MacroPass: David Stockman On Stolen Economic Growth

Growth stolen from the future ain’t “growth”

This week’s installment (our ninth) of our new MacroPass service for premium members of this Substack comes from David Stockman, former Congressman, economic policymaker & financier.

For decades now, the US has pursued monetary and fiscal policies that have pulled tomorrow’s prosperity into today, largely by issuing ever more debt while debasing the dollar’s purchasing power.

That has allowed us to live higher on the hog than we could otherwise be able to. And as time has progressed, keeping the party conditions going has required ever-greater acts of theft from our future selves.

Now we’re hitting the point when the spoils we’re enjoying are diminishing, and the piper is preparing his bill.

As we step into the very future we’ve already plundered, what will we find is the true price we’ll end up paying?

If you somehow missed our previous announcements, MacroPass is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino and Adam Kobeissi (The Kobeissi Letter). And more keep joining…

The reports issued so far in this MacroPass series include

If you’re already a premium subscriber to this Substack, just continue below to read this week’s report from David.

And if you’re not (yet), read the start of it below. If you like what you see, just upgrade to premium and access the full report, as well as all past and future MacroPass content.

Growth Stolen From The Future Ain’t “Growth”

JUN 3

It is truly amazing that the Keynesian and statist fanboys (yes, we do repeat ourselves) at both ends of the Acela Corridor continue to believe that monetary and fiscal stimmies are effective when the evidence keeps on pouring in that they are not.

Yesterday came more proof—this time in the form of a wimpy 1.2% gain in Q1 real GDP. Of course, we prefer the real final sales of domestic product metric because is excludes short-term inventory fluctuations that have no bearing on the underlying trends. And once again, that figure came in at only 1.7% on an annualized basis, but, more importantly, posted at just 1.9% per annum for the entirety of the four years since Q4 2019, which was the eve of the pandemic/lockdown turmoil.

But here’s the thing. There has been a staggering total of nearly $11 trillion of combined fiscal and monetary stimmies since Q4 2019. Yet what we have to show for it is a real growth rate that is barely half of its historic 3.5% trend.

Annualized Real Final Sales Growth, Q4 2019 to Q1 2024

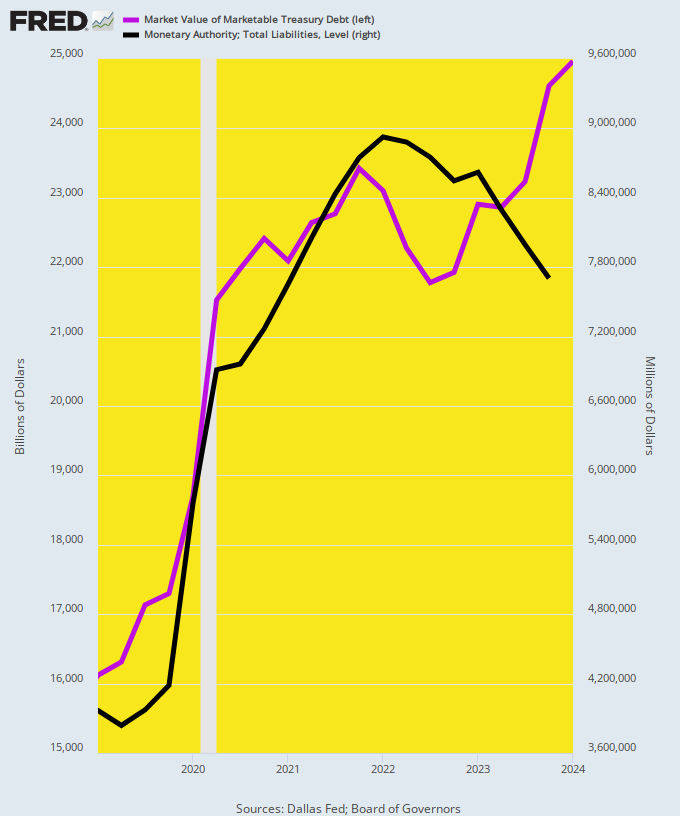

For want of doubt, here is the increase in the public debt and the Fed’s balance sheet since Q4 2019. The market value of the public debt is up by +$7.3 trillion or 42% during that span and the Fed’s balance sheet is still +$3.5 trillion or 83% larger, notwithstanding the modest QT-driven shrinkage in recent quarters.

While these numbers are not strictly additive, the larger point is unassailable: None of the GDP account “spending” that was financed or stimulated by these massive government injections arose from new economic production in the here and now. To the contrary, their materialization in the reported GDP accounts simply represents economic resources stolen from the future and artificially pulled forward in time through the magic of government borrowing and money-printing.

Eventually, the public debt will be recouped in the form of interest payments as far as the eye can see. Likewise, the fiat credit printed by the Fed will end up as inflated financial assets and swollen goods and services prices. That is to say, the government has no magic wand that generates real economic wealth; only workers, entrepreneurs, consumers, savers, investors and speculators operating on the free market in pursuit of their own best interests can accomplish that.

Public Debt And Fed Balance Sheet Since Q4 2019

What is worse, however, is that

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.