We're Dealing With An "Unprecedented, Unusual, Challenging" Economy | Michael Kantrowitz

But recession danger remains muted (for now)

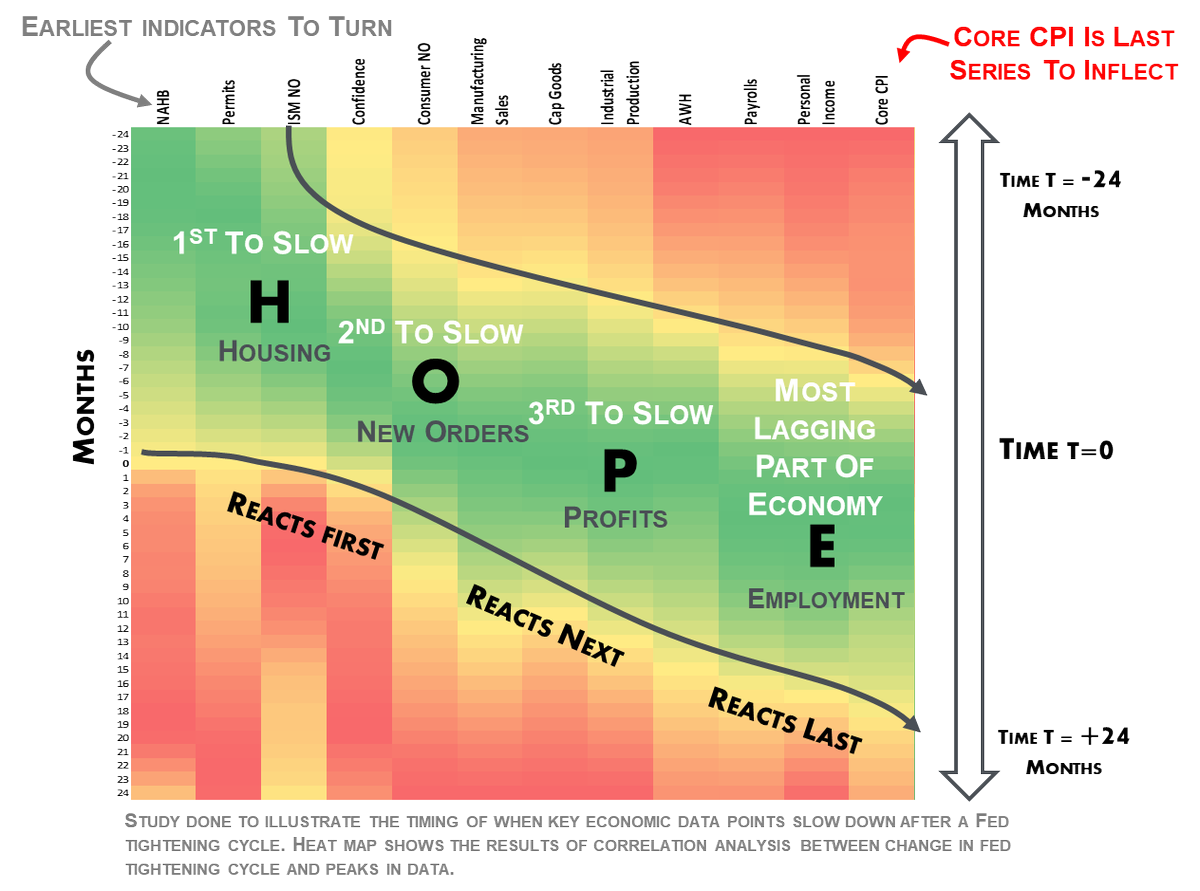

Today's guest is best known for his HOPE framework, a highly effective way to measure the health of the economy, and tell whether it's getting stronger or weaker:

As we enter the second half of 2025 -- with momentum stocks stumbling while the markets remain richly valued near all-time highs -- what does his framework tell us 2025 has in store?

To find out, we have the good fortune to speak today with Michael Kantrowitz, chief investment strategist & managing director at Piper Sandler.

He reports that the most recent HOPE data isn’t encouraging, and that the economy — and society, as well — is becoming more bifurcated than ever. But the data is not (yet) indicating a recession is nigh, suggesting a prolonged period of economic stagnation without a clear landing.

For all the details, click here or on the video below:

GOT GOLD?: Read our free Guide To Buying and Storing Gold & Silver:

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this Substack. It’s making an important difference in helping me fund the substantial operating costs of running Thoughtful Money.

Premium supporters receive my “Adam’s Notes” summaries to the interviews I do, the wildly-popular MacroPass™ rotation of reports from esteemed experts, VIP discounts, plus periodic advance-viewing/exclusive content. My Adam’s Notes for this discussion with Michael are available to them below.

If you, too, would like to become a premium subscriber to this Substack (it’s only $0.52/day), then sign up now below:

Adam’s Notes: Michael Kantrowitz (recorded 7.8.25)

EXECUTIVE SUMMARY:

Bifurcated Economy Persists: Michael Kantrowitz highlights an ongoing bifurcated economy, with housing weakening regionally and AI thriving, but aggregate stability prevents recession, driven by stable employment and government transfer payments.

HOPE Framework Insights: The HOPE framework (Housing, Orders, Profits, Employment) shows sideways trends since 2022, with no significant deterioration or improvement, suggesting a prolonged period of economic stagnation without a clear landing.

Student Loan Repayment Risks: Rising student loan delinquencies (10 million borrowers) pose a potential debt contagion, but Michael views this as an idiosyncratic issue, not systemic, due to economic offsets like low oil prices and fiscal support.

Market Complacency and Valuations: High P/E ratios and tight credit spreads indicate

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.