What a week!

The unwind of the yen carry trade sent global markets into free-fall on Monday.

Equities tanked, as did Bitcoin, oil and gold. US Treasurys jumped, returning to their traditional inverse relationship to stocks.

And then...everything reversed.

Mostly due to central bank intervention in Japan, as well as some better than expected jobs data in the US.

So, everyone is asking: Is the sell-off over?

Is now the time to buy back in?

Portfolio manager Lance Roberts doesn't think so (yet).

In this week's Market Recap, we discuss why, as well as his outlook for the months ahead and his firm's recent trades.

For everything that mattered to markets, watch this week's Market Recap.

To do so, click here or on the video below:

Also, as promised in the video above, here’s the Apple commercial I appeared in back in the late ‘90s:

RECENT VIDEOS

Economic Danger Ahead Now That Key Recession Indicator Has Been Triggered? | Claudia Sahm

Danielle DiMartino Booth: Recession? We Ain't Seen Nothin' Yet!!

TM NOW ON PODCAST PLAYERS

Just a reminder that if you prefer to listen to my interviews on your podcast player, Thoughtful Money is now available on the major podcast platforms:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this new Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters now receive my “Adam’s Notes” summaries to the interviews on this channel, plus periodic advance-viewing and/or exclusive content not made available to the public, and now our new MacroPass service.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now:

But whether you do or not, get ready for another week of more great content ahead. We have interviews with Darius Dale, Ivy Zelman, John Pease (GMO), Stephanie Pomboy & Grant Williams.

Stay tuned!

cheers,

A

My sincere thanks to Lance Roberts and his team at Real Investment Advice for kindly making their weekly Bull/Bear market report available to the Thoughtful Money audience below:

Market Crash – Is It Over?

By Lance Roberts | August 10, 2024

Inside This Week’s Bull Bear Report

Market Crash – Is It Over?

How We Are Trading It

Research Report – UBI – Tried, Tested, Failed

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

The Market Crash Heard Around The World

As noted last week, the correction continued. As noted:

“While the correction has been quite normal, Friday’s break of the 50-DMA suggests the correctional process continues. As we discussed in June and July, a 5-10% correction was likely, and we are in the middle of that process. The market is getting decently oversold, and we are likely seeing a short-term exhaustion of sellers. Notably, the market held the 100-DMA on Friday, which was critical support during the April correction. With markets oversold, we would be unsurprised to see a reflexive rally next week. Use rallies to rebalance risk and reduce exposure as needed.”

While we did get that reflexive rally, it came after an unexpected event shocked markets into a deep selloff on Monday. As we said in the “Yen Carry Trade:”

“Consider that ‘yen carry traders’ have leveraged highly volatile risk assets like cryptocurrencies, small-cap stocks, mega-cap stocks, and even the Japanese market. The carry trade works well as long as the Japanese Yen does not markedly appreciate, forcing a liquidation of the market leverage.

The problem is that the Yen has appreciated more than 15% in the last few weeks. As the Yen appreciates, the Japanese banks demand margin calls (i.e., the catalyst). When that occurs, the hedge funds, pension funds, insurance companies, or investors using the ‘Yen carry trade’ must either put up more collateral or sell the leveraged assets. That reversal and forced liquidation created a vicious spiral by pushing the Yen higher and risk assets lower.”

Events like these tend to be temporary and rarely devolve into more extreme market corrections. However, there is always that risk, so we suggest rebalancing portfolio risk as needed. While the reflexive rally into Friday erased Monday’s market plunge, there is still likely sufficient risk to warrant a more cautious approach over the next month or so.

In this week’s missive, we will discuss the recent events in more detail. What caused it, and what will likely happen next?

Why Did The Market Crash?

The events on Monday sent investors running for cover. As discussed on the Real Investment Show, headline events like the economy, employment, debt, deficits, or geopolitical conflict are quickly evaluated and hedged by market participants. Therefore, the “known” events rarely cause sharp market declines as buyers and sellers compensate for those risks.

However, some events, like the spike in the Yen that collapsed the “Yen Carry Trade,” can take market participants by surprise. These “unexpected, exogenous events” lead to a “shoot first, ask questions later” response from market participants, which acts as the “catalyst” that unwinds market complacency. As noted in that linked article, the ingredients of a mean-reverting event were present; all that was needed was a trigger.

“If I gave you a bunch of ingredients such as nitrogen, glycerol, sand, and shell, you would probably stick them in the garbage and think nothing of it. They are innocuous ingredients and pose little real danger by themselves. However, you make dynamite using a process to combine and bind them. However, even dynamite is safe as long as it is stored properly. Only when dynamite comes into contact with the appropriate catalyst does it become a problem.

