Weekly Market Recap: Stocks Are EXPENSIVE Here

Yet...a new short-term buy signal just got triggered this week

In 2024 so far, stocks have had one of the best years in decades.

And that's on top of a great year in 2023.

Bulls are obviously cheering this, but how long can the party continue?

Stocks are richly priced here.

And if earnings don't start growing aggressively, at some point, prices will have to correct, warns portfolio manager Lance Roberts.

That said, a new buy signal just got triggered this week (invalidating last week's sell signal).

So investors need to determine how much risk they want to take to pursue upside from here vs the growing risks of overvaluation.

Lance and I discuss this, as well as this week's new inflation data, bonds and the wisdom of Howard Marks in this week's Market Recap.

To hear it all, click here or on the video below:

LOCK IN YOUR TICKET! Tickets are now on sale for our Oct 19th, 2024 Fall online conference. Buy your ticket now at our ‘Last Chance To Save’ discount price:

Don’t worry if you can’t watch the conference live on Oct 19th. A replay of the entire event will be sent to everyone who registered within 24 hours of its conclusion.

RECENT VIDEOS

Gold Could DOUBLE If This Bullish Cycle Acts Like Past Ones | Brien Lundin

Bill Fleckenstein: The Bond Market Is Losing Confidence In The Fed

David Rosenberg: Boomers Sleepwalking Into A Bear Market + Recession

TM NOW ON PODCAST PLAYERS

Just a reminder that if you prefer to listen to my interviews on your podcast player, Thoughtful Money is now available on the major podcast platforms:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this new Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters now receive my “Adam’s Notes” summaries to the interviews on this channel, plus periodic advance-viewing and/or exclusive content not made available to the public, and now our popular MacroPass™ service.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now:

But whether you do or not, get ready for another week of more great content ahead. We have interviews with Jim Rogers, Michael Howell, Chris Whalen and Nomi Prins.

Stay tuned!

cheers,

A

My sincere thanks to Lance Roberts and his team at Real Investment Advice for kindly making their weekly Bull/Bear market report available to the Thoughtful Money audience below:

NFIB Survey Poses Risk To Bullish Forecasts

By Lance Roberts | October 12, 2024

Inside This Week’s Bull Bear Report

NFIB Survey Poses Risk

How We Are Trading It

Research Report –GDP Report Quells Recession Concerns

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

Seasonal Buy Signal Triggered

Last week, we discussed that while the markets have recently risen in anticipation of a more aggressive rate-cutting cycle, recent data may start to reverse some of that optimism. On top of a strong job report, the latest CPI reading reduced market hopes of a more aggressive rate-cutting cycle. In September, CPI rose 0.2% versus a 0.1% expectation, bringing the annual inflation rate to 2.4%, which was also higher than the expectation of 2.3%. Notably, Core CPI rose 0.3% versus a 0.2% expectation.

The biggest component of the CPI calculation (housing) reversed its previous gain, but food and beverages increased since the last survey. The other big component, transportation, decreased due to the decline in oil prices, offsetting the gains in medical care.

Given that healthcare and rent are fixed monthly payments for most individuals, a measure of headline inflation, less healthcare, and rent provides a better examination of the day-to-day living costs for most Americans. Notably, all measures of inflation are returning to a more normalized trend of historical price pressures.

With the Fed funds rate at 5% versus inflation running at 2.4% annually, the Federal Reserve is endeavoring to bring rates down to a level more aligned with economic growth and inflation. While the latest report likely will not deter the Federal Reserve from cutting rates, it will likely temper the speed of those cuts.

However, with that said, the market took the news well, selling off only slightly on Thursday but rallying strongly on Friday on a cooler PCE price report. In last week’s commentary, we noted the “ascending wedge” pattern in the market that developed from the August lows. To wit:

“An ascending triangle is forming on the daily charts, another bullish pattern that typically signals further upward movement. In this case, we’ve seen a series of higher lows in recent weeks, indicating buyers are stepping in earlier during each pullback. The flatter upper trendline from the previous to the recent all-time high indicates an ongoing increase in buying pressure.”

