With stocks still firmly in overbought territory and the uncertainty of the US presidential election nearing, portfolio manager Lance Roberts warns "We're due for a correction"

He expects a 5-10% pullback in the near term.

And perhaps a slightly larger drop leading up to November as Wall Street de-risks ahead of voting.

Lance and I review the latest chart technicals, whether Japan’s Norinchukin Bank and its announced liquidation of its US Treasury portfolio poses a risk to bond market, the dangers of private investing, and the worrying extent to just how far the S&P 500 is trading above historical valuation averages.

For everything that mattered to markets this week, click here or on the image below:

In case you haven’t yet seen them, here are the other videos that ran on the Thoughtful Money channel this week:

Sven Henrich: Could The S&P Really Hit 9000 In the Next Few Years?

Is A Meltdown In Tech Stocks Nearing As Doubts Of A.I.'s Impact Mount? | Fred Hickey

Unavoidable Crisis Ahead: We Have Too Much Debt That We Can't Afford | Matt Piepenburg

TM NOW ON PODCAST PLAYERS

Just a reminder that if you prefer to listen to my interviews on your podcast player, Thoughtful Money is now available on the major podcast platforms:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this new Substack. It’s making an important difference in helping me afford the substantial startup costs of running Thoughtful Money.

Premium supporters now receive my “Adam’s Notes” summaries to the interviews on this channel, plus periodic advance-viewing and/or exclusive content not made available to the public, and now our new MacroPass service.

If you, too, would like to become a premium subscriber to this Substack (it’s only $15/mo, less than $0.50/day), then sign up now:

But whether you do or not, get ready for another week of more great content ahead. We have interviews with Rick Rule, Nick Gerli (housing market), Joanne Hsu (UMich consumer sentiment) and the New Harbor team (a primer on how to hedge your portfolio) lined up.

Stay tuned!

cheers,

A

My sincere thanks to Lance Roberts and his team at Real Investment Advice for kindly making their weekly Bull/Bear market report available to the Thoughtful Money audience below:

Bad Breadth Keeps Getting Worse

By Lance Roberts | June 22, 2024

Inside This Week’s Bull Bear Report

Bad Breadth Keeps Getting Worse

How We Are Trading It

Research Report – A Fundamental Shift Higher In Valuations

Youtube – Before The Bell

Market Statistics

Stock Screens

Portfolio Trades This Week

Two Mistakes Investors Make

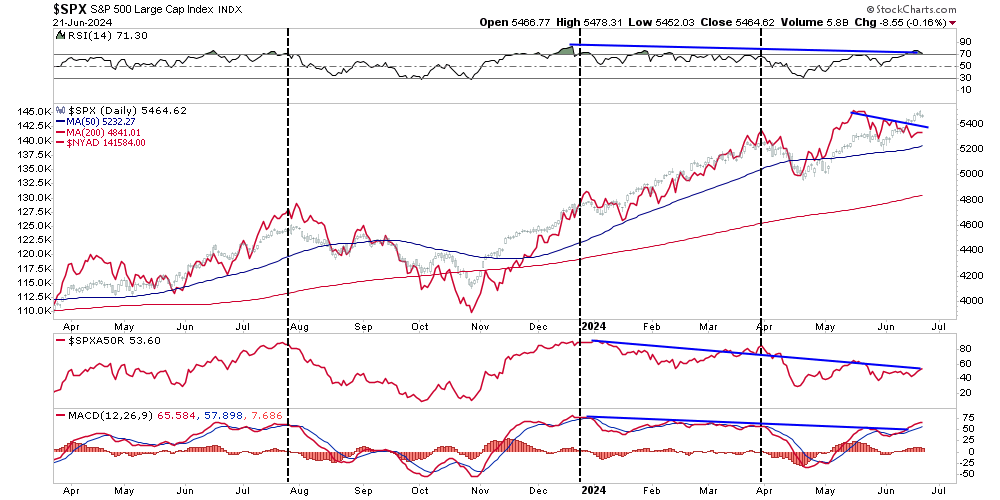

Last week, we discussed the issue of the negative divergences and bad breadth of the market. To wit:

“While the bullish trend remains intact, along with a MACD ‘buy signal,’ which suggests an increased allocation to equity exposure, we have some concerns.

