Prepare For "The Mother Of All Blow-Off Tops" | New Harbor Financial

The peak to this bull run in stocks is likely still ahead

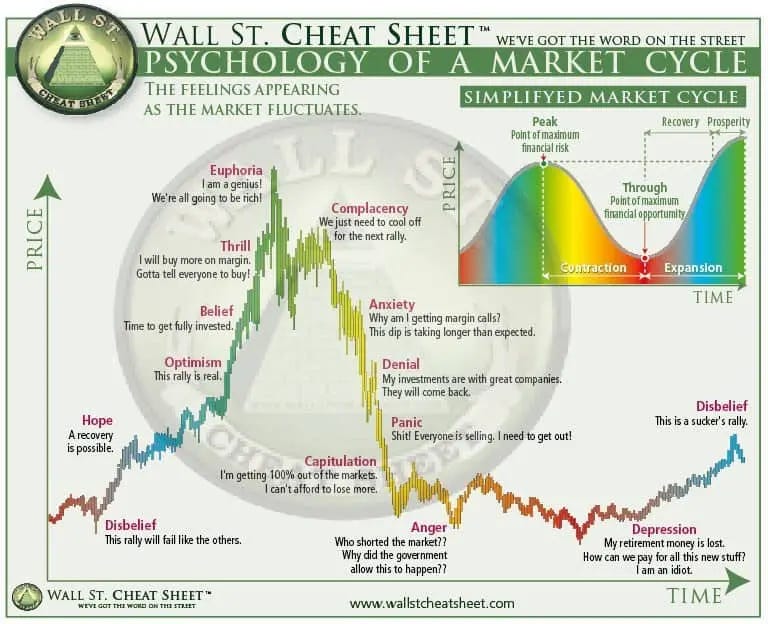

Asset prices bubbles follow a predictable trajectory, driven by investor psychology:

The final stage before the bursting is a Euphoric peak.

The financial advisors at New Harbor Financial think we're on our way to such a blow-off top, but we're not quite there yet. They expect the action to get even more manic before we do.

If Euphoria indeed arrives, prices will likely zoom to highs that just seem silly right now.

Prepare yourself for this: you will not believe what your eyes are telling you.

But also prepare for this peak to be very short-lived.

Be very cautious about getting sucked in, because the gains will likely evaporate quickly once the downcycle begins.

This is why bubbles are so destructive to so many people -- especially those who go "all in" at the top.

For an important discussion on this dynamic, click here or on the video below:

SET YOURSELF UP FOR SUCCESS IN 2025: The year end is approaching fast. Schedule a free, no-commitment consultation with one of Thoughtful Money’s endorsed financial advisors to identify the right steps (e.g., tax loss harvesting, portfolio rebalancing) to secure your 2024 investment returns and position your portfolio advantageously for 2025

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this Substack. It’s making an important difference in helping me afford the substantial operating costs of running Thoughtful Money.

Premium supporters receive my “Adam’s Notes” summaries to the interviews I do, the new MacroPass rotation of reports from esteemed experts, plus periodic advance-viewing/exclusive content. My Adam’s Notes for this discussion with the New Harbor team are available to them below.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now below:

Adam’s Notes: New Harbor Financial (recorded 11.26.24)

EXECUTIVE SUMMARY:

Historical evidence suggests that political shifts, such as a Republican sweep, do not guarantee favorable market outcomes. During George W. Bush's presidency, the S&P 500 posted negative returns despite tax cuts and deregulation policies, mainly due to overvaluation following the tech bubble. Similarly, the current market is significantly overvalued, with cyclically adjusted PE ratios at levels seen during prior market peaks.

The market appears poised to move from the "thrill" phase to "euphoria," characterized by rapid gains fueled by fear of missing out (FOMO). Examples include predictions of the S&P 500 surging 1,000 points in a month. Drawing on historical bubbles, such as the South Sea Bubble, investors are cautioned against letting emotions drive decisions, as this often leads to regret during sharp corrections.

New Harbor maintains a balanced stance with 38-40% equities, deliberately avoiding full exposure in a historically overvalued market. Of this allocation, 10% is directed toward mid-cap stocks, which show sustained outperformance and no signs of reversal. This allocation remains unhedged to capture potential short-term gains while closely monitoring risks.

The team has identified strong relative performance in specific sectors, including

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.