MacroPass: Edwin Dorsey On The Problems At Primerica

The reasons why the stock is on The Bear Cave's "short" list

This week’s installment (our sixth) of our new MacroPass service for premium members of this Substack comes from Edwin Dorsey, stock analyst and publisher of The Bear Cave.

Edwin’s Substack focuses on publicly traded companies that are at risk of a major business model unraveling and/or scandal, thus making them compelling candidates for courageous & experienced investors to consider shorting.

The report below is one Edwin recently sent to his private subscriber list identifying the litany of concerns he has with Primerica, “a leading provider of financial products and services to middle-income households in the United States and Canada.”

Whether or not you’re interested in shorting companies yourself, the below report is gripping drama and an engrossing read. You’ll enjoy it.

If you somehow missed our previous announcements, MacroPass is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino and Adam Kobeissi (The Kobeissi Letter). And more are joining each week…

The reports issued so far in this MacroPass series include

If you’re already a premium subscriber to this Substack, just continue below to read this week’s report from Edwin.

And if you’re not (yet), read the start of it below. If you like what you see, just upgrade to premium and access the full report, as well as all past and future MacroPass content.

Problems at Primerica (PRI)

APR 18

Primerica (NYSE: PRI — $7.34 billion) describes itself as “a leading provider of financial products and services to middle-income households in the United States and Canada.” The company has over 141,000 “life insurance-licensed sales representatives” who have written 5.7 million life insurance policies and advise “approximately 2.9 million client investment accounts.” Investors believe Primerica’s unique agency recruitment model enables the company to provide much-needed financial advice to low and middle-income households and the company explicitly states it “is not a pyramid scheme.” The Bear Cave sees things differently.

The Bear Cave has reviewed extensive evidence suggesting that Primerica’s highest producing agents are engaged in misleading, false, or deceptive conduct including 1) a recorded Zoom presentation from a Senior National Sales Director that alleges crooked conduct, “fake numbers,” and appears to suggest an ongoing internal investigation, 2) a text message recruiting script for new agents that appears to deliberately obfuscate their association with Primerica, 3) agent presentations that emphasize recruiting over serving independent customers and 4) a presentation by a high-producing agent saying “it’s normal to be a millionaire.” In addition, complaints obtained through public records requests allege forged signatures on six-figure investment contracts, “institutionalized theft,” and one senior said the company “raped me financially.” In sum, The Bear Cave believes Primerica stands against the winds of progress and is a losing proposition that victimizes all those involved.

At the very top of the Primerica organization are a handful of Senior National Sales Directors who each manage their own teams such as Otto Empire Builders, The Millionaire Movement Team, and Arrizon Hierarchy.

Perhaps no Senior National Sales Director, the highest distinction within Primerica, is more charismatic than Mr. Mario Arrizon, who was reportedly the youngest agent to ever become a “million-dollar earner” within Primerica at the age of 29. Mr. Arrizon has spoken at multiple Primerica conventions, is highlighted as a success story on PrimericaLatino.com, serves as a member of Primerica’s Hispanic American Leadership Council, and on his popular social media boasts he is a “leader and coach to over 7,000 agents.”

If you click on an application form on the Arrizon Hierarchy website, you are taken to a short five question survey that ends on a ClickFunnels welcome page with an embedded unlisted YouTube video of Mr. Arrizon explaining the Primerica opportunity.