While the market is making all-time highs as momentum continues, its breadth is narrowing. The number of stocks trading above their respective 50-DMA continues to decline as the market advances, along with the MACD signal. Furthermore, the NYSE Advance-Decline line and the Relative Strength Index (RSI) have reversed, adding to the negative divergences from a rising market. While this does not mean the market is about to crash, it does suggest that the current rally is weaker than the index suggests.

As discussed, these negative divergences have often preceded short to intermediate-term corrective market actions. At this point, investors tend to make two mistakes. The first is overreacting to these technical signals, thinking a more severe correction is coming. The second is taking action too soon.

Yes, these signals often precede corrections, but there are also periods of consolidation when the market trades sideways. Secondly, reversals of overbought conditions tend to be shallow in a momentum-driven bullish market. These corrections often find support at the 20 and 50-day moving averages (DMA), but the 100 and 200-DMAs are not outside regular corrective periods.

If you remember, in March, we discussed the potential for a 5 to 10% correction due to many of the same concerns noted above. That correction of 5.5% came in April. We are again at a juncture where a 5-10% is likely. The only issue is it could come anytime between now and October.

As is always the case, timing is always the most significant risk. Therefore, be careful not to overreact or act too soon. The market will let us know when to become more aggressive in reducing risk.

Let’s dig into the market’s “bad breadth.”

Bad Breadth Keeps Getting Worse

As noted above, the market is emitting several concerning “technical warnings” that I want to investigate further. As was the case earlier this year, it is essential NOT to overreact to these warnings because the current bullish momentum and exuberance can keep markets elevated for far longer than logic would presume. We noted the increasing number of technical signals that a correction was likely in February and March. For example, in “Investor Sentiment Is So Bullish, It’s Bearish:”

That unstoppable advance, driven by the mega-capitalization stocks on Friday, topped the psychological 5000 level on the index. With the strong momentum carrying that particular group of stocks, the index will likely try to push higher over the next few days. However, as shown, the market is back to more extreme overbought levels, and bullish sentiment has reached ‘greed.‘”

Most notably, the deviation between the index and the 200-DMA is getting rather extreme, which has typically preceded short-term corrections. As discussed in this week’s newsletter, those extensions and deteriorating internals suggest we should begin rebalancing portfolio risk.

While we are highly confident that a correction is coming, the timing of that event is uncertain. As such, we must maintain exposure to garner performance while we can. However, we will become more aggressive in the risk reduction process once signals are triggered.” – February 10th

The chart below is from that article.

Of course, while the correction eventually came, it was over a month later.

It is critical that while the warnings were early, they are often ignored as bullish momentum carries stocks higher. Such is the case again today, where multiple technical indicators warn of some corrective action in the future.

Notably, the market’s “bad breadth” is a rising concern as fewer stocks perform with the markets. Bob Farrell once said, “Markets are strongest when broad and weakest when narrow.” As shown, we currently have a very narrow market. While the top 50 stocks in the index are making new highs, the bottom 450 are not.

The chart below more appropriately represents the “bad breadth” issue, comparing the S&P 500 to the number of stocks trading above their respective 50- and 200-DMAs. With a market sitting at all-time highs, combined with robust money flows, the breadth of the market should be healthy. However, despite the market advance, the number of stocks above their respective moving averages has declined since April.

Unsurprisingly, such is the byproduct of the “momentum chase” at this juncture, and the bad breath reflects that momentum.