On Friday, the market broke out to the upside of that wedge pattern, triggering a “seasonal MACD buy” signal. Notably, that buy signal also marks the beginning of the seasonally strong 6 months of the year. The series of high lows, now combined with higher highs, remains a significant bullish backdrop for investors. With earnings season starting in earnest this coming week, the bias remains to the upside, but risk management protocols should not be abandoned.

Just because the seasonally strong period of the year has technically started, it doesn’t mean that the markets won’t have corrections along the way. The market is short-term overbought, so use the current rally to rebalance risk as needed, but pullbacks to support should be bought.

With that said, some data suggests Wall Street is likely overly optimistic about economic growth.

Wall Street Is Optimistic About Economic Growth

As we approach the final quarter of 2024, Wall Street analysts remain bullish about economic growth heading into 2025. Despite concerns about inflation, higher interest rates, and geopolitical tensions, the prevailing narrative is one of resilience and recovery. Most analysts expect the U.S. economy to continue expanding, albeit slower, driven by a few key factors.

1. A Resilient Labor Market

One of the primary drivers of Wall Street’s optimism is the ongoing strength of the labor market. Unemployment remains historically low, and job growth, though slowing, continues to be positive. Goldman Sachs expects employment levels to be 150,000 jobs monthly, equating to the post-2000 average monthly creation rate. This assumes that the employment rate stabilizes from its currently slowing growth rate.

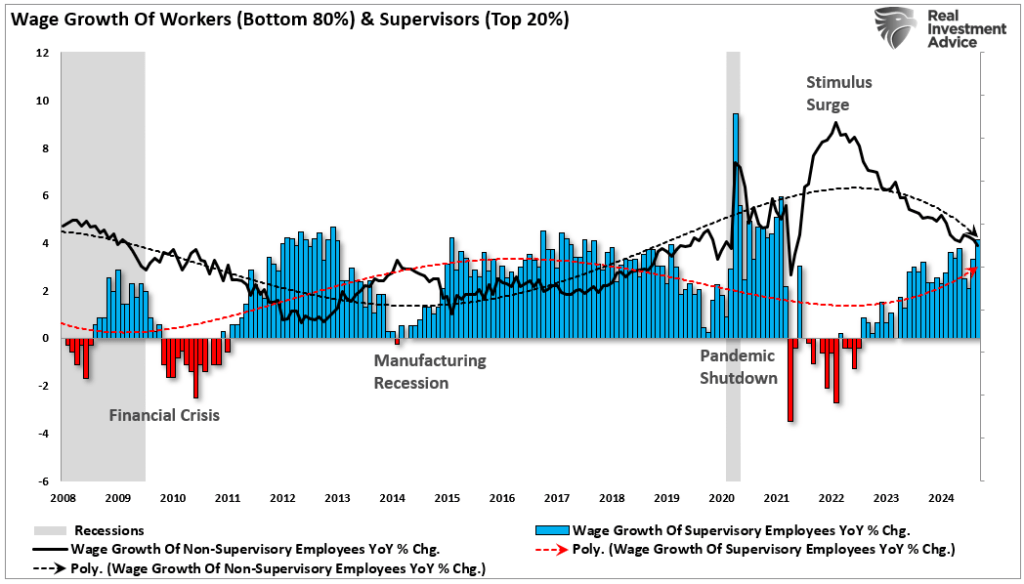

Along with hopes for continued employment, wage growth, particularly in the non-supervisory sector of the market, is imperative to stronger economic growth. It gives consumers more disposable income, bolstering spending, which comprises more than two-thirds of economic growth. As shown, wage growth for the bottom 80% of workers is declining but remains above pre-pandemic levels. Analysts argue that as long as the labor market remains strong, households will continue spending, helping fuel economic activity. Additionally, the labor market’s resilience reduces the chances of a deep recession.

However, the risk to that outlook is that wages are failing to keep up with the cost of living (i.e., inflation), which may slow economic demand further in the future, particularly if inflationary pressures resurface.

