Weekly Market Recap: Is A Santa Claus Rally Into Year End Still Likely?

After the current chop ends, are stocks more likely to go up or down?

Stocks have been choppy over recent weeks, as portfolio manager Lance Roberts predicted due to end-of-year rebalancing by the major Wall Street funds.

Once that wave is over, does a Santa Claus rally still look likely to occur?

Lance and I discuss the odds of this, as well as the recent inflation data, poor price action in bonds, market correction risk in 2025, and Lance's firm's latest trades.

For everything that mattered to markets this week, click here or on the video below:

RECENT VIDEOS

2025 Could See A Repeat Of 2022's Market Pain | Brent Johnson

Felix Zulauf: Expect A Wild Ride (Up & Down) In Markets From Here

Stephanie Pomboy: A "Spectacular Implosion" In Stocks Is Due Once The Euphoria Ends

SET YOURSELF UP FOR SUCCESS IN 2025: The year end is approaching fast. Schedule a free, no-commitment consultation with one of Thoughtful Money’s endorsed financial advisors to identify the right steps (e.g., tax loss harvesting, portfolio rebalancing) to secure your 2024 investment returns and position your portfolio advantageously for 2025

TM ON PODCAST PLAYERS

Just a reminder that if you prefer to listen to my interviews on your podcast player, Thoughtful Money is now available on the major podcast platforms:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this new Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters now receive my “Adam’s Notes” summaries to the interviews on this channel, plus periodic advance-viewing and/or exclusive content not made available to the public, and now our popular MacroPass™ service.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now:

But whether you do or not, get ready for another week of more great content ahead. We have interviews with Jan van Eck, Ted Oakley, Jesse Felder & Graham Weaver.

Stay tuned!

cheers,

A

My sincere thanks to Lance Roberts and his team at Real Investment Advice for kindly making their weekly Bull/Bear market report available to the Thoughtful Money audience below:

Trump Election Sends NFIB Optimism Surging

By Lance Roberts | Dec 14, 2024

Inside This Week’s Bull Bear Report

Trump Election Sends NFIB Optimism Surging

How We Are Trading It

Research Report – Economic Indicators And Earnings Expectations

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

First Comes The Fed, Then Santa

Last week, we discussed that the risk to the markets was the annual portfolio rebalancing process. To wit:

“With the year-end approaching, portfolio managers need to rebalance their holdings due to tax considerations, distributions, and annual reporting. For example, as of this writing, the S&P 500 is currently up about 28% year-to-date, while investment-grade bonds (as measured by iShares US Aggregate Bond ETF (AGG) are up 3.2%. That differential in performance would cause a 60/40 stock/bond allocation to shift to a 65/35 allocation. To rebalance that portfolio back to 60/40, portfolio managers must reduce equity exposure by 5% and increase bond exposure by 5%. Depending on the magnitude of the rebalancing process, it could exert downward pressure on risk assets, leading to a short-term market correction or consolidation.”

That certainly seemed the case this past week, with the market trading being fairly sloppy. Attempts to push the market higher were repeatedly met with sellers, and we saw a rotation from over-owned to under-owned assets. Notably, that selling pressure arrived as expected, and while such could persist until early next week, we should be getting close to the end of the distribution and rebalancing process. The good news is that the recent consolidation paves the way for “Santa Claus to visit Broad and Wall.”

Technically speaking, the market did register a short-term MACD sell signal last week, which could exert further downward pressure on stocks into next week. With relative strength not oversold, there is some risk of the market declining toward the 20-DMA by the time the Fed announces its next rate cut on Wednesday. However, barring any unexpected events, the market should be able to rally into year-end with a target of 6100 to 6150.

Short-term forecasts always have risks, so we suggest managing risk accordingly. However, the seasonal tendencies, current bullish sentiment, and share buybacks continue to favor higher prices into the first week of 2025. After that, all bets are off as a new administration, executive actions, and the first 100 days of policymaking will set the stage for market expectations next year. As noted last week, optimism is exceptionally high. Still, a radical transformation of Government, which will be great in the long term, does not come without short-term economic and financial. risks.

Speaking of optimism, we will review small business owners and what that potentially means for the economy this week.

