santiago Capital, and developer of the Dollar Milkshake Theory (DMT).

In today’s discussion, Brent offers an important update to the DMT, which provides clarity both dollar bulls and bears should understand.

To hear it, click here or on the image below:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters receive my “Adam’s Notes” summaries to the interviews I do, the new MacroPass rotation of reports from esteemed experts, plus periodic advance-viewing/exclusive content. My Adam’s Notes for this discussion with Brent are available to them below.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now below.

Adam’s Notes: Brent Johnson (recorded 6.5.24)

EXECUTIVE SUMMARY

Brent revisits his Dollar Milkshake Theory in order to clarify it, explaining it as a framework for understanding the unfolding sovereign debt and currency crisis. DMT essentially predicts that all fiat currencies (including the US dollar) will fail and be replaced by a new currency regime…but the numerous vast advantages that the US holds and *will* wield ensure that the dollar will fare better through the collapse than other currencies and, as a result, capital will flow into the US and support its economy and markets better than other nations.

While Brent acknowledges that his expecting timing for the dollar endgame was initially too aggressive, he maintains that the DMT framework has been largely accurate in predicting currency, capital & market movements.

Since Brent predict such back in 2018, interest rates have risen significantly, bond prices have dropped, and the US dollar has strengthened. US equities and gold have also increased in value, validating his theory that the US would outperform due to capital inflows driven by higher interest rates and global economic conditions. Brent points out that while these trends are not linear, the overall direction and continued momentum remain consistent with the DMT’s predictions.

Brent notes that global cooperation during the COVID-19 pandemic postponed an inevitable crisis. However, increasing geopolitical tensions since then, such as those between the US and China, and the retreat from globalization indicate that the next debt crisis will be harder to manage. He points out that the world is moving towards regional supply chains and geopolitical blocks, making coordinated economic responses more challenging.

He anticipates the US dollar will

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.