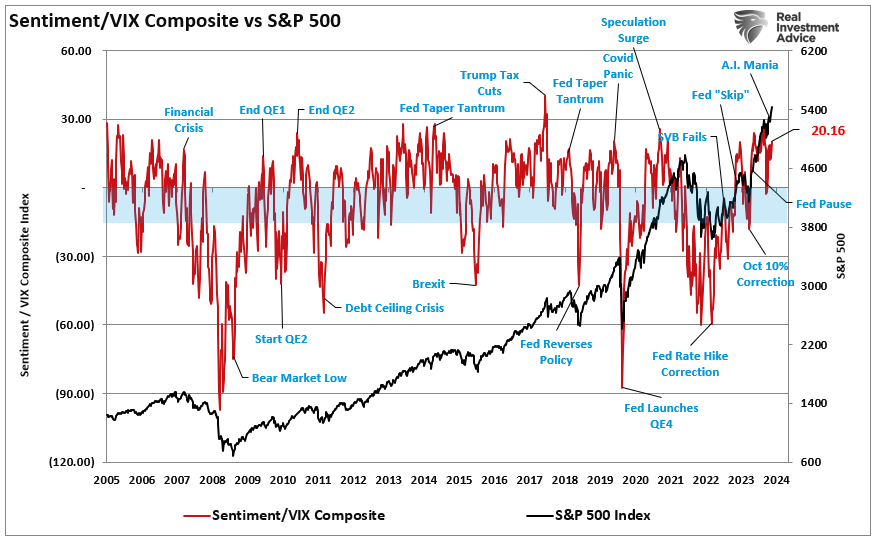

Of course, as investors are treated with higher asset prices each day, the concerns of a market decline fade as “greed” overtakes “fear.”

It’s Calm Out There. Too Calm.

Just recently, Sentimentrader.com released an excellent report on the lack of volatility in the market.

“It’s been nearly a year and a half since the S&P 500 suffered a 2% daily loss. While it has gone much longer without a big loss, returns have been muted by the time it gets to this point. The index recorded more than 50 new highs during this stretch, a level of performance matched only twice since 1928.”

While there have certainly been more extended periods in the market without a 2% decline, it is essential to remember that low volatility represents a high “complacency” with investors. In other words, the longer the market moves higher without a significant correction, the more confident investors become. They respond by raising their allocations to equities (risk) and reducing their allocations to cash (safety).

Of course, as Sentimentrader noted:

“When we get to this stage, Wall Street is only too happy to supply the market with all kinds of products to capitalize on investors’ regrets for the recent past. Many of those products are based on the low volatility we’ve seen, which is inarguable on the index level.”

The chart below combines the increased investor sentiment toward taking on more risk with the decline in concerns of a market correction. Currently, we are at levels that have been more coincident with near-market peaks rather than the start of a bullish move.

As Sentimentrader concluded:

“Technically, the best thing that stocks have going for them is momentum. When it reaches the level it’s at, it becomes a powerful force that can continue for weeks or more. There is significant deterioration under the surface of this momentum, so it’s on a shaky foundation and is more likely to fail than if there were more supports. By the time it gets to this stage, we’re usually at the “weeks, not months” part of the cycle. It doesn’t say much about prospects for longer-term investors, but those with a more medium time frame should be on guard. When gains get this easy, it’s usually about to become much less so.”

We agree and are looking for the market to signal us to begin reducing risk accordingly.

