MacroPass™: Lacy Hunt's Latest Quarterly Outlook

A global capacity glut sends an ominous warning of growing economic weakness

This week’s installment of our popular MacroPass™ service for premium members of this Substack comes from bond investor & former Federal Reserve senior economist Lacy Hunt whom I interviewed on Thoughtful Money earlier today.

It’s the latest quarterly review and outlook issued by Lacy’s firm, Hoisington Investment Management.

In it are a number of the charts that Lacy briefly made reference to in today’s interview. As they say “a picture is worth a thousand words'“, and these charts demonstrate how disinflationary forces — declining capacity utilization & rising unemployment — are building.

Which is why Lacy remains so convinced that the current macro focus on inflation will soon prove to be misplaced.

As a reminder, MacroPass™ is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Lacy Hunt (Hoisington), Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Ted Oakley (Oxbow Advisors), Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino, Adam Kobeissi (The Kobeissi Letter), Sven Henrich (Northman Trader), Jeff Clark (The Gold Advisor), Charles Hugh Smith, Steven Bavaria (Inside the Income Factory®), Chris Whalen (The Institutional Risk Analyst), Felix Zulauf, Jesse Felder (The Felder Report) and Brent Johnson (Macro Alchemist).

Recent MacroPass™ reports in this series include:

If you’re already a premium subscriber to this Substack, just continue below to access Lacy’s full outlook letter.

But if you’re not (yet), read the start of it below and consider upgrading to premium and access the full version, as well as all past and future MacroPass™ content.

The Global Capacity Glut

Factories across the world are growing increasingly idle. Global industrial capacity utilization (CAPU) has fallen significantly, and a rising unemployment rate has followed suit, signaling that the available factors of production globally are progressively more redundant. The reason this is relevant is that since 1990, this thirty-four year correlation is consistent with the U.S. experience where data has been available for seven decades. As such, CAPU appears to be the dominant supply-side variable in determining inflation in the United States, China, Japan, U.K. and the EU.

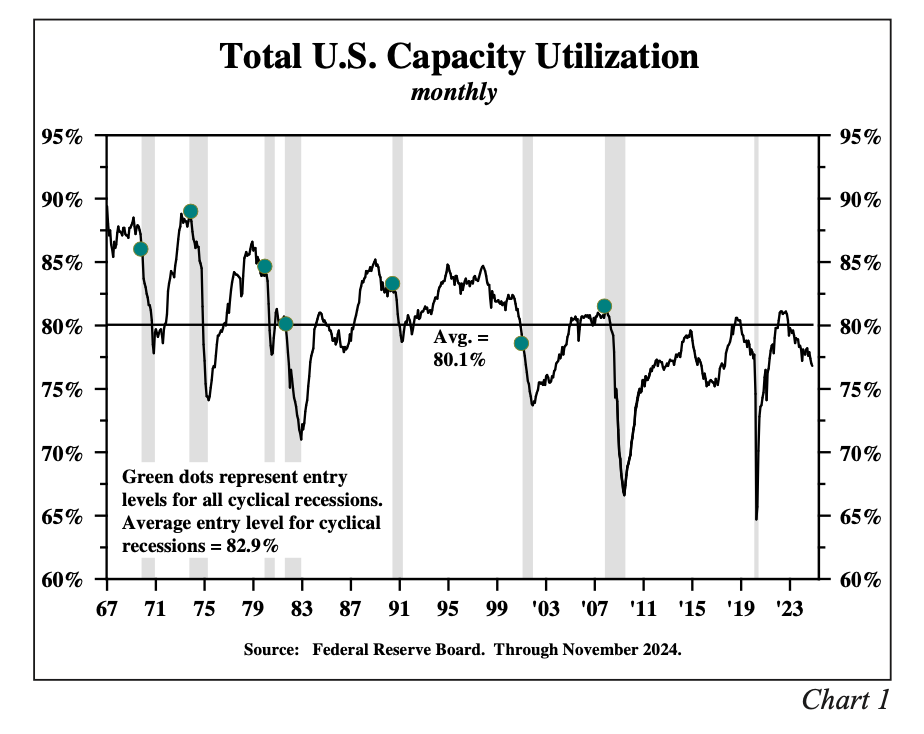

CAPU - At Recessionary Levels

In the United States, CAPU has plummeted to levels lower than at the start of all of the cyclical recessions since 1967:

This vividly reflects a significant underutilization of resources, a circumstance which has historically led to moderating economic growth. Based on nearly complete fourth quarter 2024 data, the U.S. CAPU is estimated to have been 76.9%, a significant 3.2 percentage points lower than the post-1967 average and 6 percentage points below the historical level of 82.9%, which is the average entry level for the cyclical recessions. This surplus capacity reflects an irregular cyclical decline in industrial production from the fall of 2022.

The estimated level of CAPU outside the U.S. in the fourth quarter was 74.8%, 4.3% lower than its post-1990 average of 79.1%. Since 1990, foreign CAPU has generally led U.S. CAPU:

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.