Of course, inflation remains the key.

2. Lower Inflation and a More Accommodative Federal Reserve

While inflation remains above the Fed’s 2% target, there are signs that price pressures continue to ease as a function of slowing economic growth. Such is unsurprising since consumer demand impacts the pricing of existing supply.

As shown, there is a high correlation between economic growth and inflation. At the current pace of inflation growth, reported CPI will fall below the Federal Reserve’s 2% inflation target in April 2025. However, due to the base effects when using annual comparisons, inflation will stabilize at the historic average of 2.4% by the end of next year. This assumes the economy avoids a recession and increases in debt and leverage do not curtail consumption further next year.

Analysts hope the Fed will continue to reduce interest rates further next year, given the current deviation above inflation, to reduce borrowing costs for businesses and consumers. The easing of monetary conditions is also hoped to support stock prices, boosting household wealth through equity markets.

However, this optimism is not without its skeptics, particularly when juxtaposed with the latest data from the NFIB Small Business Optimism Index, which paints a more cautious picture of future growth.

The NFIB Survey: A Contrasting View

While Wall Street’s bullish narrative is compelling, the latest data from the NFIB Small Business Optimism Index provides a stark contrast. Small businesses are the backbone of the U.S. economy, and the sentiment captured in the NFIB survey offers a more granular view of the challenges facing Main Street, which often diverges from Wall Street’s broader outlook. The index remains at levels more normally associated with economic contractions versus expansions.

Here are some key components of the NFIB survey that suggest caution:

1. Business Expectations for Future Sales

One of the more troubling components of the NFIB survey is the outlook for future sales. According to the data, many small business owners expect sales to decline over the next six months. This pessimism is particularly pronounced in the retail and service sectors, where rising costs and shrinking profit margins force many businesses to scale back their operations. The survey provides two fascinating components: actual sales during the last quarter and expected sales in the upcoming quarter. Usually, business owners are always more optimistic about future sales despite actual sales often more disappointing. However, both expected and actual sales are currently dismal, as shown by the average of the two measures.

While consumer spending has remained robust so far, many small businesses are not seeing the same level of demand that Wall Street analysts expect. If sales expectations continue to weaken, it could signal a broader slowdown in economic activity, particularly among the smaller enterprises that drive job creation and innovation. Unsurprisingly, as sales demand slows, the expectation for capital expenditures has plunged to some of the lowest levels on record. This is certainly not a sign of a robust economy, and historically, it suggests that GDP will weaken into next year.

2. Hiring Difficulties and Labor Costs

Another key concern highlighted in the NFIB survey is small businesses’ difficulty finding qualified workers. Despite the strong labor market overall, small business owners report that labor shortages are one of their biggest challenges.

This has forced many businesses to raise wages to attract talent, further squeezing profit margins.

A strong labor market indicates economic health for Wall Street, but higher labor costs can be a double-edged sword for small businesses. The NFIB survey suggests that rising wages, while good for workers, put pressure on small business profitability. This could lead to reduced hiring or layoffs, weakening the labor market and dampening economic growth. This is likely why, as with retail sales, the hiring that small businesses expect to do in the coming quarter has not materialized. The current gap between expectations and reality continues to realign itself as slower economic growth rates lead to a reduced demand for labor.

3. Inflation and Input Costs

While Wall Street is optimistic that inflation is cooling, the NFIB survey indicates that many small businesses still struggle with rising input costs. Supply chain disruptions, higher energy prices, and increased costs for raw materials continue to weigh on profitability. Many business owners have been forced to pass these costs onto consumers, reducing demand.

Investors should not overlook the implications of slower demand. What is often overlooked by overly optimistic Wall Street analysts and investors, particularly during a strongly trending bull market, is that earnings are derived from economic activity. This is why there is a relatively high correlation between the expected sales data of the NFIB and the annual rate of change in the S&P 500 index earnings.

If economic growth does slow, given the relatively high valuations of the S&P 500 index, a reduction in expected earnings growth will lead to a repricing of markets.