‘Mean reverting events,’ bear markets, and financial crises result from a combined set of ingredients that a catalyst ignites. Like dynamite, the individual ingredients are relatively harmless but dangerous when combined.

Leverage + Valuations + Psychology + Ownership + Momentum = “Mean Reverting Event”

Importantly, this particular formula remains supportive of higher asset prices in the short term. Of course, the more prices rise, the more optimistic investors become. While the combination of ingredients is dangerous, they remain “inert” until exposed to the right catalyst.

That catalyst is always an unexpected, exogenous event that triggers a rush for the exits.“

To understand why there was a sudden rush for the exits, we must realize that “Buyers Live Lower.”

“The market price is always a function of buyers and sellers negotiating to make a transaction. While there is always a buyer for every seller, the question is always, ‘What price?’

During a strongly trending bull market, few people are willing to sell, so buyers must keep bidding up prices to attract a seller to make a transaction. As long as this remains the case and exuberance exceeds logic, buyers will continue to pay higher prices to get into the positions they want to own. Such is the very definition of the ‘greater fool’ theory. However, at some point, for whatever reason, this dynamic will change. Buyers become more scarce as they refuse to pay a higher price. When sellers realize the change, there will be a rush to sell to a diminishing pool of buyers. Eventually, sellers begin to ‘panic sell’ as buyers evaporate and prices plunge.

Sellers live higher. Buyers live lower. What causes that change? No one knows.”

In this particular event, the spike in the Japanese Yen led to effective “margin calls” on the leverage being applied through the carry trade. Given that this massive $20 Trillion carry trade is used broadly across Wall Street hedge funds, everyone must sell simultaneously, with potential buyers being very scarce. Notably, there were indeed buyers in the market on Monday. They were just 3% lower than when the market closed on Friday.

The next question is whether the “selling” is over.

A History Of Event Corrections

When a market crashes, investor fear increases. Two psychological responses from investors tend to precede and exacerbate a market crash. The “herding effect” and “loss aversion.”

These two behaviors tend to function together, compounding investor mistakes over time. As markets rise, individuals are optimistic the current price trend will continue indefinitely. The longer the rising trend lasts, the more ingrained that optimistic belief becomes until the last of “holdouts” finally “buys in” as the financial markets evolve into a “euphoric state.”

As the markets decline or during a market crash, people realize that “this decline” could be more than a “buy-the-dip” opportunity. As losses mount, loss anxiety increases until individuals seek to “avert further loss” by selling.

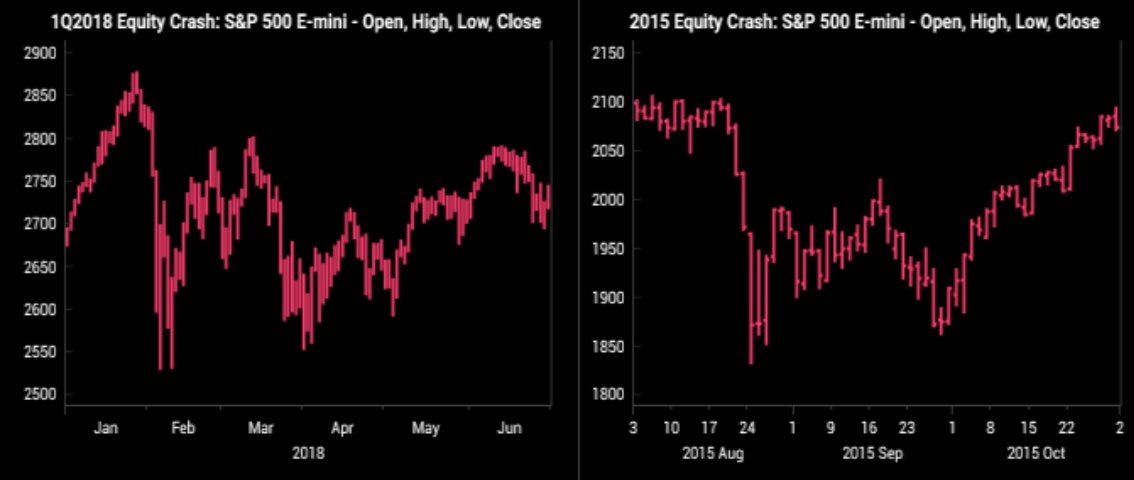

This behavior often results in investors selling near market lows. The charts below, courtesy of @themarketear, show previous market crashes that resulted in swift, sharp declines caused by unexpected exogenous events. While the current market environment and recent market crash differ from these earlier periods, we will likely find similar psychological responses in the weeks ahead.