A Quick History Lesson

Over the last several years, we have regularly discussed the importance of the National Federation Of Independent Business Survey (NFIB) concerning the economy. As noted in our most recent update (October 12th) on the index:

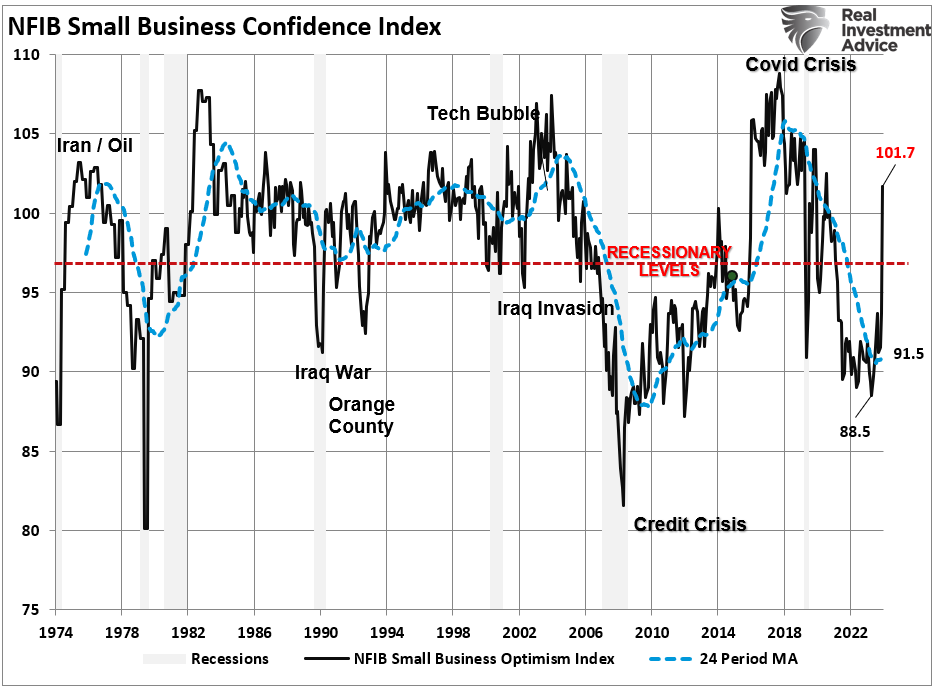

“While Wall Street’s bullish narrative is compelling, the latest data from the NFIB Small Business Optimism Index provides a stark contrast. Small businesses are the backbone of the U.S. economy, and the sentiment captured in the NFIB survey offers a more granular view of the challenges facing Main Street, which often diverges from Wall Street’s broader outlook. The index remains at levels more normally associated with economic contractions than expansions.”

As noted, that article was posted before Trump’s election in November. At that time, sentiment was broadly negative regarding everything from the outlook on sales to employment. Given that retail sales comprise roughly 40% of Personal Consumption Expenditures (PCE) which make up nearly 70% of the GDP calculation, small businesses are an important driver of the economy. As noted in October:

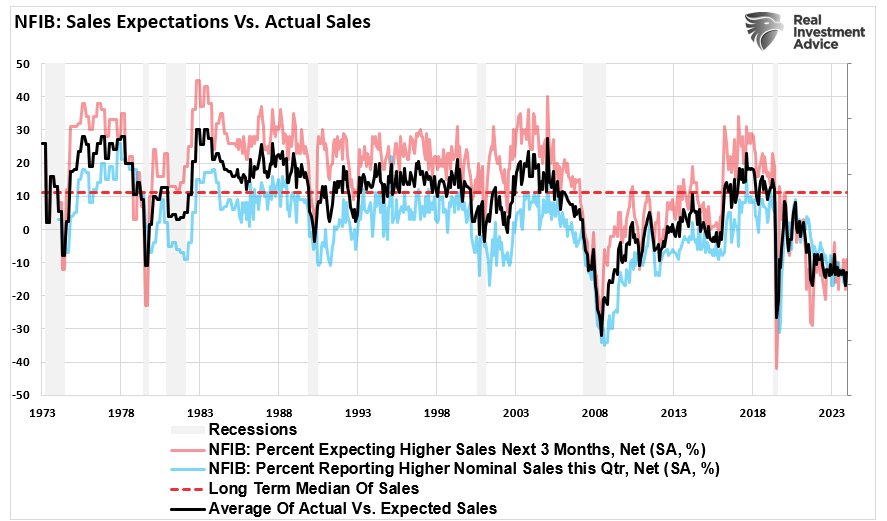

“One of the more troubling components of the NFIB survey is the outlook for future sales. According to the data, many small business owners expect sales to decline over the next six months. This pessimism is particularly pronounced in the retail and service sectors, where rising costs and shrinking profit margins force many businesses to scale back their operations. The survey provides two fascinating components: actual sales during the last quarter and expected sales in the upcoming quarter. Usually, business owners are always more optimistic about future sales despite actual sales often more disappointing. However, both expected and actual sales are currently dismal, as shown by the average of the two measures.”

