Weekly Market Recap: Market Break In Process?

Stocks have broken below their trendline. Will they regain it?

The unending string of up weeks we saw in stocks in Q1 has ended here in April.

The market had a volatile week, with the S&P ending roughly 100 points lower and bond yields continuing to rise, with the UST 10-year yield now over 4.5%.

Notably, the S&P has broken below the bullish trendline it has been trading in since the bull rally began back in November.

The breakdown is unconfirmed as of yet. But if stocks close a little lower from here without regaining their 20 Daily Moving Average, then it will be...so next week will bear close watching.

Portfolio manager Lance Roberts and I discuss this in depth - as well as Jesse Felder's "three 50s" warning charts, inflation, bonds, the price action in gold & oil, as well as Lance’s firm's recent trades.

For everything that mattered to markets, watch this week's Market Recap featuring Lance Roberts.

To do so, click here or on the image below:

In case you haven’t yet seen them, here are the other videos that ran on the Thoughtful Money channel this week:

Marc Faber: Most Households Are Drowning Financially While The Rich Get Richer

The Market Is Priced For A Fairytale Economy, But Stagflation Is Much More Likely | Jesse Felder

Market To Fall 25%, Recover Before The Election, Then "Drop Precipitously" | David Brady

TM NOW ON PODCAST PLAYERS

Just a reminder that if you prefer to listen to my interviews on your podcast player, Thoughtful Money is now available on the major podcast platforms:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this new Substack. It’s making an important difference in helping me afford the substantial startup costs of birthing Thoughtful Money.

Premium supporters now receive my “Adam’s Notes” summaries to the interviews on this channel, plus periodic advance-viewing and/or exclusive content not made available to the public, and now our new MacroPass service.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now:

But whether you do or not, get ready for another week of more great content ahead. We have interviews with Darius Dale, New Harbor Financial, Adam Kobeissi, and Kevin Muir (of The Macro Tourist) lined up.

Stay tuned!

cheers,

A

My sincere thanks to Lance Roberts and his team at Real Investment Advice for kindly making their weekly Bull/Bear market report available to the Thoughtful Money audience below:

Cracks Appear In The Market’s Bullish Armor

By Lance Roberts | April 13, 2024

Inside This Week’s Bull Bear Report

Cracks Appear In The Market’s Bullish Armor

How We Are Trading It

Research Report –Immigration And Its Impact On Employment

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

Market Confirms Break Of The Bullish Trend

Last week, we discussed the current bullish trend’s ongoing, mind-numbing, narrow channel. We have suggested there was little to worry about until the market violates the 20-DMA. The market confirmed that “crack” to this “unstoppable” bullish rally on Friday. As we noted last week:

“However, as we previously noted, just because the market breaks the 20-DMA does not mean we must take immediate action. What we need to see is a confirmation of that break with either a failed retest of previous support or a further decline. If the market is lower on Monday and takes out Thursday’s low, as shown, this would confirm the break of support and suggest lower prices. The 50-DMA will quickly become the next significant support level.”

As shown, the market did break below the previous low on Friday after failing to reclaim that previous support at the 20-DMA. The failure to reclaim that support turns the previous 20-DMA into resistance and makes the 50-DMA new critical support over the next few days. (Note: If the market makes a confirmed break of the 50-DMA, the 100- and 200-DMAs become the following logical targets.)

The market is oversold enough for a bounce early next week that investors should use to make further adjustments to portfolio allocations. Crucially, this signal DOES NOT mean to “sell everything and go to cash.”

The confirmed break of support suggests reviewing portfolio allocations and taking profits in well-performing positions. However, while some stocks have only begun to correct from previously overbought conditions, many have already corrected by 10% or more over the last few weeks. Those companies may see inflows as a rotation trade in the market occurs.

In other words, as is always the case, be careful “throwing the baby out with the bathwater.” Opportunities to acquire better-priced companies always exist, even during a corrective process.