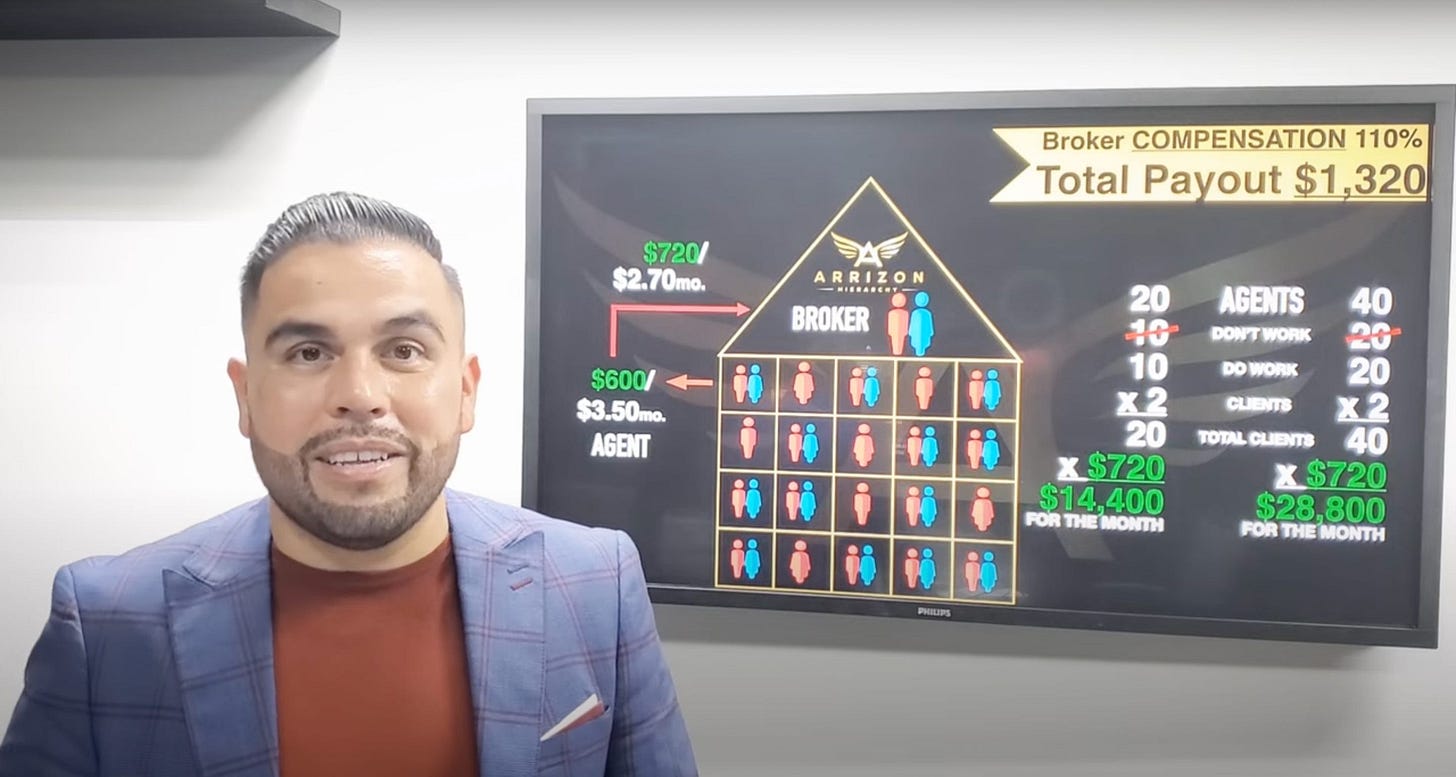

In the video, Mr. Arrizon suggests that a family with a $300/month investment budget put $100/month into insurance products that would generate a 50% advance for the agent ($600/year), and recommends the other $200/month go into mutual funds that with meaningful fees that would generate “residual income” for the Primerica agent. Below, a screenshot from Mr. Arrizon’s example.

Mr. Arrizon adds, in part,

“Our clients need help, they just don’t know who to trust, they don’t know who to go to, this is why we have an advantage. This is why we have an edge.” (5:20)

The pitch to join the Arrizon Hierarchy as a Primerica agent revolves around the opportunity to “help” families while making meaningful earnings. Mr. Arrizon says, in part,

“The average financial advisor that’s an employee, in New York makes $154,000, in California $143,000, in Florida $123,000, as an employee! Right now is the greatest opportunity to be part of this. I don’t care if you have no experience in this. It doesn’t matter… I promise you I’m the guy that would educate people about their finances for free. I see the difference we make in families’ lives and I can’t believe the compensation that’s involved.” (7:42)

In his presentation, Mr. Arrizon does not disclose that the average Primerica agent only earned $7,185 in 2023 from the company.

Mr. Arrizon’s pitch, which was difficult to follow at times, also explains how lucrative selling products can be for all involved in the “hierarchy” saying in part,

“As a broker, for that one client, that client I showed you that pays $100/month for their insurance, you get paid $1,320 as a broker with this. 110%! Not including bonuses and a lot of other stuff that we do.” (9:58)

Mr. Arrizon added,

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.