MacroPass™: David Hay's Top Investment Rankings

From the best of the best, to the ones to watch out for

This week’s installment of our popular MacroPass service for premium members of this Substack comes from money manager David Hay, CIO of Evergreen Gavekal.

Every week he publishes a ranked list of the asset classes that he watches closely: the Champions (aka, the best of the best) , the Contenders, and the Down-For-The-Counts (aka, the ones to avoid).

If you’re looking for investing ideas, this is an extremely useful cheat-sheet.

As a reminder, MacroPass™ is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Lacy Hunt (Hoisington), Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Ted Oakley (Oxbow Advisors), Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino, Adam Kobeissi (The Kobeissi Letter), Sven Henrich (Northman Trader), Jeff Clark (The Gold Advisor), Charles Hugh Smith, Steven Bavaria (Inside the Income Factory®) and Chris Whalen (The Institutional Risk Analyst).

Recent MacroPass™ reports in this series include:

Jeff Clark on the promising outlook for junior mining stocks

Darius Dale on the market's transition from 'Goldilocks' towards Deflation

The Kobeissi Letter on tech stock weakness & recession fears

If you’re already a premium subscriber to this Substack, just continue below to access David’s Haymaker report.

And if you’re not (yet), read the start of David’s analysis below and consider upgrading to premium and access the full version, as well as all past and future MacroPass™ content.

Making Hay Monday - October 21st, 2024

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day's financial fray.

Charts of the Week

It is hard to overemphasize how disturbing the above image is. For any country – particularly an aging one like the U.S. – an adequate savings level is essential to provide the funding for productivity-enhancing capital investments. Relying on the kindness of overseas strangers to provide that is dangerous, if not reckless, especially for a nation like America which is so diligently debasing its currency. That’s not the type of behavior that inspires confidence among offshore investors. The fact that this appalling situation is occurring at a time of low unemployment and, if official statistics are to be believed, healthy economic growth is unprecedented. It also undercuts the constant raving on financial channels like CNBC about the exceptional strength of the U.S. economy. The obvious question is how much of the post-pandemic GDP increases have been driven by $2 trillion annual federal government deficits?

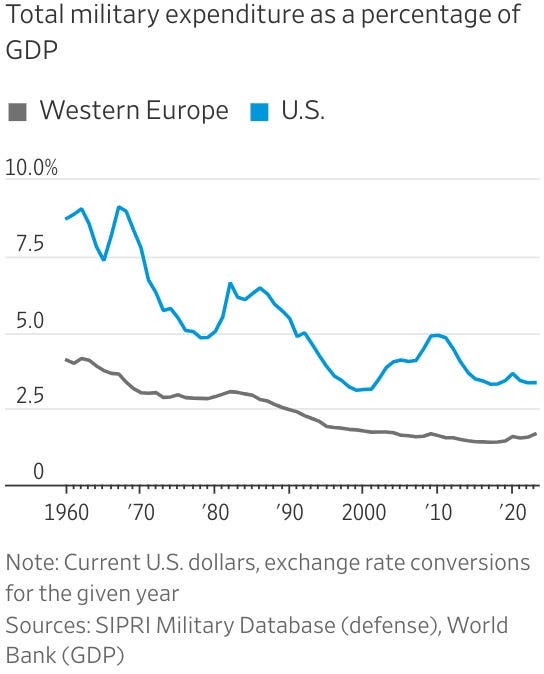

Another pertinent question is what the size of U.S. deficits would be today if military spending was running at 9% of GDP as it was when John F. Kennedy was president. Notably, this was before the U.S. entered the Vietnam War. Based on the current state of the world, it’s hard to believe America’s defense spending will remain this subdued. This is particularly unlikely for a country that is the planet’s bulwark against China, Russia, Iran, and North Korea, the Four Horsemen of the potential apocalypse.

Champions

The Sector That Truly Stinks

“Some years ago one oil company bought a fertilizer company, and every other major oil company practically ran out and bought a fertilizer company. And there was no more damned reason for all these oil companies to buy fertilizer companies, but they didn't know exactly what to do, and if Exxon was doing it, it was good enough for Mobil and vice versa.” -Charlie Munger

“Money doesn’t stink.” -Roman emperor Vespasian, defending his toilet tax

A rational investor would have reasonably assumed that, in the wake of Russia’s vicious attack on Ukraine, fertilizer stocks would have been superior performers. Actually, for a couple of months, that was indeed the case, as you can see below, at least based on the company that is considered to be the premier operator in this space.

Stock chart of the leading U.S. fertilizer producer in early 2022

A 60% price increase in 60 days or so is nothing to sneeze at, but if you do, we suggest you see your allergist ASAP. (We know, a 375% annualized return isn’t quite as exceptional as it once was in this era of hot stocks doubling almost overnight, but, trust us, these giddy days will not last forever.)

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.