What is essential is that there are now cracks in the market’s bullish armor. Let’s dig into that more deeply.

Cracks Appear In The Market’s Bullish Armor

As we have repeatedly discussed over the last month, the 20-DMA has consistently supported the rally that began in November. Notably, that support cracked over a week ago as geopolitical risks heightened. As we discussed in our Daily Market Commentary:

“However, a rash of Fed speakers left the markets uncertain about the “certainty of rate cuts” this year, sending stocks lower mid-afternoon. Furthermore, international tensions between Iran and Israel raised commodity prices, weighing on market outlooks as the risk of war increased. That selloff broke the market below the 20-DMA trend line, violating that support.”

However, as we noted, just because the market breaks the 20-DMA does not mean we must take immediate action. What we need to see is a confirmation of that break with either a failed retest of previous support or a further decline. On Friday, the stronger-than-expected employment report sent stocks higher as “good news is good news” as more robust economic growth should support earnings. However, “bad news also remains good news,” as it would mean Fed rate cuts.

The market continued to hold support on Monday and Tuesday, but the hotter-than-expected inflation report on Wednesday sent stocks crashing through support once again.

This type of price action shows that cracks are now appearing in the “can’t stop, won’t stop” bull market rally. As such, we will review the market’s short-term technical price action. From that analysis, we can define potential support and resistance levels to pay attention to if a larger correction process is beginning to unfold.

As is always the case, no one knows what will happen next. Such is particularly true in a market still heavily driven by excess liquidity and more extreme bullish sentiment. As shown, the liquidity index remains supportive of the current rally.

The same goes for overall bank reserves, which have continued to rise since October 2022, when this bull market rally started following the 2022 correction. Notably, those reserves continue to increase despite concerns about overall bank liquidity and stress in regional banks.

Nonetheless, according to our technical review, despite this liquidity flow, several cracks are worth noticing.

Crack No. 1 – A Slowing Of Momentum

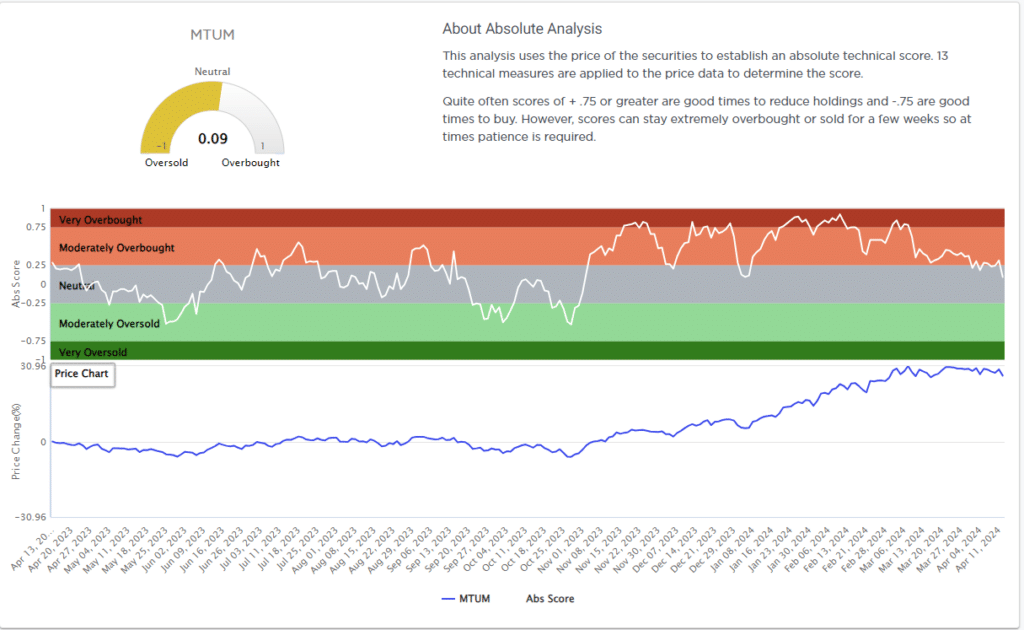

Since the October lows, the chase for equity exposure, particularly in the “artificial intelligence” and “weight loss drug” sectors, has been phenomenal. We can measure that momentum chase by looking at the Momentum ETF (MTUM), which regularly rebalances its holdings for “what’s hot.”

