Yes, the news is true. Friday was my last day at Wealthion.

This is probably a big surprise for many of you. And you likely have a million questions.

I’m going to do my best to answer as many of them as I can — in this post, as well as in the comments section below over the next few days.

Because you deserve it. Any success I’ve enjoyed while running Wealthion has been due to the support from you, its loyal viewers. I owe you an immense debt of gratitude and so will do my best to be an open book here.

That said, please understand there will be some pages missing, as there are limits in what I can reveal due to contracts, etc.

But let me be up front with these points:

This is a good thing, for everyone involved

The departure is amicable

I’m cheering on the team that will run Wealthion from here

If you’ve found value in my work up to now, then you should love what this transition is making possible

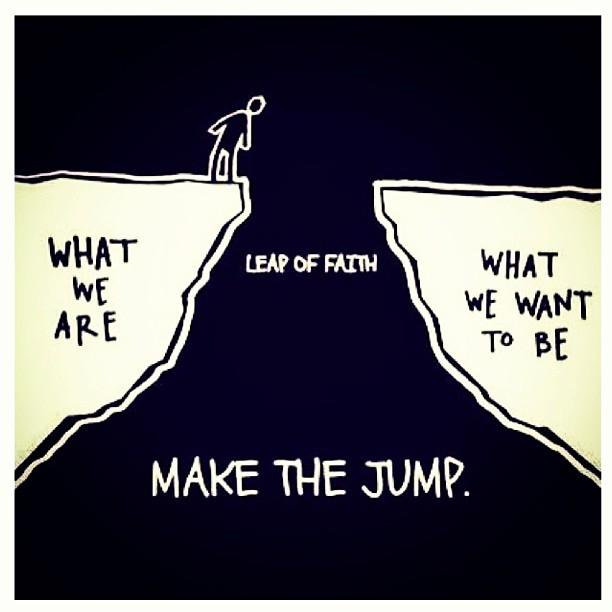

At its core, my decision to leave was all about control. While Wealthion was my brainchild and I ran nearly all aspects of its operation from Day 1, I did not own the company.

Going independent gives me the liberty to runs things exactly the way I want to for you.

And boy, do I have ideas that really excite me. My goal is keep delivering the same high quality, actionable wealth-building insights you’ve come to expect, while adding new content & solutions that delve more deeply into the areas of money & investing that folks are most interested in.

What exactly will that look like?

To find out, stay tuned to this Substack account. I’m going to give myself just a tiny bit of time over the next few days for some long overdue rest & reflection. Then I’ll start feverishly building out the vision that’s already taking shape inside my head. As that build-out progresses, I’ll start sharing updates here on what to expect, and when. (And if you have any strongly-felt desires for what you’d like to see from me in the future, please share them in the comments section below)

How long will all this take?

I’m not entirely sure, but I don’t expect very long. And I won’t be radio-silent on you like I had to be over the past week (which was VERY difficult for me). I’ll start sharing my thoughts on the key developments & data that catch my attention, like my write-up below on another recent interview with investing legend Jeremy Grantham. On a daily basis, you can catch me on X/Twitter at @menlobear, and I’ll post my deeper thoughts here on Substack as I have them.

What can you do to support this new venture?

Well, when it launches, please watch it!

As with my previous work, nearly all of the material will be free to the world. In order to succeed with the mission of educating & empowering regular people to build wealth, the information should be freely accessible to all.

But one of the realities of going independent is that all of the start-up and operating costs are born in full by yours truly. I’m not the type to pass the hat and ask for free money, so to help fund things, I will start creating extra bonus content that will be available here to premium subscribers on Substack.

So, if you feel you’ve ever found value in my work in the past and you’d like to support the development of its next generation, please consider becoming a premium subscriber to this Substack, if even only for a brief while. It’s pretty cheap, only $8/mo. But every little bit will help!

And whether you choose to subscribe now or not, I don’t want you to leave empty-handed. It’s been over a week since I’ve conducted an interview and I’m starting to get the withdrawal jitters. So to calm them, I’ve written up an “Adam’s Notes” summary below of a recent important interview with Jeremy Grantham.

Here it is below, for your education & enjoyment.

And as I sign off, let me once again say THANK YOU for all the wonderful support you and the millions of Wealthion’s viewers have given me over the years. As I’ve said, any success I’ve enjoyed on this journey is entirely due to you and your loyal viewership.

I certainly hope you will follow me to my new venture once it has been birthed into the world. But whether you do or not, I’m humbled and honored that you have been with me this far. I cannot thank you enough.

Ok…and now, here’s the write-up of Jeremy Grantham’s recent interview:

The host starts by thanking Jeremy for his advice when last on her channel in 2021, urging listeners to go out and get the longest-duration fixed mortgage they could. Back then 10-year mortgage rates in the UK were around 1.5%; now they’re around 6.5%.

Grantham still believes we are in the bursting of one of the greatest asset bubbles of all-time, which peaked in 2021. But there are several notable trends retarding or even briefly reflating the correction:

The Presidential cycle — 3rd years of an Administration are notorious for stimulus as the incumbent does his best to juice the economy heading into the election year, which leads to a ~15% average return in the stock market. This year is following that script to a “T”.

The A.I. mania — this has pushed the valuations of the largest stocks higher, dragging the indices up along with them. While he think A.I. will indeed be an important trend for the economy, Grantham thinks it will play out over the next few decades and is not big enough now to be more than a short-term sugar rush for these large stocks.

Aside from these, the leading indicators have continued to decay this year, households are weakening as the COVID stimulus funds and forbearance programs are gone, the government debt problem is escalating — all this make Grantham confident a recession is inevitable, though he is less certain on whether it will be mild or severe. He expects it to last “deep into next year”.