It’s just something that investors should consider.

Conclusion: Wall Street vs. Main Street—Who’s Right?

So, who’s likely to be correct—Wall Street or the NFIB survey? The answer likely lies somewhere in between.

Wall Street’s optimism is not without merit. The labor market remains strong, inflation is cooling, and key sectors like travel, housing, and infrastructure are poised for growth. However, the NFIB survey highlights challenges that could undermine this rosy outlook. Small businesses are struggling with rising costs, labor shortages, and weakening sales expectations, suggesting that the economic recovery may be more fragile than Wall Street anticipates.

Ultimately, the gap between Wall Street’s expectations and Main Street’s reality could widen further if small businesses face these headwinds. While large corporations and financial markets may benefit from a more accommodative Fed and resilient consumer spending, small businesses may not be as well-positioned to navigate these challenges.

Given the importance of small businesses to job creation and economic growth, the caution expressed in the NFIB survey should not be overlooked. While Wall Street may be right in forecasting continued growth, the pace of that growth will likely be slower and more uneven than many expect. As noted above, given the currently high valuations assigned to markets by optimistic investors, if GDP slows, such will be reflected in earnings.

As such, investors and policymakers should closely monitor Main Street’s underlying data, which often serves as an early warning sign for the broader economy. If small businesses continue to struggle, Wall Street’s optimism may eventually give way to a more sobering reality. In that event, a repricing of assets will likely take many investors by surprise.

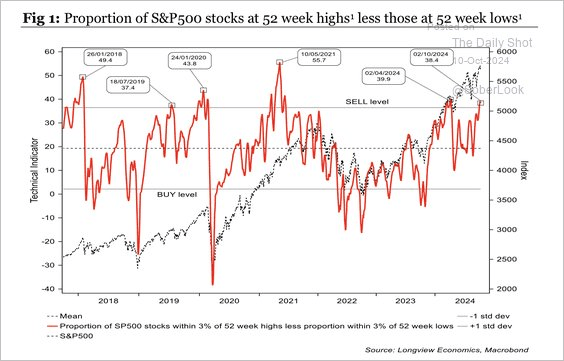

How We Are Trading It

We continue to manage our portfolios in a manner that allows us to participate in the market increase but still hedge against underlying risk. As such, we suggest rebalancing risk as necessary and adjusting portfolio holdings to provide some hedge against a sudden pickup in volatility. While the number of stocks making new 52-week highs is rising, indicating strong breadth and participation in the market also serves as a warning. As shown, previous high levels of participation also coincide with market peaks and corrections.

Sam Stovall from S&P once said: “When everyone has bought, who is left to buy?”

The trick to navigating markets is not trying to “time” the market to sell exactly at the top. That is impossible. Successful long-term management is understanding when “enough is enough” and being willing to take profits and protect your gains. For many stocks currently, that is the situation we are in.

Manage risk accordingly. (Read our article on “What Is RIsk” for a complete list of rules)

Feel free to reach out if you want to navigate these uncertain waters with expert guidance. Our team specializes in helping clients make informed decisions in today’s volatile markets.

Have a great week.