Then, on November 8th, in our Daily Market Update, we discussed Trump’s election and its potential impact on small and mid-capitalization companies. To wit:

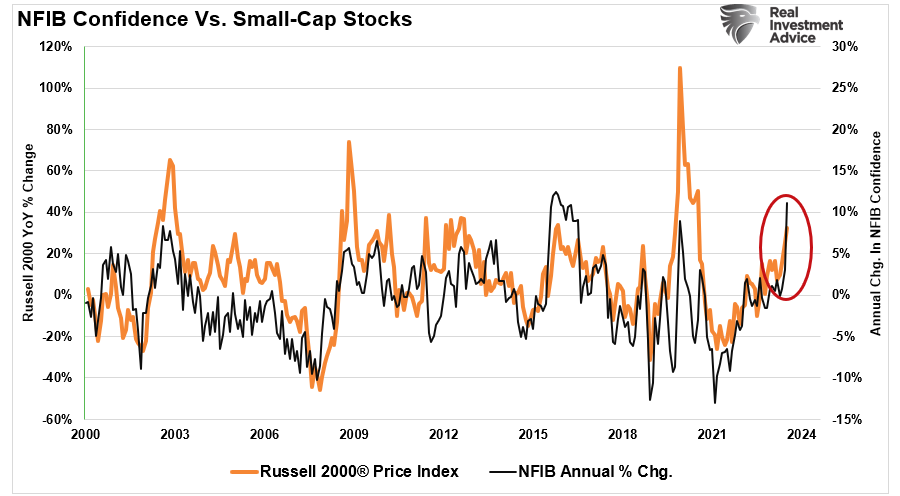

“Notably, the massive surge in small/mid-cap stocks was the most compelling. The chart below shows a very high correlation between small/mid-cap stocks’ annual rate of change and the NFIB small business confidence index. Since business owners tend to lean conservative, favoring policies that promote economic growth, reduced regulations, and tax cuts, Trump’s election supports business owners.

We suspect that the next iteration of the NFIB index will be a catchup move fueled by an explosion of business owners’ confidence. This should lead to increases in CapEx spending, employment, and wage growth.“

The reason for the quick history lesson comes down to the last sentence.

NFIB Index Surges On Trump’s Election

Early this week, the NFIB released its latest small business confidence index. I am unsure that “explosion” fully encapsulates the move we saw following Trump’s election. However, as the saying goes, “a picture is worth a thousand words.”

The more than 10-point jump in the reading is astonishing and something we haven’t seen since Trump’s election in 2016. After remaining at levels typically associated with recessionary economies over the last three years, the latest reading suggests a massively positive shift in business owners’ outlooks. That shift is a function of expectations in several areas:

Tax rates will not rise as the Tax Cuts And Jobs Act of 2017 will be made permanent.

There is a potential that corporate tax rates could be cut from 21% to 15%.

A reduction in regulatory overreach from the previous administration.

The reduction of illegal immigration and the institution of legal pathways for immigration.

A reversal of the abandonment of the “rule of law.”

A shift in policies that will support U.S.-based businesses and encourage domestic production.

Expedited permitting for U.S.-based business development investments.

While these policies are designed to support U.S.-based businesses, they present some risks that should not be overlooked. For example, while corporate tax cuts and deregulation may enhance profitability and investment, trade policies and immigration restrictions could introduce challenges such as increased costs and labor shortages. As such, small businesses, in particular, will need to navigate these dynamics to leverage potential benefits while mitigating associated risks.

However, for now, the shift in positive sentiment is reflected in many expectations from employment to sales. Let’s examine a few of the important ones.

Economic Outlook

A symbiotic link exists between the various NFIB survey data and potential economic outcomes. Since the Trump election, the number of small business firms expecting economic improvement has surged. Such a surge was also seen following Trump’s election in 2016. Notably, while the spike lasted for some time, it eventually began to reverse for two reasons. First, while economic growth did initially improve, it did not grow as strongly as was expected. Secondly, as noted above, while small businesses are optimistic about the “proposed” policies, actual enactment and offsetting risks of one policy over another (i.e., tariffs versus deregulation) muted the outcome.