Currently, the Top-10 holdings of MTUM are unsurprising, with some of the biggest high-flyer names dominating the list.

Of course, given that these names are getting the most attention, it is unsurprising that as prices rise, they attract increasing money flows as the chase for performance ensues. Therefore, we can watch MTUM for changes in that “exuberance,” which is progressing. Since the middle of March, the price of MTUM has flatlined, with the absolute score reducing from extremely overbought to just moderately overbought.

Furthermore, MTUM (momentum stocks) has shown considerable weakness over the last ten weeks.

However, if we look at a chart of the S&P 500 index (where the top 10 holdings are similar to MTUM), the loss of price momentum is visible.

While this loss of momentum suggests that cracks in the market’s bullish armor are growing, it does not mean a deeper correctional process is imminent. However, it is evidence worth paying attention to.

Crack No. 2 – Bullish Sentiment Is Fading

One of the most important aspects of a bull market is investor participation. We can measure participation by monitoring investor sentiment (how they feel about the market) and positioning (how they allocate to equity risk.)

In “Market Bubbles,” we discussed that bull markets, specifically market bubbles, result from investor psychology. To wit:

“When investors bid up asset prices that exceed underlying earnings growth rates, market bubbles have previously been present. The reason is that since economic activity generates revenues and earnings, valuations can not indefinitely exceed the underlying fundamental realities. Since valuations are a function of price and earnings, deviations of the market from the long-term exponential growth trend have marked prior peaks.”

And, when investors are very bullish, they are willing to take on risk by leveraging bets.

“Unsurprisingly, as consumer confidence improves, so does the speculative demand for equities. As stock markets improve, the “fear of missing out” becomes more prevalent. Such boosts demand for equities, and as prices rise, investors take on more risk by adding leverage.”

Therefore, if psychology drives the markets on the way up, a reversal of that psychology should be essential to monitor for a market change. As Howard Marks previously noted:

“It’s the swings of psychology that get people into the biggest trouble, especially since investors’ emotions invariably swing in the wrong direction at the wrong time. When things are going well people become greedy and enthusiastic, and when times are troubled, people become fearful and reticent. That’s just the wrong thing to do. It’s important to control fear and greed.“

Currently, investor allocations to equities by both professional and retail investors have risen sharply. In July 2023, that allocation reversal propelled the 10% correction through last October. Investor allocations are higher than the previous bullish exuberance. It is worth noting that, like today, the market turned lower before allocation levels declined in earnest.

Secondly, as we saw in 2023, the more extreme bullish sentiment of professional and retail investors peaked above a ratio of 2.5 before the reversal. Over the last six weeks, five of those weeks saw a bull versus bear sentiment ratio above 2.5.

The point is that when everyone is bullish, as they have been over the last two months, few are left to “buy” to keep markets elevated. Such is why money flows are also reversing.

Crack No. 3 – Money Flows Are Reversing

While technicals, sentiment, and positioning are all crucial to market corrections, price action ultimately dictates movement. As explained previously, buyers must coax sellers into a transaction by offering consistently higher prices during rising markets. However, when the market reverses, sellers enter the market, and buyers retract, requiring lower prices to facilitate a transaction. The Wall Street axiom “Sellers live higher, and buyers live lower” is true regarding how markets operate.