Research Report

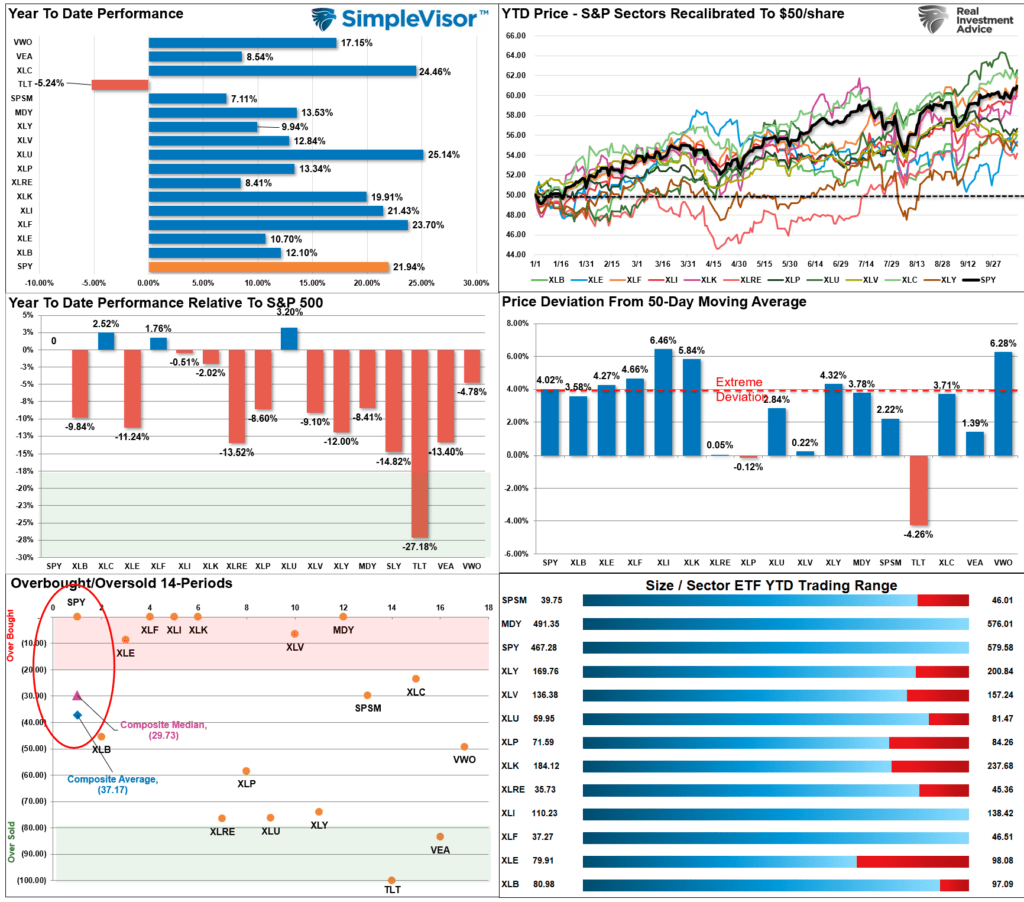

SimpleVisor Top & Bottom Performers By Sector

S&P 500 Weekly Tear Sheet

Relative Performance Analysis

We noted last week that “…the market bounced off the previous “breakout” levels… that confirmed breakout suggests the bullish trend remains intact.” That bullish trend continued this week, with the market reaching new highs. However, as shown in the overbought/sold analysis on the bottom left, the average and median stock is NOT overbought, while the broad market is. The deterioration in participation is noteworthy and suggests the market may experience a pause or correction before the traditional year-end rally.

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 84.01 out of a possible 100.

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 82.38 out of a possible 100.

Relative Sector Analysis

Most Oversold Sector Analysis

Sector Model Analysis & Risk Ranges

How To Read This Table

The table compares the relative performance of each sector and market to the S&P 500 index.

“MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

The table shows the price deviation above and below the weekly moving averages.

We had previously noted that on a risk/reward basis, Energy was deeply oversold and due for a rally. That has happened over the last two weeks. With that sector and the Dollar well above their respective monthly risk ranges, profit-taking is advised. Bonds, on the contrary, are very oversold. I would not be surprised to see some weakness in Energy and the Dollar and a bond rally next week.

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

Relative Strength Stocks

Momentum Stocks

Fundamental & Technical Strength W/ Dividends

(Click Images To Enlarge)

RSI Screen

Momentum Screen

Fundamental & Technical Screen

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

No Trades This Week

Lance Roberts, C.I.O.

Have a great week!

Thoughtful Money LLC is a Registered Investment Advisor Solicitor.

We produce & distribute educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Thoughtful Money and the Thoughtful Money logo are trademarks of Thoughtful Money LLC.

Copyright © 2024 Thoughtful Money LLC. All rights reserved.

Also not that often you see double digit growth with multiple expansion… you might argue we got the multiple expansion in 2023.