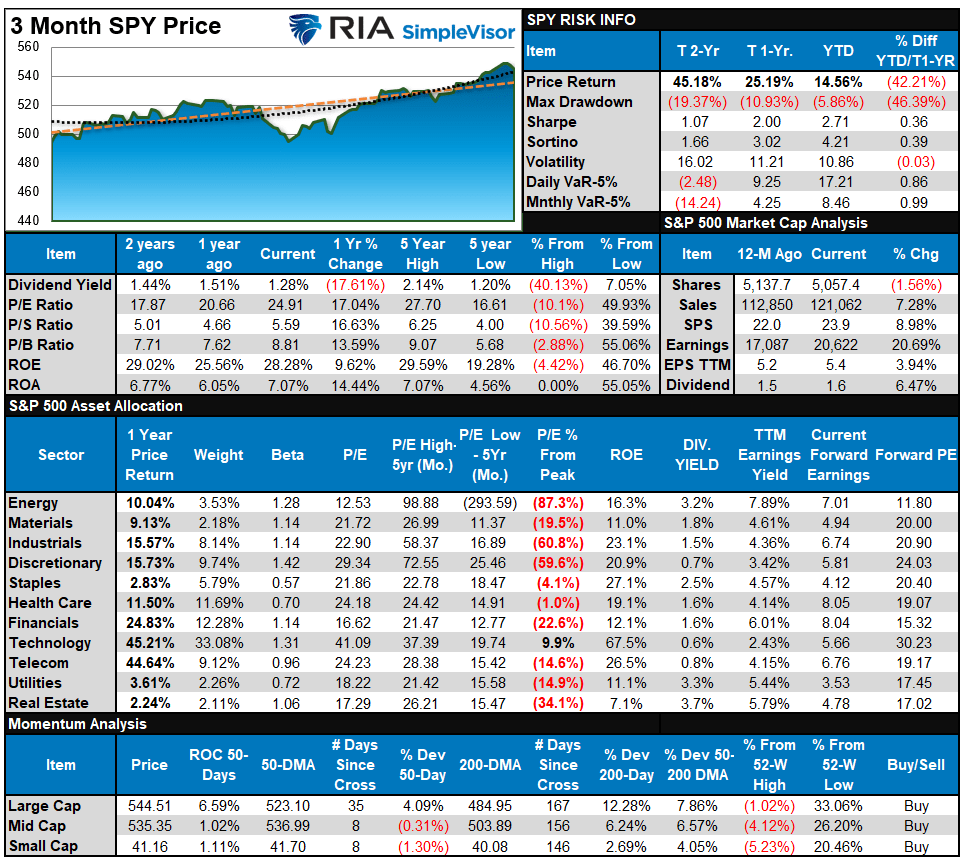

Relative Performance Warning?

As noted above, one last thing about market breadth and performance chasing can be visualized by the outperformance of the market-capitalization-weighted S&P 500 index (SPY) versus the equal-weighted index (RSP). The chart below shows the performance differential between the two indices since the end of 2022.

The table below compares the weighting of the top 10 stocks of each index. Given that the momentum chase has occurred primarily in the biggest market-capitalization weighted stocks, you can understand why the differences in holdings and weightings can lead to such a differential in performance.

As shown, given that “Artificial Intelligence” and Technology have been the clear winners, the more than double weighting in SPY vs RSP is critical. More notably, the leading stocks like Nvidia, Microsoft, Apple, and the other “faces” of this rally are not in the top 10 holdings of RSP.

Since those “Mega-cap” stocks have led the rally over the last two years, comparing the two-year performance spread is telling. As shown, the spread in performance between the SPY and RSP is at the highest level since the “Pandemic” and higher than the peak of the market heading into the “Financial Crisis.”

I do not know what eventually causes a reversal in market performance or when it will occur. However, I can say with high certainty that it will happen.

That does not mean it will happen tomorrow, next week, or even next quarter. Momentum-driven markets can last longer and go further than anyone can predict. Such is why we suggest a healthy risk management and portfolio rebalancing diet. Just like a diet to lose weight, the initial impact is slowly recognized; however, over time, it will mitigate the effect of potentially destructive events.

How We Are Trading It

There is little doubt that the market is bullish, as evidenced by its consistent new highs. However, as noted above, the negative divergences in relative strength and breadth and an increasing deviation from the 50-DMA suggest that the near-term correction risks are rising.

Continue to take action as needed using the recent push to new highs:

Tighten up stop-loss levels to current support levels for each position.

Hedge portfolios against significant market declines.

Take profits in positions that have been big winners

Sell laggards and losers

Raise cash and rebalance portfolios to target weightings.

Notice, nothing in there says, “Sell everything and go to cash.”

Just manage risk as needed to mitigate the impact of a sudden reversal.

Have a great week.

Research Report

SimpleVisor Top & Bottom Performers By Sector

S&P 500 Weekly Tear Sheet

Relative Performance Analysis

Last week, we noted:

“Technology took the lead in performance, and only TWO sectors have outperformed the S&P this year. This is further evidence of the weaker breadth in the market. Bonds are overbought short-term after last week’s surge, so don’t forget to take profits if you are trading your bond position.”

Not much changed this past week, even though we did see some profit-taking in Technology stocks heading into Friday’s massive options expiration day. The market still remains overbought even though those overbought conditions started to reverse this past week. The bullish backdrop remains, but the potential upside seems limited heading into the end of the month.