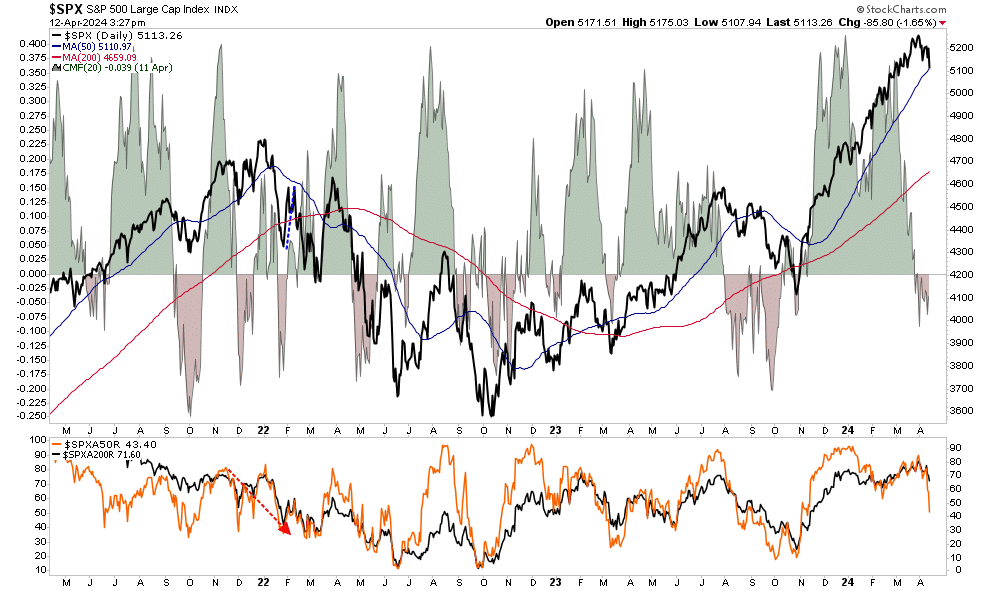

One way to see where buyers and sellers are currently “living” is to examine price action. We can visualize how much money flows into and out of the market over time. Prices will rise if more money flows into the market, and vice versa. Therefore, the Chaikin Money Flow Index is an indicator that can help us visualize money flows.

“Developed by Marc Chaikin, Chaikin Money Flow measures the amount of money flowing into an asset over a specific period. Money Flow Volume forms the basis for the Accumulation Distribution Line. Instead of a cumulative total, Chaikin Money Flow sums Money Flow Volume for a specific look-back period, typically 20 or 21 days. The resulting indicator fluctuates above/below the zero line just like an oscillator. Chartists weigh the balance of buying or selling pressure with the absolute level of Chaikin Money Flow. Additionally, chartists can look for crosses above or below the zero line to identify changes on money flow.” – Stockcharts.com

The Chaikin Money Flow Index calculates whether money flows into or out of a stock or index by examining the difference between its high, low, and closing price.

The chart below shows that the Chaikin Money Flow index declined over the last few weeks. Those flows were a warning sign that market participants were slowing their purchases, and sellers were becoming more prevalent. Returning to the market peak in July 2023, we saw a similar warning sign.

As we have been warning over the last few months, we expect a 5-10% correction in the markets to reverse some excess bullish sentiment and positioning. Such an event is a normal and healthy process for the bullish market trends to continue.

Is that correction starting now? Many of our indicators are ringing alarm bells, so we should consider taking action to reduce risks and rebalance exposures as needed.

If this is a repeat of 2023, the next couple of months could get a bit rough.

How We Are Trading It

There is no magic formula for managing portfolios; everyone does it differently. However, as we often discuss, a few practices can significantly reduce the risk of an unexpected market correction.

As noted, there is an apparent crack in the market that suggests investors should take some portfolio actions. While we have discussed these simplistic rules over the last several weeks, it is time to rebalance risk if you have an allocation to equities.

Tighten up stop-loss levels to current support levels for each position.

Hedge portfolios against major market declines.

