MacroPass™: Kevin Muir On 'The Bear Case' For Markets

Why a 35% correction could be in the cards this year

This week’s installment of our popular MacroPass™ service for premium members of this Substack comes from market & macro analyst Kevin Muir, proprietor of The Macro Tourist.

It’s an explanation how Kevin, who was quite bullish following the tsunami of liquidity unleashed by the central planners’ response to COVID, is now finding it harder and harder to remain so.

In the full report below, he makes the argument for why a 35% correction in the S&P this year wouldn’t even require some sort of calamitous economic crisis. Just a return to mean valuations.

But more importantly in his eyes, it’s not Kevin’s own analysis that he finds the most compelling, but that of several of his mentors, namely Steve Cohen and Peter Berezin. In his eyes, when the smartest & most successful investors you know turn bearish — you ignore that at your peril.

As a reminder, MacroPass™ is a weekly rotating selection of premium analysis from many of the big thinkers interviewed on Thoughtful Money.

To-date that list of contributors includes experts like Lacy Hunt (Hoisington), Stephanie Pomboy (Macro Mavens), Danielle DiMartino Booth (QI Research), Tom McClellan, Michael Howell (Capital Wars), Darius Dale (42 Macro), Doomberg, Ted Oakley (Oxbow Advisors), Kevin Muir (The Macro Tourist), Alf Peccatiello (The Macro Compass), Lance Lambert (ResiClub), Ed Yardini (Yardini Research), David Hay (Haymaker), Melody Wright (M3_Melody), David Stockman (Contra Corner), David Brady (FIPEST Report), John Rubino, Adam Kobeissi (The Kobeissi Letter), Sven Henrich (Northman Trader), Jeff Clark (The Gold Advisor), Charles Hugh Smith, Steven Bavaria (Inside the Income Factory®), Chris Whalen (The Institutional Risk Analyst), Felix Zulauf, Jesse Felder (The Felder Report) and Brent Johnson (Macro Alchemist).

Recent MacroPass™ reports in this series include:

If you’re already a premium subscriber to this Substack, just continue below to read Kevin’s full post.

But if you’re not (yet), read the start of it below and consider upgrading to premium and access the full version, as well as all past and future MacroPass™ content.

THE BEAR CASE

And why you fade Steve Cohen at your own peril

Kevin Muir - March 4, 2025

I always say that my career wasn’t built on anything I thought of. It’s me working out who the smartest person is in the room, and then listening to them extremely carefully.

• Paul Sankey - founder of Sankey Research

The ‘Tourist’s bear case

I’ve been bearish on American stocks for a while now. It was most uncomfortable earlier in the year, when the “Trump Bump” was in full force and Wall Street market strategists proclaimed that “they were the most bullish they have ever been in their career.” Although they were foaming-at-the-mouth excited about DOGE and other developments, I counseled that the economic policies of reducing both the fiscal and trade deficit were not market friendly.

TWIN DEFICITS: THE WORRIES ARE BACK

Jan 20 - Read full story

It’s not like I am one of those perma-bears. In fact, I spent much of the post-COVID period arguing that unprecedented fiscal stimulus would make the US economy much more resilient than market participants expected. However, circumstances have changed. No longer is fiscal policy a tailwind at investors’ back, but has now become a major headwind. I’m not going to risk getting scolded by Keynes’ ghost by staying bullish when the facts have so clearly changed.

Long-term money is still long

Earlier this afternoon, Trump has announced 25% tariffs on Canada and Mexico, and the market stumbled. Although it might feel like everyone is bearish, let me assure you, the big money has not even started to sell.

Let’s rewind back to January. At the time, the market was flying. Money was flowing into the US and most everyone was convinced that Trump would usher in a new golden age for American capitalism.

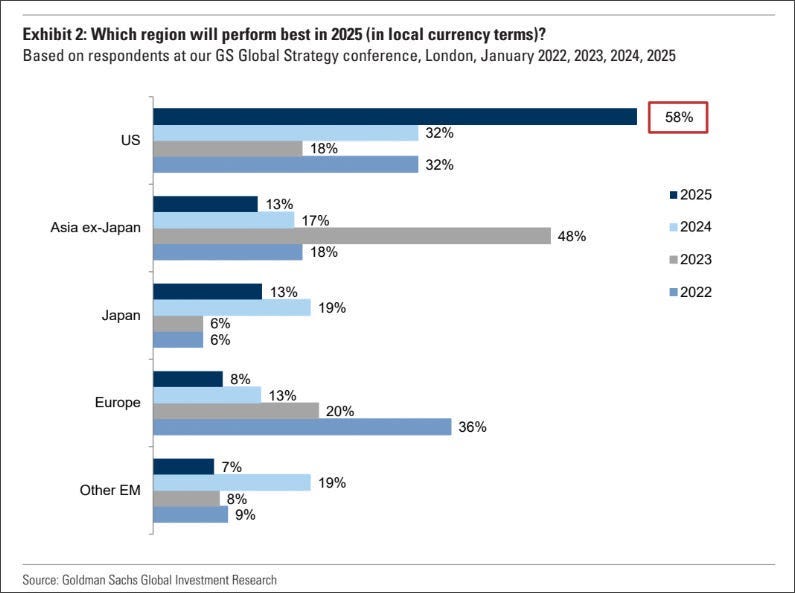

Goldman Sachs has a conference every January, and they asked institutional participants what region would perform best in 2025. The most common answer? America. By far.

58% of respondents thought America would be the best performing region. But the really interesting part? Look at the answer for 2023. Back then, only 18% believed America would lead the pack.

If you plot the share of respondents who believed that American assets would be the best performing region over time, you will see that in 2023 it was the lowest reading in five years.

Yet, how did America end up performing in 2023? For the next two years, US stocks blew the doors off. They were huge winners. It was even more perplexing because the vast majority of investors were negative because of Biden’s policies and were forecasting recessions around every corner.

Too many ignored the fact that government deficits are the private sector’s credit. They might not like it, but that money injected into the economy via fiscal stimulus caused stocks to rise.

Now, compare the January 2023 survey when 18% thought the US would outperform to January 2025 when 58% believed that the US would outperform! This reading has never been higher.

But they are all bullish at a point when the stock market has just clocked in one of the best two year periods in history, at a point where the S&P 500 is trading at a P/E level not seen since the DotCom bubble, and most importantly — when the fiscal stance has gone from being uber accommodative to restrictive. Although it’s difficult to position against the herd, this is a terrible risk/reward.

One of the greatest traders in modern history is bearish

Don’t take my word for it, instead listen to trading legend’s, Steve Cohen’s comments from last week.

Keep reading with a 7-day free trial

Subscribe to Adam Taggart's Thoughtful Money® to keep reading this post and get 7 days of free access to the full post archives.