Technical Composite

The technical overbought/sold gauge comprises several price indicators (R.S.I., Williams %R, etc.), measured using “weekly” closing price data. Readings above “80” are considered overbought, and below “20” are oversold. The market peaks when those readings are 80 or above, suggesting prudent profit-taking and risk management. The best buying opportunities exist when those readings are 20 or below.

The current reading is 87.42 out of a possible 100.

Portfolio Positioning “Fear / Greed” Gauge

The “Fear/Greed” gauge is how individual and professional investors are “positioning” themselves in the market based on their equity exposure. From a contrarian position, the higher the allocation to equities, the more likely the market is closer to a correction than not. The gauge uses weekly closing data.

NOTE: The Fear/Greed Index measures risk from 0 to 100. It is a rarity that it reaches levels above 90. The current reading is 78.73 out of a possible 100.

Relative Sector Analysis

Most Oversold Sector Analysis

Sector Model Analysis & Risk Ranges

How To Read This Table

The table compares the relative performance of each sector and market to the S&P 500 index.

“MA XVER” (Moving Average Crossover) is determined by the short-term weekly moving average crossing positively or negatively with the long-term weekly moving average.

The risk range is a function of the month-end closing price and the “beta” of the sector or market. (Ranges reset on the 1st of each month)

The table shows the price deviation above and below the weekly moving averages.

The S&P 500 index trades above its historical risk range and 10% above its long-term average. Even with this past week’s “stall,” it remains outside of its normal risk ranges for the month. Technology, Discretionary, and Bonds are also above normal risk ranges. A short-term corrective or consolidation process will likely occur at some point, but at the moment, momentum remains the key story for the market.

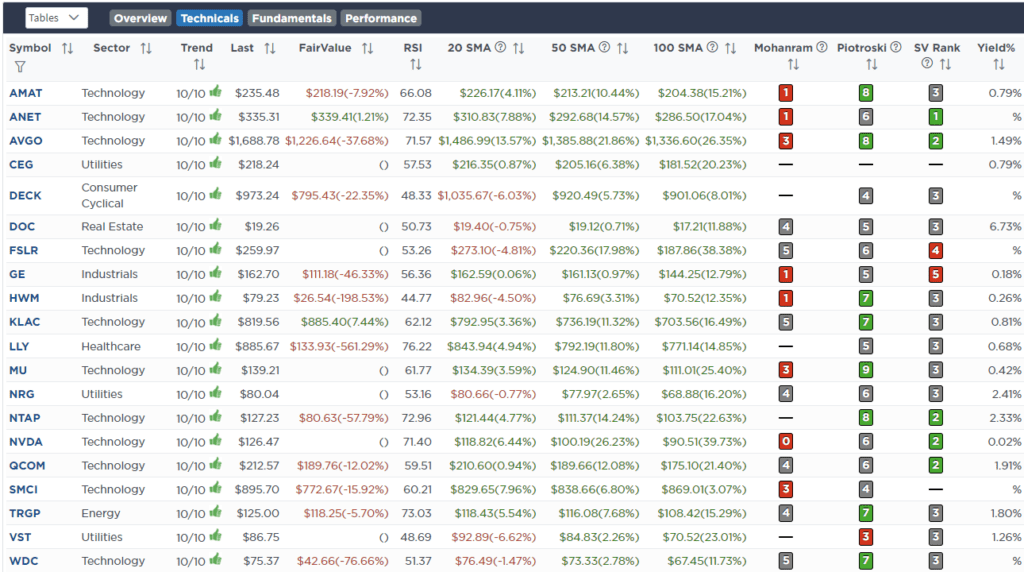

Weekly SimpleVisor Stock Screens

We provide three stock screens each week from SimpleVisor.

This week, we are searching for the Top 20:

Relative Strength Stocks

Momentum Stocks

Fundamental & Technical Strength W/ Dividends

(Click Images To Enlarge)

RSI Screen

Momentum Screen

Fundamental & Technical Screen

SimpleVisor Portfolio Changes

We post all of our portfolio changes as they occur at SimpleVisor:

No Trades This Week

Lance Roberts, C.I.O.

Have a great week!

Thoughtful Money LLC is a Registered Investment Advisor Solicitor.

We produce & distribute educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.