The crash of 1987 resulted from the failure of “portfolio insurance.” The decline in 2011 was due to an earthquake that sparked a tsunami, flooding Japan and shuttering essential exports. In late 2015, the market moved sharply lower as Janet Yellen discussed tapering monetary support. The market crash in 2018 resulted from an unexpected statement by the Federal Reserve that interest rates were “nowhere near the neutral rate,” suggesting further rate increases.

The recent market crash has many of the same hallmarks as these past events:

An unexpected, exogenous event causes sellers to swamp buyers in a “rush for the exits.”

The market price moves sharply lower to find “buyers” at substantially lower prices.

The market bounces as buyers step in to buy at reduced prices.

The initial market rally fails, prices revert to previous lows, and investors’ sentiment becomes bearish.

Buyers return to meet sellers at lower prices, ending the corrective period.

What Did They Know

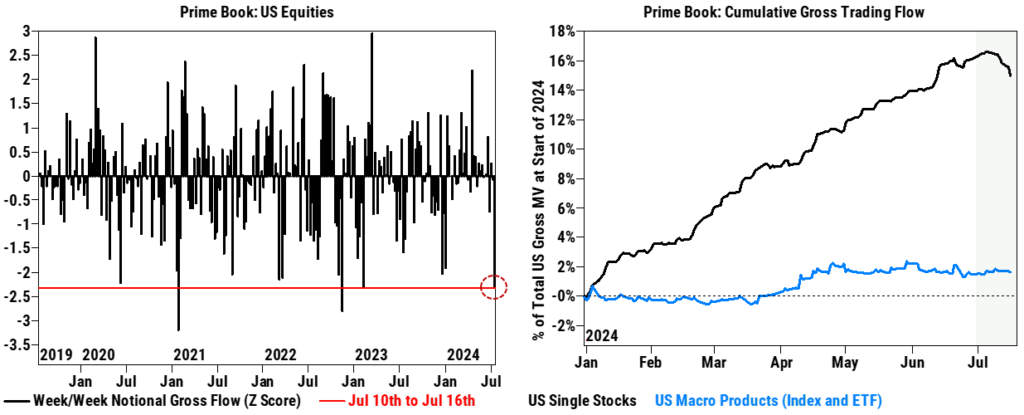

While the “Yen Carry Trade” shock spooked markets on Monday, the correction was already underway as hedge funds were reducing exposure. As we noted on July 27th:

“Hedge fund exposure to tech dropped sharply during the past two months. At the same time, hedge funds remained highly exposed to all other sectors, and the violent selling in the ‘Mag 7’ sparked a burst in volatility, which prompted broader selling across the board. It was one of the sharpest rotations over the last decade.”

As noted, it was one of the largest de-grossing of long exposures since 2022.

While retail investors were unaware of the stress building, hedge funds were already working their way out of positioning. Unfortunately, hedge funds weren’t able to completely reverse their positioning as the explosion in the Yen required a rapid uncontrolled liquidation of assets across portfolios. Like the events noted above, there was a rapid “rush for the exits,” sending stock prices lower and volatility higher.

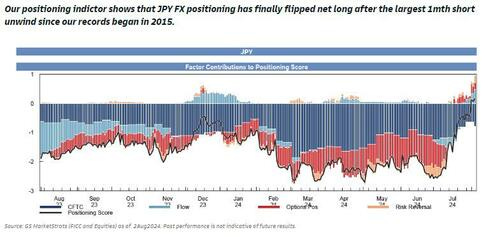

Notably, Goldman Sachs and JPM Morgan noted that much of the pressure from the Yen carry trade has been resolved. According to Goldman, investors are net long the Yen as of this week, which implies that the carry trade has been primarily unwound.

We agree with their conclusion, as hedge funds are now re-grossing their books.

While we expect to see a further bounce in August simply because sellers have exhausted themselves, we are likely not done with the recent volatility.

For the rest of the report, go here

Thoughtful Money LLC is a Registered Investment Advisor Solicitor.

We produce & distribute educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Thoughtful Money. MacroPass and the Thoughtful Money logo are trademarks of Thoughtful Money LLC.

Copyright © 2024 Thoughtful Money LLC. All rights reserved.

I’m not a forced seller. Are you?

i have seen estimates that the carry trade with 5 Trillion USD or even 20 Trillion. No one seems to know.

It seems highly unlikely this amount was unwound already