Credit, Not Stocks, May Be The Better Investment From Here | Steven Bavaria

8-10% returns, but with greater safety

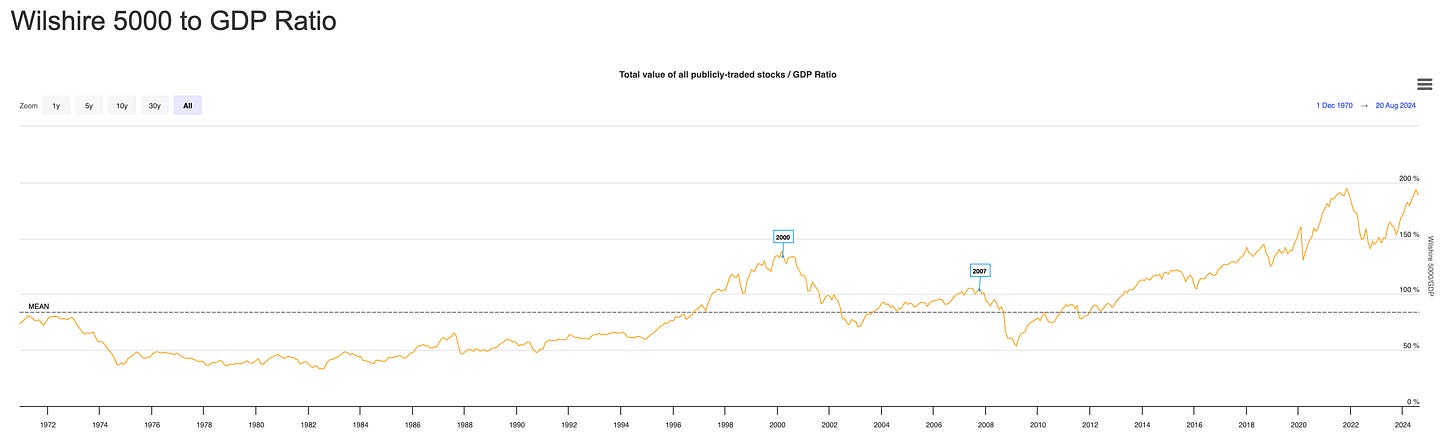

The Buffett Indicator currently stands at almost 200%, one of the most extreme readings of overvaluation in its history:

With stocks so richly valued, prudent investors worry that stretching for further gains here may not be worth the risk.

Which is why more and more of them are starting to prioritize investing for income over appreciation.

A few months back, I interviewed Steven Bavaria, creator of the Income Factory framework about the merits of constructing a lower-risk portfolio of income-generating assets that include: high dividend stocks, senior bonds, high yield bonds, covered call funds, Master Limited Partnerships, closed-end funds, and more.

Today, Steven returns to drill down on the specifics of credit investing, an area that many investors don't have much personal experience in, but have the potential to offer attractive income yields — 8-10% annually on average — with relative safety vs equities in today's market environment.

For the details, click here or on the video below:

ANNOUNCEMENT: tickets are now on sale for our Oct 19th, 2024 Fall online conference. Buy your ticket now at our lowest Early Bird discount price:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters receive my “Adam’s Notes” summaries to the interviews I do, the new MacroPass rotation of reports from esteemed experts, plus periodic advance-viewing/exclusive content. My Adam’s Notes for this discussion with Steven are available to them below.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now below:

Adam’s Notes: Steven. Bavaria (recorded 8.19.24)

EXECUTIVE SUMMARY

The global economy and financial markets are currently marked by high volatility, influenced by geopolitical events, U.S. political uncertainty, and fluctuating interest rates. Steven expressed that these factors increase the risks associated with equity investments, making credit investing a more appealing and stable option in this environment.

Steven prefers income investing, with a strong focus on credit investing, over equity investing due to its lower risk and consistent income generation. While equity investors rely on a company's continued success and capital gains, credit investors primarily focus on the company's ability to meet its debt obligations, offering more predictable returns.

In credit investing, the primary risk is existential, meaning the risk that the borrower might default on its debt. Equity investing, on the other hand, carries both existential risk and entrepreneurial risk (the risk that the company must grow its earnings to justify higher stock prices). Steven highlighted that credit investments generally involve less risk, as they prioritize debt repayment over the performance of equity.

Steven mentioned that default rates for corporate credit have been historically low. Over the last few years, the default rate for the corporate sector has been around 1% annually. Even during the Great Recession, the default rate peaked at approximately 10%. He explained that in cases of default, secured loans typically recover 60-70% of the principal, while unsecured high-yield bonds recover 40-50%. Therefore, even in a severe economic downturn, the losses for well-diversified credit investors are limited and manageable.

Steven's "Income Factory" approach involves building a portfolio that acts like a factory producing a steady stream of income. This income is then reinvested to grow the portfolio, similar to how a factory reinvests profits to expand its production capacity. This method allows for continuous growth, even during market downturns, as reinvested income can be used to purchase assets at lower prices, effectively increasing future income.

Steven invests in credit through

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.