While Trump will likely not face another “pandemic-related” crisis over the next four years, many other potential risks, from economic recession to credit-related events, could impact future expectations.

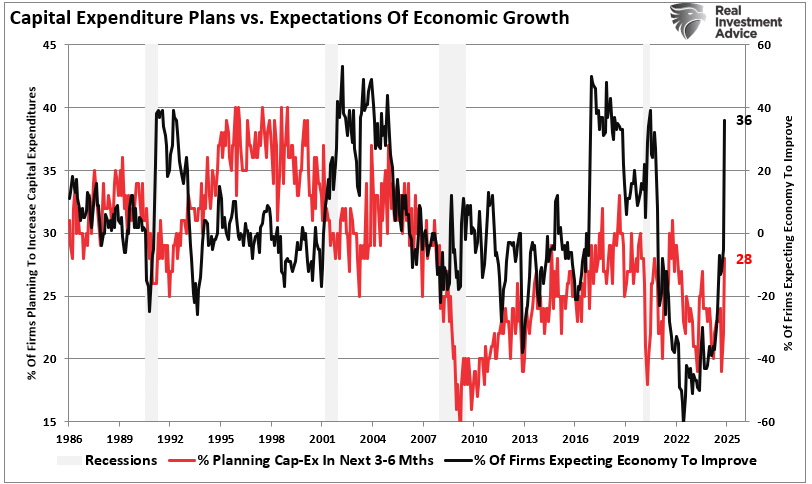

Nonetheless, in the near term, the surge in expectations for economic growth will likely “loosen the purse strings” of small business owners to increase capital expenditures. Capital expenditures, or CapEX, are included in the “private investment” component of the GDP calculation. Unsurprisingly, there is a correlation between economic growth and CapEx. As the economy grows, derived from consumer demand, businesses must invest to increase production. Therefore, if current expectations are for the economy to grow over the next 6-months, it is logical that expectations for CapEx would also increase.

Given the impact of small businesses CapEx plans on the economy, we should expect economic growth to increase if they follow through with those plans. Notably, the expectation improvement suggests a further decline in recession risks into 2025.

Crucially, if small businesses expect economic improvement, which supports the need to increase CapEx, they also expect sizable increases in sales and employment.

Increased Sales And Employment

There is a very basic diagram that explains our economy. In a consumption-based economy, like the U.S., individuals must produce something first to consume. That consumption is the demand side of the economic equation, to which producers create the supply. The more demand in the economy, the more production is needed. That demand for production drives employment and wages.

Understanding the surge in economic growth expectations since Trump’s election aligns with a sharp increase in future sales expectations. Both expected and actual sales were previously at levels that always aligned with economic recessions. However, since the election, sales expectations have climbed sharply. What will be crucial to the economy is to see ACTUAL sales increase into 2025. While historically, there was a deviation between actual and expected sales; if sales do not increase from current levels, neither will economic growth rates.

While the NFIB survey is very optimistic about future sales, it is worth noting that actual (inflation-adjusted) retail sales, as reported by the BEA, while correlated, are often less optimistic. Given the current state of the consumer, elevated interest rates, and higher rates of inflation, we will likely see some disappointment in future NFIB sales expectations.

However, for now, if small business owners expect an increase in sales, such will also lead to more demand for hiring and an increase in wages. Again, it should be evident that sales increases result in higher wages.

Lastly, to complete the economic cycle, sales (demand) increase production (supply), requiring higher wages and employment and facilitating more demand. This is the basis of the economic growth cycle.

If the optimism since Trump’s election turns out to be well-founded, it could bode well for small and mid-capitalization stocks at least early into 2025.

Small Cap Stocks – Look At Me Now

As I noted at the outset, there was previously a rather significant gap between small and mid-capitalization stocks, as represented by the iShares Russell 2000 Index (IWM) and the annual change in the NFIB index. Given the historical correlation, one would eventually catch up with the other. In this case, the market expected a Trump win, with IWM running well ahead of NFIB sentiment. Since the election, that gap has now closed, with sentiment surging higher.

While small and mid-capitalization stocks have surged higher in recent weeks, many risks still plague those companies going forward. As noted previously, roughly 41% of these unprofitable companies are heavily indebted, with a maturity wall approaching over the next two years. If interest rates remain elevated, such could weigh on both refinancing capability and profitability, leading to a pickup in default rates. The problem with surging expectations for economic growth, employment, and wages is that such will sustain inflation and higher interest rates.