Take profits in positions that have been big winners

Sell laggards and losers

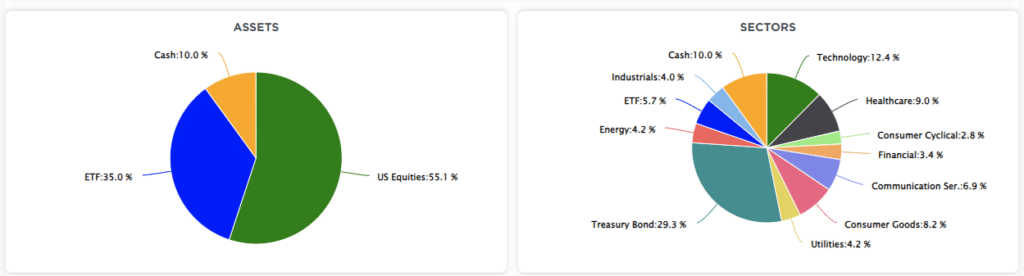

Raise cash and rebalance portfolios to target weightings.

Notice, nothing in there says “sell everything and go to cash.”

Remember, our job as investors is pretty simple – protect our investment capital from short-term destruction so we can play the long-term investment game. Here are our thoughts on this.

Capital preservation is always the primary objective. If you lose your capital, you are out of the game.

Seek a rate of return sufficient to keep pace with the inflation rate. Don’t focus on beating the market.

Keep expectations based on realistic objectives. (The market does not compound at 8%, 6% or 4%)

Higher rates of return require an exponential increase in the underlying risk profile. This tends to never work out well.

You can replace lost capital – but you can’t replace lost time. Time is a precious commodity that you cannot afford to waste.

Portfolios are time-frame specific. If you have a 5-year retirement horizon but build a portfolio with a 20-year time horizon (taking on more risk), the results will likely be disastrous.

Keep moves small for now. As the markets confirm their next direction, we can continue adjusting accordingly.

Have a great week.

Research Report

SimpleVisor Top & Bottom Performers By Sector

S&P 500 Weekly Tear Sheet

Relative Performance Analysis

As noted last week:

“That reversal came on Thursday this past week, except for Energy, reducing much of the previous overbought condition. While the recent correction still has some additional work, some froth is getting worked off. Bonds have become oversold, and we will likely see some buying pressure ahead.”

On Monday and Tuesday, we saw additional buying, pushing the market back above the 20-DMA. However, the inflation data on Wednesday sparked a turn in market sentiment, sending stocks to the 50-DMA on Friday. As shown below, almost every sector is now very oversold. Expect buyers to step in early next week to defend that support level but use any rally to reduce exposure as needed to rebalance portfolio risk. We have likely started a correction or consolidation process that could last several weeks.

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 78.09 out of a possible 100.

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 72.55 out of a possible 100.

Relative Sector Analysis

Most Oversold Sector Analysis

Sector Model Analysis & Risk Ranges

How To Read This Table

The table compares the relative performance of each sector and market to the S&P 500 index.

“MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

The table shows the price deviation above and below the weekly moving averages.

The selloff that began on Wednesday reversed some of the market’s very short-term overbought conditions. Several sectors, including bonds, are oversold and will likely bounce soon. While the longer-term deviations remain extreme, suggesting we could see a deep correction at some point, most markets and sectors are on BULLISH BUY signals. Given this is weekly data, those bullish buy signals suggest that asset prices will likely be higher than lower in the coming months. Therefore, correction processes should be used to increase equity exposures when oversold levels are present.

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

Relative Strength Stocks

Momentum Stocks

Fundamental & Technical Strength W/ Dividends

(Click Images To Enlarge)

R.S.I. Screen

Momentum Screen

Fundamental & Technical Strength

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

No Trades This Week

Lance Roberts, C.I.O.

Have a great week!

Thoughtful Money LLC is a Registered Investment Advisor Solicitor.

We produce educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Thank you; particularly enjoyed this morning's episode and will be replaying it while digesting the charts that were provided by Lance and also Big Thank You for the MacroPass!

Thank you for the added feature of MacroPass!

Dave