MacroPass™: Doomberg On The USA's Fiscal Outlook

"As far as turnarounds go, this one is utterly achievable"

This week’s installment of our popular MacroPass™ service for premium members of this Substack comes from energy & macro analyst Doomberg.

It examines the very real fiscal hole the US is currently in, and the prospects for digging out of it.

While for certain there are major — massive, even — financial and economic problems & challenges facing the nation, they are not insurmountable. And America has a number of tactical options, some of which remain completely untapped at present, that can be brought to bear in bringing its national books towards balance.

It won’t be easy or pain-free by any stretch. But a classic “workout” like many insolvent corporations go through, may be achievable here. Doomberg lists out a plausible framework making the case, which then begs the question: Will we have the courage & the competence to see this kind of major reform through?

As a reminder, MacroPass™ is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Lacy Hunt (Hoisington), Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Ted Oakley (Oxbow Advisors), Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino, Adam Kobeissi (The Kobeissi Letter), Sven Henrich (Northman Trader), Jeff Clark (The Gold Advisor), Charles Hugh Smith, Steven Bavaria (Inside the Income Factory®), Chris Whalen (The Institutional Risk Analyst), Felix Zulauf, Jesse Felder (The Felder Report) and Brent Johnson (Macro Alchemist).

Recent MacroPass™ reports in this series include:

If you’re already a premium subscriber to this Substack, just continue below to read Doomberg’s full post.

But if you’re not (yet), read the start of it below and consider upgrading to premium and access the full version, as well as all past and future MacroPass™ content.

The US Is Not Broke

A contrarian call on America’s fiscal outlook.

Feb 13, 2025

“I’m the king of debt. I’m great with debt. Nobody knows debt better than me.” – Donald Trump

When private sector companies become distressed, an entire ecosystem of experts springs into action. Turnaround specialists from firms like Alvarez & Marsal swoop in to replace management teams, cut spending, and negotiate with creditors. A sophisticated set of tools is deployed with vigor, much like triaging patients in hospital emergency rooms. Identifying which companies will survive has enriched many a bond investor, and executives experienced in navigating workouts are highly sought after.

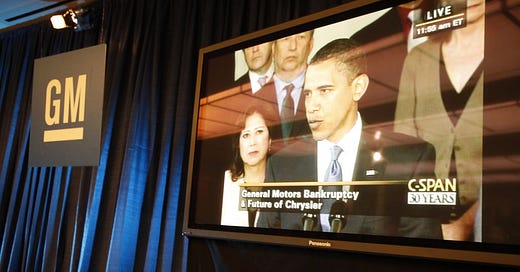

The question of solvency is rarely clear-cut, and filing for bankruptcy is often a strategic decision. Companies can remain insolvent for some time but never file, while others seek court protection long before all options are exhausted. Deciding if and when to act is more of an art than a science, as demonstrated by the divergent paths chosen by Ford and General Motors during the global financial crisis.

By any measure, the current US fiscal situation is highly distressed. Total public debt outstanding exceeds $36 trillion, double what it was just a decade ago and more than 120% of gross domestic product (GDP). Annual interest expense is set to surpass a staggering $1 trillion. The federal deficit was $1.8 trillion for fiscal year 2024, or 6.4% of GDP. Respected analysts argue the US is already in fiscal dominance, defined as “an economic condition that occurs when a country’s debt and deficit levels are sufficiently high that monetary policy can no longer effectively control inflation.”

Lurching rapidly towards this wall of worry is the looming wave of debt refinancings confronting newly confirmed Treasury Secretary Scott Bessent. The situation was exacerbated by his predecessor, Janet Yellen, who relied heavily on short-term debt to finance deficits during her tenure. Dan Oliver of Myrmikan Capital described the predicament in his most recent (and highly insightful) research note:

“Yellen’s policy also had the effect of issuing fewer long-term bonds than expected, which supported their prices, creating artificially lower rates in the 10-year bond, which is the reference point for mortgages and other long-term credit. Now Trump’s anointed Treasury Secretary Scott Bessent must decide how to roll the $6.7 trillion in Treasury bonds coming due in 2025. He is well aware of the problem, having written about it in his investor letter dated January 31, 2024…

If Bessent reverts to standard Treasury practice, issuing only 15%-20% in bills, the 10-year financing reference rate will drift higher, and a falling short-term rate risks enticing money back into the Fed’s reverse repo facility, sending a tightening shock through markets and the economy. Even if he were to continue Yellen’s policy, she has timed it such that the reverse repo facility is drained—the Treasury no longer has much ability to neuter the Fed’s balance sheet shrinkage.”

Perhaps no US president has been more familiar with the bankruptcy code than the current occupant of the Oval Office, a man who previously boasted of using such laws “brilliantly” in the corporate setting. To wit, the first three weeks of his presidency bear the telltale signs of an experienced executive navigating a turnaround with urgency and direction. Contrary to the constant alarmism about America’s irreversible slide into insolvency, the country is far from broke, and Trump has considerable flexibility at his disposal. Let’s review the options and set a few markers for success.

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.