MacroPass™: Ted Oakley On His Latest Market Outlook

A lot of trends changes are occurring, many of which investors aren't sufficiently prepared for

This week’s installment of our popular MacroPass service for premium members of this Substack comes from investment advisor Ted Oakley.

It’s the quarterly market update that Ted sends to his private clients. In it, he shares his current market outlook as well as which assets his firm is holding and what recent trades he and his team have made.

And below that is a video Ted just released adding additional context to the main points in his quarterly letter.

As a reminder, MacroPass™ is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Lacy Hunt (Hoisington), Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Ted Oakley (Oxbow Advisors), Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino, Adam Kobeissi (The Kobeissi Letter), Sven Henrich (Northman Trader), Jeff Clark (The Gold Advisor), Charles Hugh Smith, Steven Bavaria (Inside the Income Factory®) and Chris Whalen (The Institutional Risk Analyst).

Recent MacroPass™ reports in this series include:

Jeff Clark on the promising outlook for junior mining stocks

Darius Dale on the market's transition from 'Goldilocks' towards Deflation

The Kobeissi Letter on tech stock weakness & recession fears

If you’re already a premium subscriber to this Substack, just continue below to access Ted’s Q4 market outlook.

And if you’re not (yet), read the start of Ted’s outlook below and consider upgrading to premium and access the full version, as well as all past and future MacroPass™ content.

The Coming Changes

This year has brought many changes that are having varying effects on investing: economic measures, Federal Reserve policy and unsettled international conditions. In this paper we will be concentrating on potential additional new changes that we think may soon occur.

Most investors currently are sitting happily without major worries. It reminds us of the song written by Milton Ager in 1929, “Happy Days Are Here Again.” President Franklin Roosevelt then used this phrase as his campaign song in 1932. Ironically, history shows that this theme had to wait a while before it worked. Today many of the likely new changes will bring both opportunity and pitfalls. Exhibit 1 shows the investment returns of various popular market measurements for the first nine months ending September 30, 2024.

Change … the Road Ahead

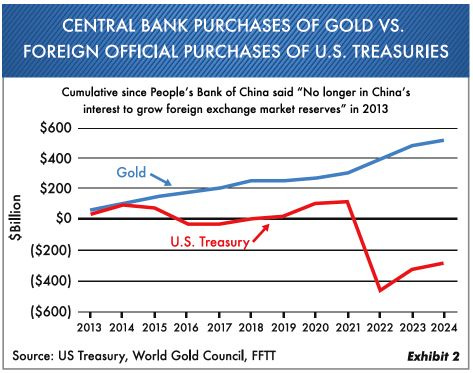

The biggest headache for the Federal Reserve and the U.S. government has been – and continues to be – the large and growing national debt. Sad to say, going forward the annual, rising U.S. debt service will be more expensive than total spending on national defense. The principal problem with this is that few foreign investors are buying U.S. bonds anymore … change. Most of them would rather purchase gold and trade in other currencies other than the dollar. This has been going on since early 2013, as seen in Exhibit 2.

If the U.S. government continues to run $2 trillion deficits in good times,

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.