Furthermore, the long-term performance of small and mid-capitalization stocks remains dismal, as shown.

Could that change in the future? Yes. However, such would require a reset in earnings growth expectations, likely following the next recession. For now, most earnings growth remains attributed to large capitalization companies and primarily just a small subset of those stocks. While we could see a pickup in overall economic activity, there is a risk that it will not translate to small and mid-capitalization companies.

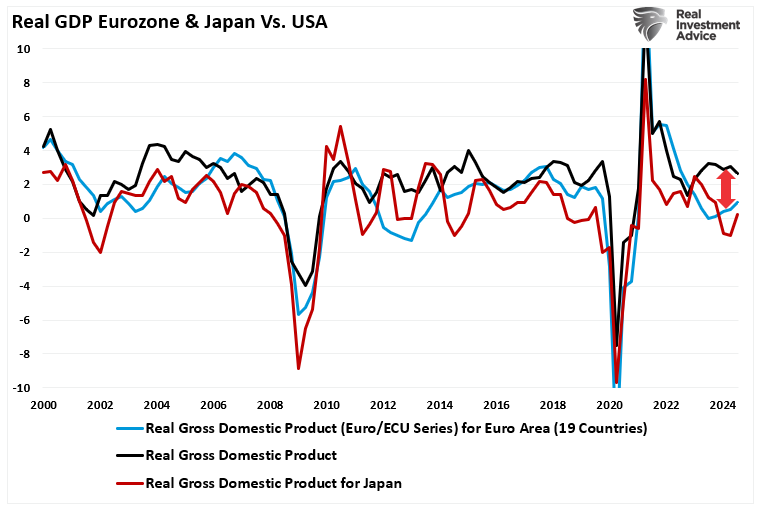

Even though consumer and business owners’ confidence has surged since Trump’s election, we must continue to monitor the incoming data and adjust our risk preferences accordingly. While the new administration certainly has many ambitious plans to “Make America Great Again,” the reality remains that many of these plans may not come to fruition. There will also likely be offsetting forces between policies, and the debt and deficits are still a longer-term problem weighing on economic growth trajectories. Most importantly, while the U.S. is generating economic growth currently, the rest of the world is not. As such, we are more likely to import economic weakness over the next year rather than export growth.

We remain optimistic and allocated to equities in the near term. However, we realize that the more excessive optimism about 2025 comes at a risk. Many things could derail those expectations and the market, so we must remain focused on the data as it presents itself.

With the S&P 500 up nearly 30% this year and a more than 20% return last year, tempering expectations for returns in 2025 seems prudent.

How We Are Trading It

With portfolio rebalancing likely mostly behind us, there is still a risk of some sloppy action before Christmas. However, we need to start thinking about preparing for the year-end “window dressing” action known as the “Santa Claus Rally.”

If you are long equities in the current market, rebalancing risk is manageable.

Tighten up stop-loss levels to current support levels for each position.

Hedge portfolios against major market declines.

Take profits in positions that have been big winners

Sell laggards and losers

Raise cash and rebalance portfolios to target weightings.

Remember, our job as investors is pretty simple – protect our investment capital from short-term destruction so we can play the long-term investment game. Here are our thoughts on this.

Capital preservation is always the primary objective. If you lose your capital, you are out of the game.

Seek a rate of return sufficient to keep pace with the inflation rate. Don’t focus on beating the market.

Keep expectations based on realistic objectives. (The market does not compound at 8%, 6% or 4%)

Higher rates of return require an exponential increase in the underlying risk profile. This tends to never work out well.

You can replace lost capital – but you can’t replace lost time. Time is a precious commodity that you cannot afford to waste.

Portfolios are time-frame specific. If you have a 5-year retirement horizon but build a portfolio with a 20-year time horizon (taking on more risk), the results will likely be disastrous.

There is a wide range of potential outcomes, based on valuations, in 2025. No one knows with any certainty what next year will hold. However, by focusing on risk controls and the technical underpinnings, we can safely navigate the waters to safety.

Feel free to reach out if you want to navigate these uncertain waters with expert guidance. Our team specializes in helping clients make informed decisions in today’s volatile markets.

Have a great week.