Our economy is a complicated system. So predicting what will be the factor that kicks off the recession in earnest is a fool’s game. But with that said, Jeremy thinks the US regional banking system is a good contender. He also thinks the VC & private equity sectors are already in recession and will likely continue to get worse ahead of most other asset classes.

Housing is a dead man walking at this point. It’s all about math. Prices will come down with these higher rates, and we can see that already happening in countries with shorter duration mortgages than the US (e.g., Scandinavia, the UK). Grantham calculates this housing market bubble reached higher extremes than the 2007 one…and is concurrent with a vastly higher stock market bubble than ever before in history.

He sees the Russell 2000 as the most vulnerable part of the US stock market. It has a high density of “zombie” companies, 40% of the stocks in the index don’t have positive earnings, the debt/equity ratio of this index is far worse than the S&P or the NASDAQ, and the total debt levels are at record highs. Its performance has been pretty disappointing over the past 5 years, showing it is already in trouble — it’s down 18% over its high from a year and a half ago, despite inflation being a lot higher.

Importantly, consumer confidence is still quite skittish. Confidence in the economy is very low in the US and UK, and is getting worse as the pandemic-era stimulus is running out. This is true for both the rich and the poor. Savings rates are rock-bottom (especially in the US) and families are having to increasingly turn to credit cards for living expenses.

So, is the market bottom in or not?

Grantham doesn’t think so. And he reminds us that history shows us that bear market corrections often have periods of sharp “recoveries” that eventually fail before sending the market to fresh lows. He expects that to be the case from here. He doesn’t expect the bottom to be in until there is a major price capitulation and stocks become a toxic asset in most investors’ minds. Once that happens, when truly bargain prices abound but no one wants to jump back into stocks, THAT will be the time to hold your nose & buy. (Grantham’s firm GMO made a killing loading up in 2009 when everyone had abandoned stocks).

Crediting the work of John Hussman, Grantham calculates the stock market is at nosebleed levels of over-valuation. He can easily make the case why the market should correct by 50% or more from here, though that isn’t his base case prediction. But he’s waiting for the S&P to drop below 3,000 before he starts getting interesting in buying anything. If it falls below 2,000, he’ll be buying aggressively.

So what does he think the market is most likely to go from here?

Markets like low, contained inflation (~2%) and high profit margins. Profit margins have been coming down, faster than many realize. Grantham calculates the Shiller PE should be around 16.8x under today’s existing conditions — though it currently stands at 28.1x

And corporate earnings have never been so concentrated into so few stocks (i.e. the Magnificent 7) as they are right now. If you take these out, the rest of the stock market looks anemic and is proving the same low single-digit return as most other stock markets around the world.

Basically, he’s warning that there’s lots of risk here. If these companies, which are priced to perfection, disappoint or are attacked by governments (e.g., windfall taxes or damaging regulations), the compression to their PE ratios AND/OR the hit to their projected earnings will very quickly pull their prices down and the rest of the markets down with them.

He thinks it’s much more likely than not that the market will either offer dismal returns for the next decade OR experience a material correction, after which it will deliver normal returns.

Where should investors consider putting their money now?

Grantham sees the biggest value right now in stock markets outside of the US. They have underperformed the US stock market for a good while (and certainly now).

Japan and the U.K./Europe look very affordable right now.

Grantham warns you still have to do your homework on exactly which markets offer the best opportunities, but in general, he says developed markets “look reasonable” right now.

He sees more risk and volatility in developing markets though those, too, look “investable” to him at current prices.

Stay away from real estate and US stocks, he advises.

If you have to invest in US stocks, then look at quality value plays (e.g. Coca-Cola), which have been underpriced as markets became enthralled with tech/growth. Look for companies with high stable returns with monopoly elements and low debt.

Are there good ways right now to invest in energy transition?

Grantham thinks lots of money will be made in companies offering solutions for climate change. He also thinks oil demand will remain higher in the near term, even with demand for EVs rising higher than most realize. This is for several reasons, but the biggest one being that growth in demand for energy & other core commodities is outstripping our economy’s ability to produce them. This will send prices higher, especially for nickel, copper, cobalt & lithium…but not as high as demand for fossil fuels. They will be essential to provide the bridge to a truly “clean” energy future.

If you had to hold one of these assets — gold, bitcoin or cash— for the next 10 years, which would you choose?

Gold.

I hope you found the above write-up of value. I will be doing more for you going forward.

Thanks very much for joining my Substack. And again, if you feel you’ve ever found value in my work in the past and you’d like to support the development of its next generation, please consider becoming a premium subscriber to this Substack, if even only for a brief while.

You will never work harder for someone like you will for yourself and you have been putting in the work for sure.

If half of Wealthion subs follow you here things should be pretty good.

Congrats again.

Adam, I’m just a run of the mill commercial airline pilot. I started my career as a fighter pilot in the Navy many years ago. I have become super interested in macro economics when I ran across your channel not too long ago. I have branched out to other channels over time, but you were always my go to first stop. If I could do life over, I would have liked to follow in your footsteps... but at this point I’m just happy to find further challenge and meaning in life trying to follow the macro logic of what is happening. It’s so fascinating, and I owe you a debt of gratitude for starting my journey.

I’ll certainly follow your career wherever you go, people like you come into this world for a purpose, and you have been quite a vessel for channeling the truth whether you like it or not. Many thanks, my good brother and I am looking forward to your future of adding goodness into this crazy world, Lord knows it is needed!