Research Report

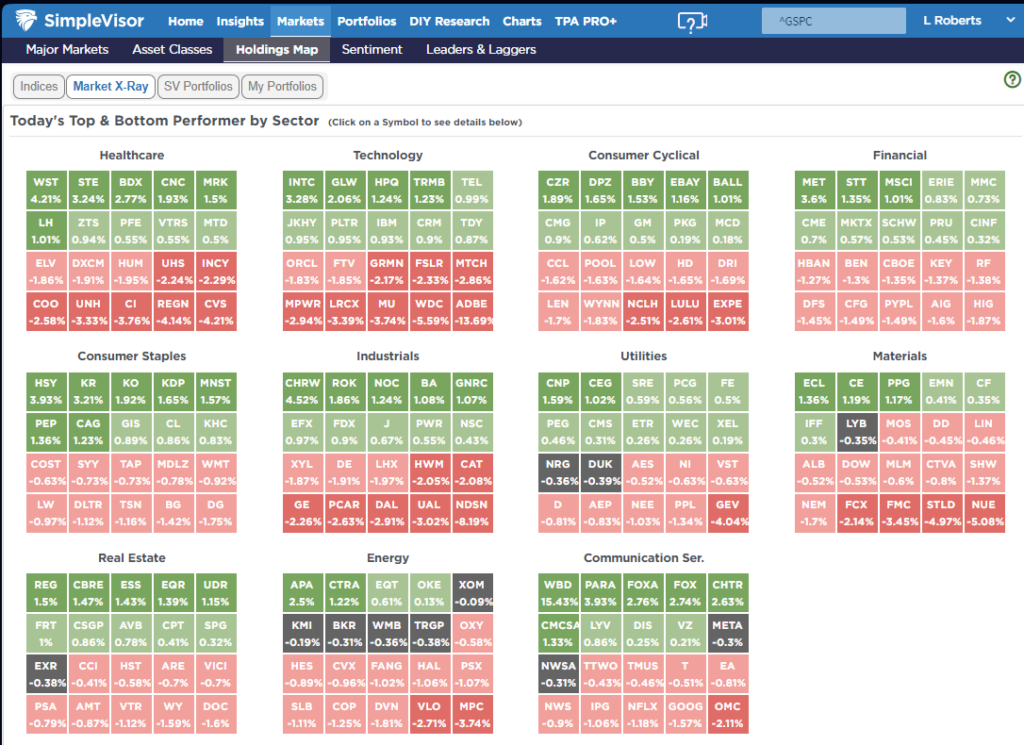

SimpleVisor Top & Bottom Performers By Sector

S&P 500 Weekly Tear Sheet

Relative Performance Analysis

In last week’s newsletter, we noted that this past week would be when mutual fund rebalancing begins, which could lead to increased volatility and sloppy trading action. With the index overbought along with technology, discretionary, and bonds, a pullback in those assets would be unsurprising. We saw much of that rebalancing occur as expected, and now the market is mostly oversold, with the exception of technology, discretionary, and communications, which are driven by the “Magnificent 7.” While we could see a bit more sloppiness starting the week, managers should start “window dressing” portfolios by Wednesday for year-end reporting. Such will likely support the “Santa Claus” rally, and with the market remaining bullishly biased, increasing equity risk into year-end is doable. Don’t forget to manage your risk in that process, “just in case.”

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 86.43 out of a possible 100.

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 84.45 out of a possible 100.

Relative Sector Analysis

Most Oversold Sector Analysis

Sector Model Analysis & Risk Ranges

How To Read This Table

The table compares the relative performance of each sector and market to the S&P 500 index.

“MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

The table shows the price deviation above and below the weekly moving averages.

The sell-off this past week took a majority of sectors, along with bonds, well below their monthly risk ranges. Such sets up those sectors, along with bonds, for a rally into year-end as portfolio window dress their portfolios for year-end reporting. We discussed previously that much of the trading action this past week would be on the downside due to the need for funds to make annual distributions and complete tax loss selling for year-end. That has mostly been completed, giving the market room to rally.

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

Relative Strength Stocks

Momentum Stocks

Fundamental & Technical Strength W/ Dividends

(Click Images To Enlarge)

RSI Screen

Momentum Screen

Fundamental & Technical Screen

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

No Trades This Week

Lance Roberts, C.I.O., RIA Advisors

Have a great week!

Thoughtful Money LLC is a Registered Investment Advisor Promoter.

We produce & distribute educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Thoughtful Money and the Thoughtful Money logo are trademarks of Thoughtful Money LLC.

Copyright © 2024 Thoughtful Money LLC. All rights reserved.